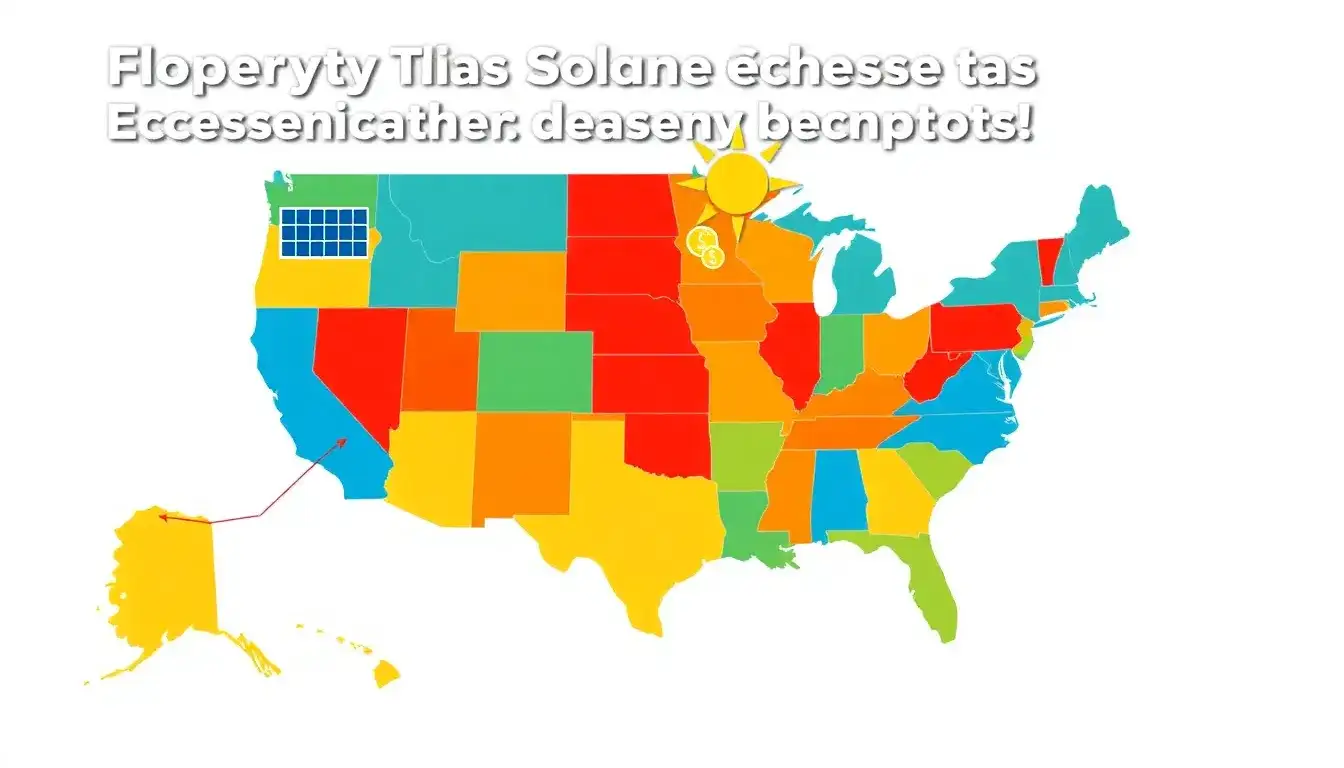

Several states offer both property and sales tax exemptions for solar equipment. Here’s a list based on recent data:

- Arizona: Offers both a 100% property tax exemption and a state sales tax exemption for solar purchases.

- Colorado: Exempts solar systems from state sales and use tax, and while not all localities offer property tax exemptions, some areas may have them.

- Florida: Has a property tax exemption, and although not listed for both sales and property exemptions in all sources, it’s essential to verify local rules.

- New Jersey: Provides a full exemption from state sales tax for solar equipment and exempts solar systems from local property taxes.

- New York: Offers both a property tax exemption and a sales tax exemption for solar energy equipment.

Additionally, other states might offer some form of these exemptions, so it’s advisable to check with individual state tax authorities for the most current information. As of the latest data, more than a dozen states provide some level of both sales and property tax exemptions for solar panels.

Here is a list of states that have either sales or property tax exemptions for solar equipment as of September 2024:

States with Sales Tax Exemptions

- Arizona

- Colorado

- Connecticut

- Florida

- Iowa

- Maryland

- Massachusetts

- Minnesota

- New Jersey

- New Mexico

- New York

- Ohio

- Rhode Island

- Tennessee

- Utah

- Vermont

- Washington

- Wisconsin

States with Property Tax Exemptions

Over 30 states offer some form of property tax exemption for solar energy systems, including Arizona and New Jersey mentioned above.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/which-states-offer-both-property-and-sales-tax-exemptions-for-solar-equipment/