Investing in energy storage systems encompasses various dimensions, including 1. technology selection, 2. financial implications, 3. market dynamics, and 4. environmental considerations. Each of these factors plays a critical role in shaping investment decisions in the energy storage landscape.

1. TECHNOLOGY SELECTION

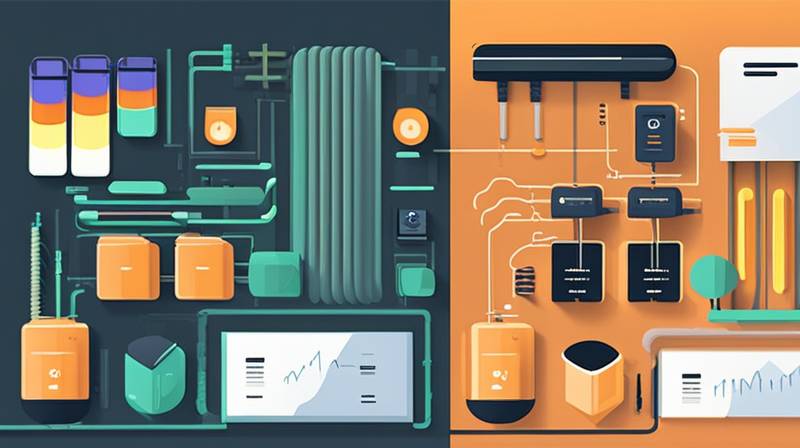

Investors venturing into the realm of energy storage systems must first comprehend the diverse technological options available. Battery storage technologies, such as lithium-ion, lead-acid, and newer alternatives like solid-state batteries, dominate the current market. Lithium-ion batteries, widely adopted due to their efficiency and decreasing costs, have enabled widespread applications in both utility-scale and decentralized projects. They serve diverse uses, from grid stabilization to renewable energy integration, underscoring their versatility.

Examining lead-acid batteries, it’s evident that while they have a long history in various applications, their limitations in energy density and cycle life make them less favorable for many modern applications. In recent years, innovative technologies such as flow batteries and compressed air energy storage have emerged, offering unique advantages in specific scenarios. The selection of a storage technology hinges on project requirements, budgetary constraints, and long-term operational considerations. Understanding these technical nuances empowers investors to make informed decisions aligned with their strategic goals.

2. FINANCIAL IMPLICATIONS

The financial landscape surrounding energy storage systems is multifaceted and crucial for potential investors. Initial capital outlay represents a significant factor, as energy storage systems require substantial upfront investment. Evaluating the cost per kilowatt-hour and ongoing operational expenses is essential. It is important to note that cost trajectories have been favorable for battery technologies in recent years, leading to a decline in overall project costs. Consequently, this trend opens avenues for improved economic feasibility and quicker returns on investment.

In parallel, the economic dynamics of energy markets necessitate a robust analysis of incentives and regulatory frameworks that can influence returns. Governments worldwide increasingly recognize the importance of energy storage in facilitating energy transition and grid resilience. Tax credits, subsidies, and revamped regulatory standards can enhance profitability. Therefore, staying abreast of available financial incentives and their potential impacts is vital for investors aiming to optimize their financial outcomes.

3. MARKET DYNAMICS

The market dynamics associated with energy storage systems present a stimulating landscape rife with opportunities and challenges. As renewable energy sources, such as wind and solar, gain prominence, the need for efficient storage solutions becomes paramount. The intermittency associated with these energy sources necessitates robust energy storage to ensure balance and reliability. Demand for energy storage continues to surge, driven primarily by transitioning energy infrastructures towards a more sustainable model.

Competitors in this market include both new entrants and established players, which collectively shape pricing and availability. Grid modernization, enabled by technology advancements, drives investment interest in energy storage systems. As utilities and independent power producers (IPPs) integrate more renewables, their reliance on energy storage systems will grow. This evolution necessitates due diligence, particularly monitoring trends, market share, and technological advancements, to navigate the competitive landscape effectively.

4. ENVIRONMENTAL CONSIDERATIONS

Investing in energy storage systems often intersects with critical environmental objectives. As global concerns about climate change and sustainability continue to escalate, energy storage has emerged as a pivotal instrument for reducing carbon emissions. The ability of storage systems to facilitate greater reliance on renewable energy sources directly correlates with achieving national and international climate goals.

Moreover, evaluating the environmental impact of manufacturing, deploying, and disposing of energy storage technologies is essential for responsible investment. While some storage batteries have a relatively low ecological footprint, others, especially those relying on rare earth materials, may pose sustainability challenges. The push for circular economy practices in energy storage systems highlights the need to innovate, ensuring that investment decisions align not only with financial goals but also with broader environmental responsibilities. Engaging in this discourse enhances an investor’s strategic narrative in an increasingly eco-conscious marketplace.

FAQs

WHAT ARE THE MAIN TYPES OF ENERGY STORAGE SYSTEMS?

Energy storage systems can broadly be categorized into several types, each serving distinct purposes. Mechanical storage methods, such as pumped hydroelectric storage, utilize gravitational potential energy to store electricity for later use. Another prominent type, electrochemical storage, primarily comprises batteries, ranging from lead-acid to advanced lithium-ion technologies. Thermal storage systems, operating on principles of heating or cooling fluids to store energy, also play formidable roles in specific scenarios. Lastly, chemical storage techniques, such as hydrogen production via electrolysis, serve as innovative pathways for energy retention. Understanding these classification mechanisms equips stakeholders with the knowledge needed to navigate the evolving landscape effectively.

HOW DOES ENERGY STORAGE IMPACT THE GRID?

Energy storage systems profoundly influence the grid’s performance and resilience. Their capability to balance supply and demand functions as a stabilizing force, effectively mitigating peaks and troughs in energy use. In integrated renewable setups, storage systems capture excess energy generated during high production periods to be utilized during scarcity. Consequently, this creates a more resilient grid structure better equipped to withstand disruptions, improve efficiency, and lower the need for fossil fuel reliance. Moreover, they can assist in frequency regulation and voltage support, ensuring the grid operates within required parameters. These contributions empower grid operators to enhance service quality while simultaneously lowering operational costs.

WHAT ROLE DOES GOVERNMENT POLICY PLAY IN ENERGY STORAGE INVESTMENTS?

Government policies wield considerable influence over energy storage investments through various mechanisms. Regulatory frameworks establishing incentives for energy storage deployment can significantly enhance the attractiveness of these technologies. Through tax credits, grants, and favorable tariffs, policymakers can catalyze investments, thereby ensuring technology adoption aligns with broader energy transition goals. Furthermore, comprehensive policy support fosters innovation by creating favorable conditions for research and development activities in the sector. Engaging stakeholders in policy discussions is essential for identifying barriers and opportunities, ensuring that investment narratives remain aligned with emerging regulatory environments and fostering a resilient industry landscape.

Energy storage systems emerge as indispensable components in the broader context of energy transition, shaping our approach to sustainability and grid resilience. Continued investments in storage technology not only address imminent challenges associated with energy production and consumption but also catalyze advances across industries. The evolving landscape requires multifaceted analyses, steering decisions towards solutions that are economically viable yet environmentally responsible. Prioritizing technological advancements and financial strategies ensures alignment with both market demands and ecological considerations, empowering investors to craft impactful solutions. As industries, governments, and society at large converge on unified objectives to combat climate change, the central role of energy storage systems solidifies, marking them as key instruments in our collective pursuit of a sustainable future. Strategic investments in this domain pave the way for pathways that uphold both profitability and environmental stewardship—prioritizing current needs while safeguarding future generations. The journey requires diligence, adaptability, and a commitment to innovation, setting the stage for a renewable-driven energy landscape where energy storage serves as the backbone of transformation.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-does-investing-in-energy-storage-systems-include-2/