Zeng Yuqun’s Ambitious Bet of 1.8 Trillion

Despite leading the market, Zeng Yuqun remains deeply engaged in the industry. On September 25, Ningde Times‘ A-share surged over 4%, reaching a market capitalization of 1.82 trillion yuan, surpassing Guizhou Moutai with a valuation of approximately 1.8 trillion yuan. Although the stock price experienced a pullback on the following trading day, discussions among investors on platforms like Xueqiu continued to focus on its performance in overseas and energy storage markets. One investor noted, “With expectations for energy storage rising, Ningde Times is excelling in both revenue and net profit, maintaining its leading global position, especially in overseas markets. It’s normal for its market value to reach new heights.”

According to SNE Research, in the first five months of 2025, Ningde Times held a global market share of 38.1% in power battery usage, an increase of 0.6% compared to the same period last year. In the energy storage sector, data from Xinluo Information indicated that it ranked first in global production in the first half of 2025. During that period, Ningde Times achieved a revenue of 178.886 billion yuan, reflecting a year-on-year increase of 7.27%, with a net profit attributable to the parent company of 30.485 billion yuan, marking a growth of 33.33%.

Despite holding the top position in the power battery market for eight consecutive years, Zeng Yuqun, the founder, chairman, and CEO of Ningde Times, remains actively involved in major battles both domestically and internationally, demonstrating even greater dedication than in previous years. In early September, he attended the Munich Auto Show, where he introduced new battery products tailored for the European market to executives from companies like Mercedes-Benz, Porsche, Volvo, and Renault. This thorough engagement starkly contrasts his usual practice of quickly appearing at conferences before moving on to various booths.

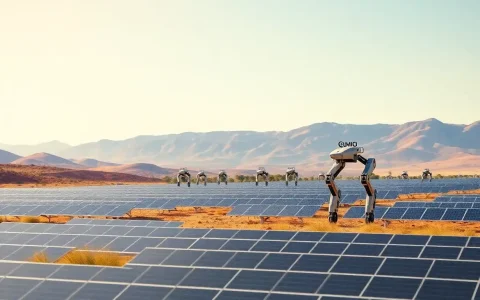

Just a week prior, he was present at the opening ceremony of the “2025 World Energy Storage Conference,” where he revealed that Ningde Times is promoting interdisciplinary and cross-domain technological integration, having made significant advancements in areas such as artificial intelligence, networked energy storage, and virtual power plants. Following his speech, Ningde Times’ stock price notably increased, showing positive trends over several trading days.

This year has witnessed a significant boom in the energy storage market, with new installations in the first half of the year increasing by over 60%. Several brokerages have raised their annual installation forecasts, and multiple market reports show a clear trend of orders concentrating among leading companies. Ningde Times is the largest beneficiary and one of the most aggressive players in this space. Some brokerages predict that its battery production plan may reach 1000 GWh next year, approximately 43% more than in 2025, exceeding market expectations. Based on projected global lithium battery shipments for 2025, its production capacity could cover 50% of the demand.

A representative from Ningde Times informed China Entrepreneur Magazine that the overall strategy this year remains largely unchanged, continuing to focus on energy storage and expanding in overseas markets. In May, Ningde Times completed its listing on the Hong Kong Stock Exchange, raising around 41 billion HKD, which was touted as the largest IPO globally this year. Zeng Yuqun did not shy away from expressing his ambitions, stating, “The listing on the Hong Kong stock market signifies the company’s broader integration into the global capital market and represents a new starting point for promoting the global zero-carbon economy.”

The business has transitioned from a “single-core” to a “dual-core” and even “multi-core” approach, expanding from a single market to a global presence. This phase represents the most intense period since the company’s inception. Born in Fujian, Zeng Yuqun is known for taking risks, such as leaving a stable job to enter the battery industry, which was previously dominated by foreign companies, and opting to venture overseas despite uncertain risks.

Fellow Fujian native and founder of Meituan, Wang Xing, once mentioned that a phrase hangs in Zeng Yuqun’s office: “Strong gambling spirit.” When asked why he didn’t display “hard work leads to success,” his response was, “Just working hard isn’t enough; that’s a physical endeavor. Gambling is a mental one.”

Focus on Energy Storage

When Ningde Times was established in 2011, Zeng Yuqun already envisioned a dual-driven strategy for power and energy storage batteries. At that time, the latter was still in its infancy, and many within and outside the industry questioned its feasibility and development potential, perceiving it as a gamble. Consequently, despite being an early mover, Ningde Times’ power battery business significantly outpaced its energy storage segment for a considerable period. Especially during the initial explosion of lithium batteries, market attention was focused solely on the power battery business.

Indeed, Zeng Yuqun prioritized this area, securing a major deal for BMW’s first pure electric vehicle battery within just two years of operation, becoming its sole battery supplier in Greater China. The client roster soon expanded to include BAIC, Geely, Dongfeng, and Changan.

By 2017, Ningde Times surpassed Panasonic and BYD, capturing 17% of the global market share in power batteries. This made its energy storage business appear even more inconspicuous during the same period. Power batteries still account for the majority of Ningde Times’ revenue, with the 2025 semi-annual report showing a revenue share of 73.55%.

However, Ningde Times’ energy storage business was not entirely lacking. In its first year, it participated in the world’s largest “wind-solar-storage” demonstration project—the Zhangbei Energy Storage Project. With an engineering background, Zeng Yuqun understands the importance of core technology, ensuring that Ningde Times holds a tight grip on the core component of energy storage systems—the battery cells, which account for 50%-60% of total costs. As the energy storage tide rises, even with new players like Haichen Energy and Ruipu Lanjun entering the market, Ningde Times retains its influence.

After 2021, various provinces and regions in China implemented policies mandating proportionate energy storage configurations for new energy projects, leading to a surge in orders for multiple enterprises. Leveraging its status as the “leader in power batteries,” Ningde Times began to expand its energy storage business significantly. The 280Ah battery cell specification, which became the industry standard, was introduced by Ningde Times in 2020.

During that period, Zeng Yuqun began to focus on both fronts. The revenue from energy storage skyrocketed from around 2 billion yuan in 2020, accounting for 3.86% of total revenue, to 13.6 billion yuan the following year, representing approximately 10% of total revenue. He directly applied the strategies used in the power battery sector to the energy storage market, emphasizing product premium through R&D. Since 2014, Ningde Times has invested over 80 billion yuan in R&D, with 18.6 billion yuan allocated last year—an amount nearing the annual revenue of some mid-tier lithium battery companies. According to a Morgan Stanley report, Ningde Times’ energy storage systems deliver approximately 14% internal rate of return premium for customers globally and around 8% in the fiercely competitive Chinese market.

Within a few years, Ningde Times surpassed established players like Panasonic and LG Chem, which had decades of experience in the energy storage business, claiming the top spot in both major markets. By 2024, Ningde Times is expected to maintain its position as the global leader in power battery usage for eight consecutive years and in energy storage battery shipments for four years.

However, the past two years have transformed the energy storage sector into a fiercely competitive battleground. With cyclical fluctuations in the power battery industry intensifying, fierce price competition, and a slowdown in demand growth, many companies focusing solely on power batteries have started treating energy storage as their “second curve.” Several photovoltaic firms have also targeted the “solar-storage integration” market, making low prices a central competitive factor. In March, the energy storage market witnessed bidding prices as low as 0.486 yuan/Wh and 0.478 yuan/Wh, breaking the previous year’s low of 0.499 yuan/Wh. Just a year earlier, conventional quotes were above 0.8 yuan/Wh.

As a result, Ningde Times experienced its first revenue decline post-IPO in 2024, with an increase in profit but a drop in revenue, including a 4.36% decline in energy storage revenue. Recently, Zeng Yuqun has frequently discussed the issue of “internal competition.” He remarked that energy storage prices have plummeted by about 80% over three years, severely deviating from costs, to the point that price wars have even spread overseas. He stated, “The issue of technology homogeneity has become apparent. Driven by capital, many enterprises choose shortcuts, leaning towards imitation and replication rather than independent R&D. Innovation requires investment, but if everyone seeks shortcuts, who will undertake innovation?”

Betting on Overseas Markets

This situation has elevated the strategic importance of overseas markets. Approximately 90% of the funds raised from the Hong Kong IPO will be directed towards the construction of the first and second phases of the factory in Hungary. Ningde Times acknowledged that the IPO was initiated due to the inability of foreign exchange reserves to cover overseas investment demands.

Zeng Yuqun is no stranger to international markets; he has benefited from them before, as Ningde Times’ first major client was BMW. His earlier venture, ATL, was also a core supplier of lithium batteries to Apple. Zeng Yuqun has a strong commitment to the global market. In 2014, when Ningde Times established its first overseas subsidiary in Germany, venturing abroad was not a mainstream approach in the battery industry, despite rapid growth in China’s new energy vehicle market. In the following years, backed by orders from BMW, Ningde Times opened subsidiaries in Hungary, the United States, and began establishing factories in certain regions of Europe.

This somewhat risky bet has yielded positive results for Zeng Yuqun. In 2019, as domestic subsidies for new energy vehicles tightened, leading to declining sales and putting many power battery companies in a difficult position, Zeng Yuqun took the proactive step of opening up international markets. By the following year, he signed a two-year supply agreement with Tesla.

Reports indicated that in 2021 alone, Tesla pre-ordered 45 GWh of lithium iron phosphate batteries from Ningde Times for its sales plan for the following year, which corresponds to nearly 800,000 vehicles—surpassing Tesla’s total sales for the first three quarters of 2021. In 2020, Ningde Times generated 7.9 billion yuan in overseas revenue, accounting for 15.71% of total revenue, a scale several times larger than direct competitors like Guoxuan High-Tech and Funeng Technology. That same year, Zeng Yuqun ascended from second on the Fujian wealth list to the top position, earning Ningde Times the moniker “Ning Wang.”

Although he enjoys taking risks, Zeng Yuqun aims for significant outcomes and is not overly concerned with short-term gains or losses. During those years, he frequently emphasized the importance of “crisis awareness.” In 2017, he sent an email titled “The Typhoon is Coming, Can Pigs Really Fly?” to all employees, urging them to think critically for a sustainable future, assuring that the storm would eventually pass.

Ningde Times indeed found itself in a “crisis moment” during its peak. In 2022, former chairman of GAC Group, Zeng Qinghong, jokingly remarked, “Am I working for Ningde Times?” By 2023, economist Ren Zeping wrote that Ningde Times was squeezing profits from upstream and downstream, stating, “The world has suffered from Ning Wang for too long.” During this period, numerous automotive companies, including Changan, Great Wall, and Zeekr, began developing in-house batteries, with the consensus in the industry being to “de-Ning.” A significant data shift occurred in the first half of 2023, where Ningde Times’ battery capacity utilization rate hit a historic low of 60.5%, compared to a peak of 95% in 2021.

In 2023, Zeng Yuqun decisively adjusted direction—focusing on international markets instead of domestic competition. Reports indicate that by the end of that year, Ningde Times employees had their computer desktops uniformly set to “Whoever goes overseas is the hero of the company; go out, go abroad.” In early 2024, he candidly stated in a company-wide email, “An ambitious company typically goes through three stages—seeking survival, pursuing development, and going global.” He emphasized that Ningde Times’ overseas business is entering a critical phase and must succeed at all costs. He personally took charge of overseas operations, with four co-presidents overseeing various aspects of international sales, infrastructure, operations, and procurement, all reporting directly to him.

Zeng Yuqun’s ambitions and investments are substantial. The market has observed that Ningde Times has invested heavily in building factories overseas. Reports indicate that the European battery factories they are constructing will cost over 13 billion euros. This process has not been easy. Initially, Ningde Times primarily expanded internationally through products and technology. In 2021, it signed a technology licensing agreement with Hyundai Mobis to support battery supply for related products globally, simultaneously providing battery products to its sibling company, Hyundai.

However, in recent years, as subsidies for new energy vehicles have increased, the European market has become a major battleground. Major European automakers are accelerating their electrification processes, achieving sales of 1 million vehicles in the first half of this year—a 24% year-on-year increase. According to regulations, all new cars sold within the EU must be electric by 2035.

Europe has yet to establish a complete lithium battery industry chain, prompting domestic companies to intensify their overseas expansions. However, discussions with industry insiders reveal that selling batteries in the European market is not straightforward, as local laws and regulations impose strict limits on carbon emissions across various stages of the battery supply chain and logistics. To maximize benefits, Zeng Yuqun opted to build factories abroad—Ningde Times’ first overseas facility in Thuringia, Germany, launched in 2023, while a planned battery factory in Debrecen, Hungary, aims for a production capacity of 100 GWh; a Stellantis battery factory is also expected to be located in Spain.

To capture the overseas market, Zeng Yuqun employs various strategies. For instance, in the U.S. market, Ningde Times collaborates with American automakers like Ford and GM using a technology licensing model to meet local requirements. Zeng Yuqun likens the capacity planning for overseas markets to a soccer “433 formation,” emphasizing that this sharing and cooperation-focused tactic can also apply to the new energy vehicle industry. Specifically, he envisions allocating 30% of capacity to resource-advantaged and market-advantaged regions, while 40% is designated for areas with technological advantages.

By 2024, Ningde Times’ overseas revenue surged from 7.9 billion yuan four years prior to 110.3 billion yuan, with its revenue share increasing from 15.71% to 30.48%. In the first half of 2025, Ningde Times’ overseas business gross margin stood at 29.02%, exceeding the domestic gross margin of 22.94%. A report from Morgan Stanley highlighted that Ningde Times’ leadership position has not only been maintained but further strengthened in the competitive landscape. The report noted significant share growth for the company in the European electric vehicle battery market, while other smaller battery manufacturers continue to struggle.

In a media interview, Zeng Yuqun candidly stated, “We are already number one, but this position is ‘virtual.’ To be the true number one, we need to solidify our standing both internally and externally; it’s not enough to be just solid. ‘Solid number one’ means reaching a stage where it’s only Ningde and the rest.” This implies that he must engage in full-scale warfare on a larger battlefield, potentially opening what could be the most important gamble of his life.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/zeng-yuquns-ambitious-bet-navigating-the-1-8-trillion-yuan-challenge-in-the-battery-industry/