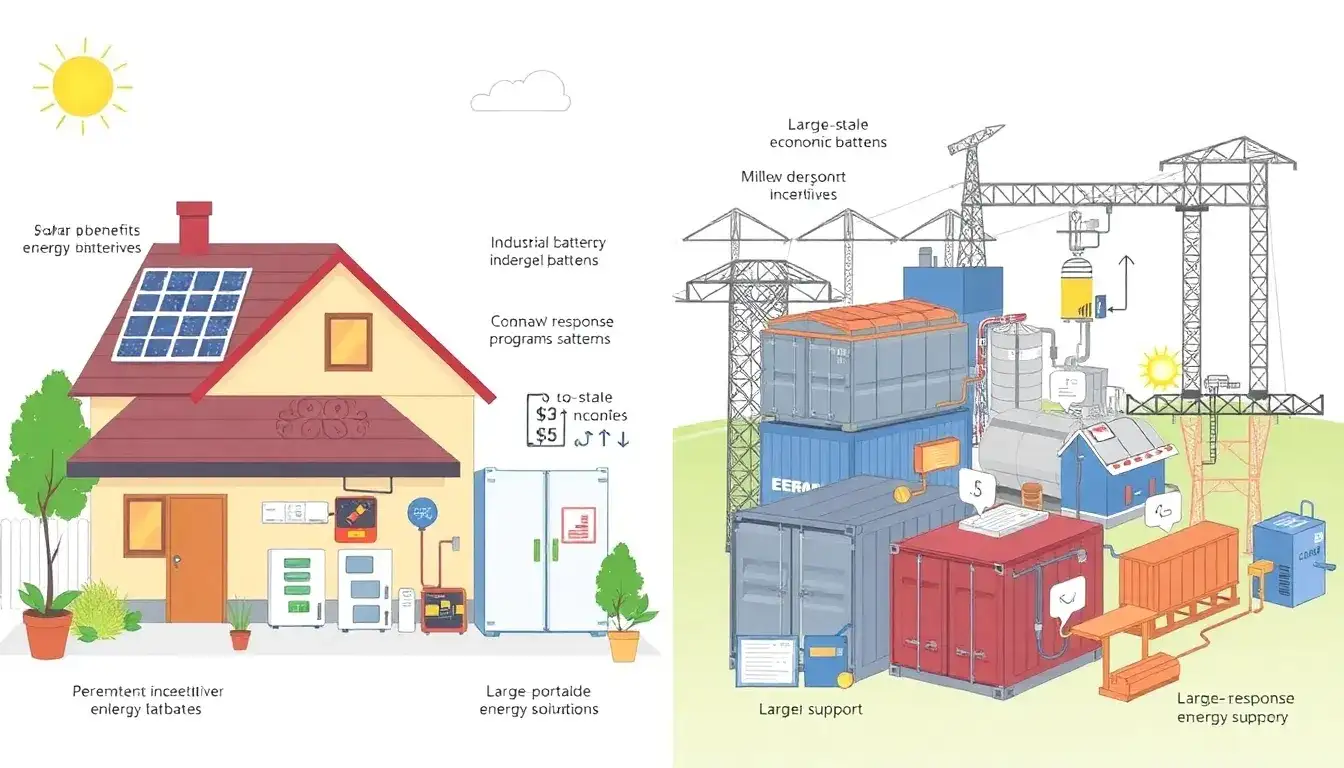

The main differences in incentives between residential and commercial energy storage systems can be summarized as follows:

Types of Incentives

- Rebates: Both residential and commercial customers can receive upfront rebates for installing energy storage systems. However, the rates can differ based on the system size and purpose.

- Performance Incentives: These incentives pay for the services provided to utilities or grid operators. Commercial customers often benefit more from this type of incentive due to their ability to participate in demand response and wholesale energy market programs.

- Combined Incentives: Programs offering both upfront rebates and ongoing performance incentives are available but may be more beneficial for commercial customers due to their ability to monetize battery services.

Residential Incentives

- Higher Per-Unit Rates: Many states, including California, offer higher per-unit incentives for residential customers compared to commercial ones, recognizing the higher cost per kilowatt for residential systems and their limited ability to monetize battery services.

- Focus on Resilience: Residential customers often install batteries for resilience during power outages. In California, the Self-Generation Incentive Program (SGIP) offers enhanced incentives for homes in high-fire-risk areas or those experiencing frequent Public Safety Power Shutoffs (PSPS).

- Equity Resiliency Incentives: In California, residents in disadvantaged areas or critical facilities can receive significantly higher rebates ($850 to $1,000 per kWh) under SGIP’s Equity Resiliency budget.

Commercial Incentives

- Lower Per-Unit Rates: Commercial customers often receive lower per-unit incentives due to economies of scale and the ability to reduce energy costs through demand charge management.

- Monetization Opportunities: Commercial systems can participate in wholesale energy markets and demand response programs, providing additional revenue streams not typically available to residential users.

- Economies of Scale: Larger commercial systems benefit from lower costs per kilowatt due to scale, allowing them to install more substantial storage solutions that can further reduce costs and enhance energy efficiency.

Federal Incentives

- Investment Tax Credit (ITC): Both residential and commercial customers can benefit from the ITC, which provides a 30% tax credit on the total cost of the system when charged with on-site renewable energy. However, residential customers may face more limitations in fully utilizing this credit unless the system is connected to solar.

In summary, residential incentives focus more on resilience and equity, offering higher per-unit rebates to offset the higher costs and limited monetization opportunities, while commercial incentives leverage economies of scale and diverse revenue streams to maximize energy efficiency and cost savings.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-are-the-main-differences-in-incentives-between-residential-and-commercial-energy-storage-systems/