The stocks of energy storage carbon black are an essential aspect of the contemporary energy landscape, reflecting growing reliance on sustainable technologies. 1. Investors are increasingly turning their attention to energy storage solutions, particularly in the context of renewable energy sources. 2. Carbon black serves as a critical component in various energy storage devices, contributing to enhanced performance and longevity. 3. Companies engaged in the production and application of energy storage carbon black are witnessing increased market demand due to shifting energy policies worldwide. 4. Several industry players represent unique investment opportunities, highlighting the potential returns associated with this often-overlooked sector. One significant aspect to explore is how market dynamics and technological advancements are shaping the future of energy storage carbon black stocks.

1. UNDERSTANDING ENERGY STORAGE CARBON BLACK

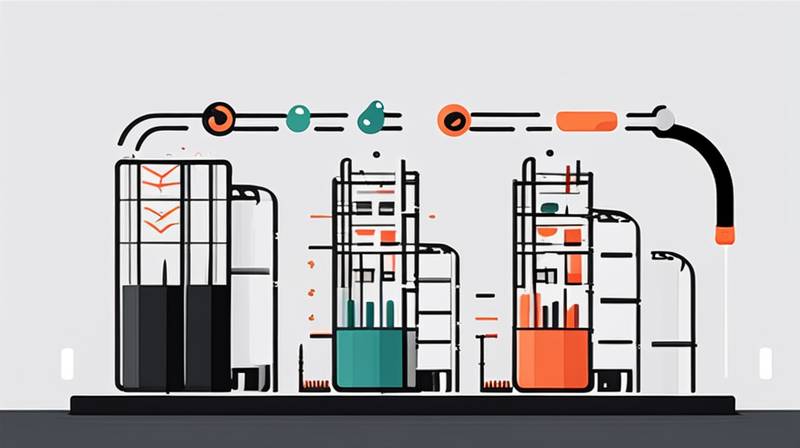

Energy storage carbon black has emerged as an intriguing subject within the financial markets, drawing interest from investors and analysts alike. This niche effectively connects the worlds of material science and renewable energy solutions. Carbon black itself is a carbonaceous material derived from the incomplete combustion of heavy petroleum products, and it plays an essential role in enhancing the properties of battery materials.

When utilized within energy storage systems, carbon black imparts notable advantages to the performance of batteries. Its high surface area and electrical conductivity create pathways that enhance the flow of electrons. Therefore, the integration of carbon black leads to improved charge/discharge efficiency, which is critical for the proliferation of renewable energy technologies. Additionally, the use of carbon black contributes to increased cycle stability, prolonging the lifespan of energy storage devices which— in turn— sparks heightened investor interest in companies specializing in this emerging market.

Investors must grasp the fundamentals of how energy storage carbon black integrates into battery technologies. It’s imperative to analyze key industry players and assess the range of applications for carbon black beyond battery production. Diverse applications include rubber manufacturing for tires, coatings, and plastics, which all utilize carbon black for enhanced strength, wear resistance, and conductivity. Thus, understanding the broader spectrum of carbon black’s usage can shed light on its significance in the evolving energy sector.

2. MARKET DYNAMICS AND TRENDS

The market for energy storage carbon black is intricately linked to a variety of dynamic forces shaping global energy policies and technological advancements. As governments enact stricter emissions regulations, there is a palpable shift toward renewable energy investments. This transition creates a burgeoning demand for efficient energy storage solutions. Companies that produce energy storage carbon black are uniquely positioned to capitalize on this trend.

Moreover, the rise of electric vehicles (EVs) is significantly altering the landscape of energy storage technology. With EV adoption on the rise, the demand for high-performance batteries is steadily increasing. Energy storage carbon black enhances battery performance, making it an indispensable component in meeting the needs of EV manufacturers. Besides improving energy density, carbon black supports fast charging capabilities, which are essential for consumer appeal.

In this context, it becomes evident that investors must monitor the regulatory environment, technological progress, and overall market trends impacting carbon black stocks. The interplay between these factors can inform investment decisions and risk assessments associated with this sector. Comprehensive market research and analysis are vital for investors hoping to navigate the complex landscape of energy storage technologies skillfully.

3. COMPANIES INVOLVED IN ENERGY STORAGE CARBON BLACK

Several companies are significant players within the energy storage carbon black market. These corporations range from specialized manufacturers of carbon black to larger industrial firms that incorporate carbon black into broader product portfolios. Noteworthy manufacturers, such as Continental Carbon and Orion Engineered Carbons, concentrate their expertise on producing carbon black tailored specifically for application in energy storage systems.

Competitively, their advances in production methods also correspond to growing concerns about sustainability and environmental impact. Innovative production techniques such as gas-phase carbon black manufacturing are being explored, which significantly reduce emissions associated with traditional carbon black production methods. The corporate landscape is evolving, and companies prioritizing environmental stewardship are gaining traction within investor circles.

Furthermore, emerging startups are disrupting the conventional carbon black sector by offering innovative solutions. Startups are leveraging advanced technologies, like artificial intelligence (AI), to optimize production processes and improve carbon black’s attributes. As energy storage solutions continue to rise in importance, investors will want to keep an eye on new entrants that promise cutting-edge technologies. This dynamic environment presents both risks and lucrative opportunities for investors willing to delve deeper into the sector.

4. RISK FACTORS AND INVESTMENT STRATEGIES

Investing in energy storage carbon black stocks is not without its risks, and potential investors must conduct thorough due diligence to mitigate these concerns. Market volatility is a fundamental characteristic of the energy sector, influenced by factors such as geopolitical developments, shifts in regulatory policies, and fluctuating commodity prices. Investors should consider these external influences when evaluating opportunities.

Financial health assessments of companies within this industry are another vital area of focus. A deep analysis of balance sheets and revenue streams can uncover potential instability or growth potential within these firms. Understanding how companies are navigating funding challenges and market demand will offer insights into their longevity and ability to adapt.

Additionally, a diversified investment approach remains crucial. By spreading investments across a range of companies engaged in the production and application of energy storage carbon black, investors can counterbalance risks. This could encompass established manufacturers, innovative startups, and firms producing complementary materials—thereby enhancing one’s portfolio resilience.

Moreover, it is beneficial to remain abreast of technological advancements in energy storage and carbon black applications. Technological breakthroughs can significantly alter the competitive landscape, opening up new opportunities and rendering current technologies obsolete. Investors who stay informed and anticipate shifts in market dynamics position themselves for success.

5. FUTURE OUTLOOK FOR ENERGY STORAGE CARBON BLACK

As the global energy landscape continues to evolve, the prospects for energy storage carbon black are increasingly promising. The shift toward sustainable practices and renewable energy, combined with advancing technologies in energy storage systems, foretells a growing market sector. Predictions indicate that the demand for energy storage technologies, which include batteries and supercapacitors, will soar in the coming years. Alongside this growth, carbon black will play a vital role due to its contributions to enhancing the efficiency and durability of these technologies.

Another compelling aspect influencing the future market is the potential for regulatory changes and incentives promoting renewable energy solutions. Governments worldwide are likely to continue implementing policies that incentivize the use of cleaner energy sources, thereby stimulating investments in energy storage technologies. The push for net-zero emissions targets will further drive innovation in the field and foster growth for companies involved in energy storage carbon black.

With advancements such as solid-state batteries gaining traction, there exists the possibility of new materials challenging the traditional reliance on carbon black. However, these developments also present opportunities for new applications of carbon black, potentially expanding its role in energy storage. Keeping an eye on the evolving market landscape and innovations will enable investors to make informed decisions about capitalizing on these trends.

QUESTIONS AND ANSWERS

WHAT IS ENERGY STORAGE CARBON BLACK?

Energy Storage Carbon Black is a specialized form of carbon black that enhances the performance and efficiency of energy storage technologies. It is a carbonaceous material produced through the incomplete combustion of hydrocarbons. This substance is integral in the manufacturing of batteries and supercapacitors, where it improves electrical conductivity and charge/discharge characteristics. The high surface area of carbon black promotes efficient electron flow, thereby enhancing energy storage capabilities. As the demand for renewable energy sources like solar and wind increases, so does the market for energy storage solutions, making energy storage carbon black an important component in the green energy transition.

HOW DOES CARBON BLACK IMPACT THE PERFORMANCE OF BATTERIES?

Carbon black significantly impacts battery performance by enhancing key aspects such as electrical conductivity, charge/discharge efficiency, and cycle stability. In lithium-ion batteries, for example, the inclusion of carbon black facilitates the movement of electrons, leading to improved power output and rapid charging capabilities. It also contributes to the overall durability of the battery, ensuring that it can withstand multiple charge/discharge cycles without significant deterioration. Furthermore, it aids in the amalgamation of various components within the battery structure, providing additional support and stability. By improving these critical performance parameters, carbon black makes batteries more competitive in the marketplace, which is especially vital in the growing sectors of electric vehicles and renewable energy storage.

WHAT ARE THE FUTURE TRENDS IN ENERGY STORAGE CARBON BLACK STOCKS?

The future trends in energy storage carbon black stocks are intertwined with the broader trajectories of renewable energy and technological advancements. With an increasing global shift toward sustainability, the demand for energy storage solutions is expected to expand significantly. Investment in energy storage carbon black companies is anticipated to rise, focusing on those that innovate and remain environmentally responsible. Trends such as the development of solid-state batteries, increased electric vehicle adoption, and regulatory incentives for cleaner energy sources will influence the performance of companies involved in this sector. Investors should also watch for emerging startups that offer cutting-edge solutions and disruptive technologies within the market. The ongoing evolution of energy storage systems will play a pivotal role in shaping the future landscape of energy storage carbon black stocks, offering substantial investment potential.

Engaging with energy storage carbon black stocks presents a unique gateway into a burgeoning sector intertwined with essential global trends. Investments in this realm correspond to a broader ecological narrative where sustainability supersedes traditional energy paradigms. Investing in firms that produce or utilize energy storage carbon black opens pathways to minting sustainable profits while contributing to the advancement of pivotal technologies aimed at combating environmental challenges. As the demand for energy storage solutions spikes, particularly within the realms of renewable energy sources and electric vehicles, market players must be prepared to adapt to evolving technological landscapes. Effective assessment of market trends, combined with a multidisciplinary approach to investment, will prove profitable for astute investors determined to capitalize on the potential unlocking within this sector. In essence, the future of energy storage carbon black appears bright; those prepared to traverse its intricacies are likely to uncover significant rewards as they invest in the future of sustainability.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-are-the-stocks-of-energy-storage-carbon-black/