Tax credits have a significant positive impact on the deployment of standalone energy storage facilities by making such projects financially more viable and attractive to investors. Key points about this impact include:

Federal Tax Credits Encourage Deployment

- The Inflation Reduction Act of 2022 (IRA) introduced important tax benefits for standalone energy storage projects, including an investment tax credit (ITC) under Sections 48 and 48E of the Internal Revenue Code. This was a major shift since previously, standalone energy storage generally only qualified for the ITC when paired with solar or other eligible generating resources.

- This standalone ITC provides a direct financial incentive that lowers the net cost of deploying energy storage facilities, thereby stimulating private sector investment and accelerating deployment across the U.S.

Expanded Eligibility and Monetization

- The IRA also introduced new manufacturing production tax credits (Section 45X) and enhanced monetization methods such as credit transferability and direct payment options. These methods allow project developers to monetize tax credits even if they lack sufficient tax liability themselves, broadening the market for investment in storage projects.

- Transferability is especially important because standalone energy storage projects often have different revenue structures compared to wind or solar projects, making traditional tax equity financing less accessible. Tax credit transferability enables developers to sell credits to investors more easily without complex long-term agreements.

Impact on Market Growth and Grid Integration

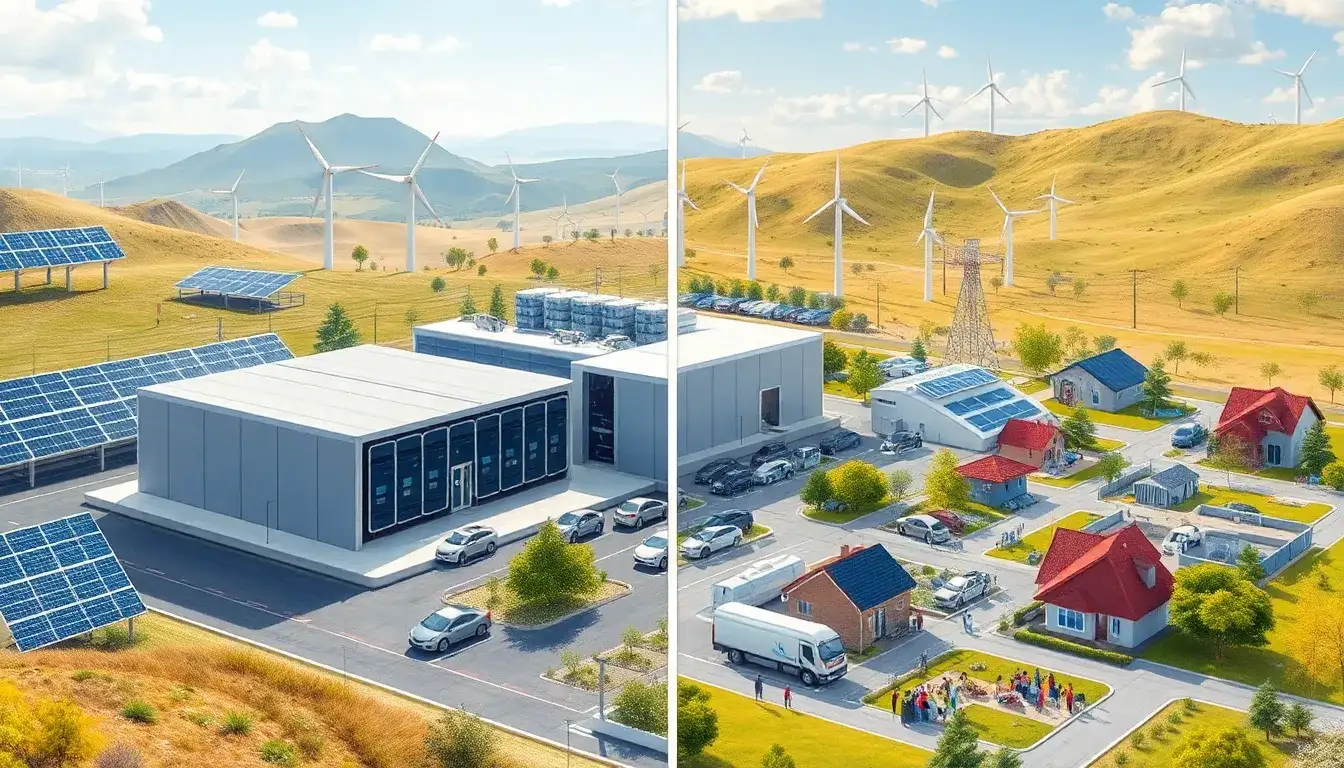

- Energy storage deployment is rapidly growing, expected to reach over 40 GW utility-scale capacity by the end of 2025, partially driven by these tax incentives. Storage supports grid reliability and allows integration of intermittent renewables such as wind and solar by smoothing supply fluctuations, which is critical for decarbonization goals.

- The financial boost from tax credits facilitates faster and more widespread deployment—including in urban areas with growing electricity demand—due to energy storage’s relatively quick installation and low environmental footprint.

Ongoing Uncertainties and Policy Considerations

- Although the tax credits have spurred deployment, the vitality of these benefits could be affected by political changes and future legislation, as noted in the context of the 2024 federal election.

- Industry groups advocate for a permanent, technology-neutral standalone energy storage ITC with direct pay options to ensure stable long-term growth in storage deployment.

Summary

Tax credits, particularly the standalone investment tax credit under the Inflation Reduction Act, substantially reduce costs and financial risks for deploying standalone energy storage facilities. They enable broader investment, provide flexible monetization paths, and thus accelerate energy storage growth, which is essential for grid reliability and renewable energy integration in the U.S.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-impact-do-tax-credits-have-on-the-deployment-of-standalone-energy-storage-facilities/