C-PACE Financing Overview

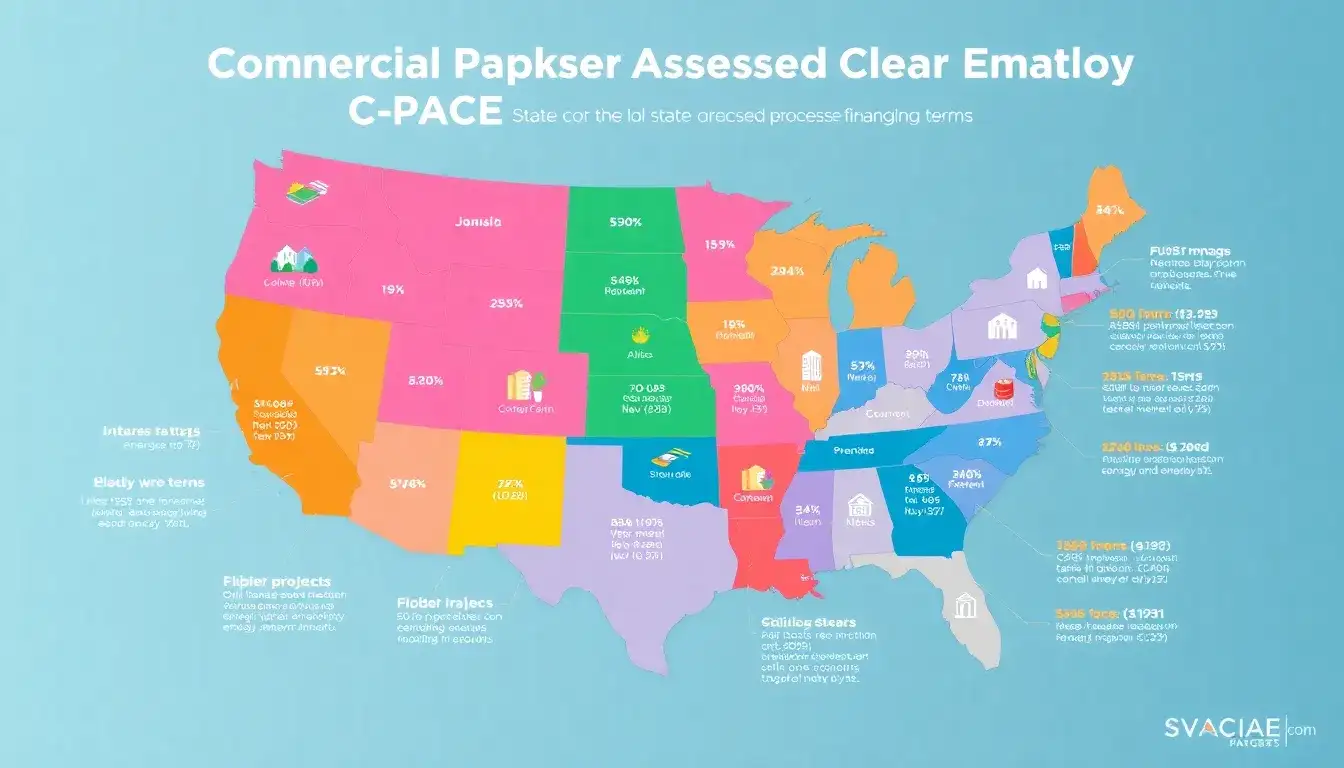

C-PACE (Commercial Property Assessed Clean Energy) financing offers a versatile tool for property owners to finance energy-efficient and renewable energy improvements across different states. However, the terms and availability can vary significantly from one state to another due to local legislation and program specifics. Here are some of the main differences:

Program Availability

- Enabling Legislation: Not all states have enacted legislation allowing C-PACE financing. Currently, more than two-thirds of states offer some form of C-PACE, but participation can differ at the local level.

- State and Local Guidelines: Each state may have its own set of guidelines and eligibility criteria for C-PACE programs, which can influence the terms of financing available to property owners.

Loan Terms

- Loan Duration: C-PACE loans generally range from 15 to 20 years, but some terms can extend up to 25 to 30 years, depending on state regulations and the useful life of the installed equipment.

- Repayment Mechanism: Repayment is typically through property tax assessments, which are tied to the property rather than the owner. This can affect property resale, as the assessment remains with the property even after a sale.

Financial Terms

- Cost and Interest Rates: C-PACE loans often offer lower interest rates compared to conventional financing options, which can vary by state depending on local market conditions and legislation.

- Non-Recourse Nature: Many C-PACE loans are non-recourse to the borrower, meaning the lender’s recourse is limited to the property itself.

Eligibility Criteria

- Eligible Projects: While C-PACE is generally available for commercial properties, the specific types of projects that qualify (e.g., energy efficiency upgrades, renewable energy installations) may differ by state.

- Savings to Investment Ratio: Some states have specific “Savings to Investment Ratio” requirements to ensure that the energy savings from the project justify the financing costs.

Local Implementation

- Administrative Setup: The setup and administration of C-PACE programs can vary significantly across states and local jurisdictions, affecting how easily projects can secure funding.

In summary, while C-PACE financing offers a valuable tool for sustainable development, its terms and availability are influenced by state-specific legislation and local implementation, resulting in differences across the U.S.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-are-the-main-differences-in-c-pace-financing-terms-between-states/