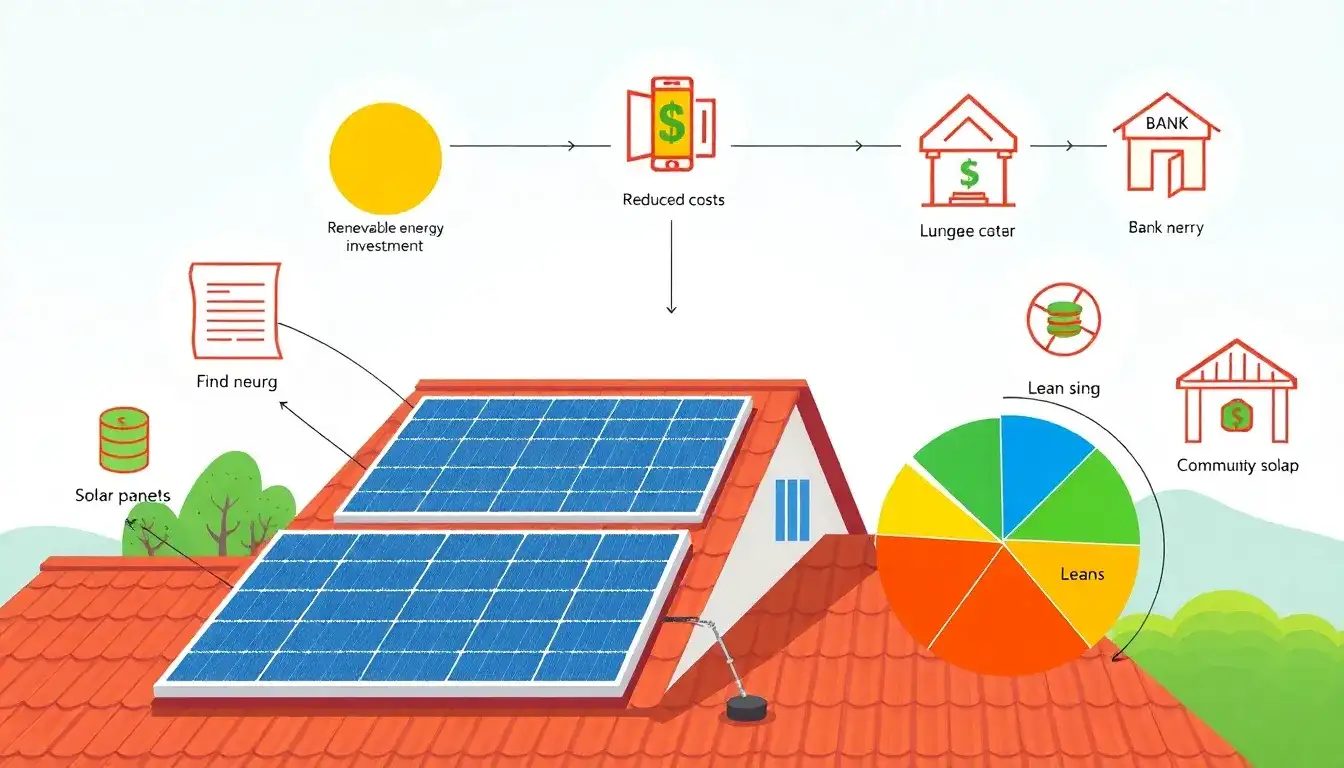

Several financing options can help reduce the upfront cost of solar panels, making them more accessible to homeowners. Here are some of the most common financing methods:

Financing Options for Solar Panels

1. Solar Loans

- Description: Solar loans allow homeowners to finance their solar panel systems through monthly payments over a set period, typically 5 to 25 years. These loans can be secured or unsecured and are often provided by banks, credit unions, and specialized solar financing companies.

- Benefits:

- Lower upfront costs compared to cash purchases.

- Homeowners retain ownership of the system, making them eligible for tax credits and incentives.

- Predictable monthly payments allow for better budgeting.

- Drawbacks:

- Interest payments increase the total cost of the system over time.

- Requires credit approval.

2. Home Equity Loans or HELOCs

- Description: Home equity loans or lines of credit (HELOCs) use your home as collateral to secure a loan. This can result in lower interest rates and tax-deductible interest.

- Benefits:

- Potential for lower interest rates due to collateral.

- Repayment terms can be extended, often 10 to 30 years.

- Tax-deductible interest.

- Drawbacks:

- The risk of losing your home if you default on the loan.

- Requires substantial home equity.

3. Contractor Financing

- Description: Some solar installation companies offer financing options through third-party lenders. This simplifies the process since it involves dealing with only one company for installation and financing.

- Benefits:

- Convenient one-stop service for both installation and financing.

- Potential for lower rates than home equity loans or personal loans.

- Drawbacks:

- May involve origination fees.

- Longer repayment terms can increase total interest paid over the loan’s life.

4. Power Purchase Agreements (PPAs) or Solar Leases

- Description: These options allow homeowners to use solar energy without purchasing the system. Instead, they pay for the electricity generated or a fixed monthly rate. Maintenance is typically handled by the provider.

- Benefits:

- Low upfront costs (often none).

- No maintenance responsibilities.

- Energy savings from day one.

- Drawbacks:

- Homeowners do not own the solar system and are not eligible for tax credits or incentives.

- Payments continue for the duration of the agreement, typically 20 years.

5. Government Programs and Incentives

- Description: Options like FHA 203(k) loans and Fannie Mae HomeStyle Renovation loans can finance solar installations alongside home purchases or renovations. Additionally, the federal solar tax credit (ITC) provides a 30% tax credit on the cost of solar panel systems.

- Benefits:

- Reduced upfront costs through incentives.

- Eligibility for multiple benefits if combined with other financing options.

- Drawbacks:

- Often involves more complex processes.

- Specific qualification requirements may apply.

By exploring these financing options, homeowners can significantly reduce or eliminate the upfront costs associated with purchasing solar panels, making renewable energy more accessible and affordable.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-financing-options-can-help-reduce-the-upfront-cost-of-solar-panels/