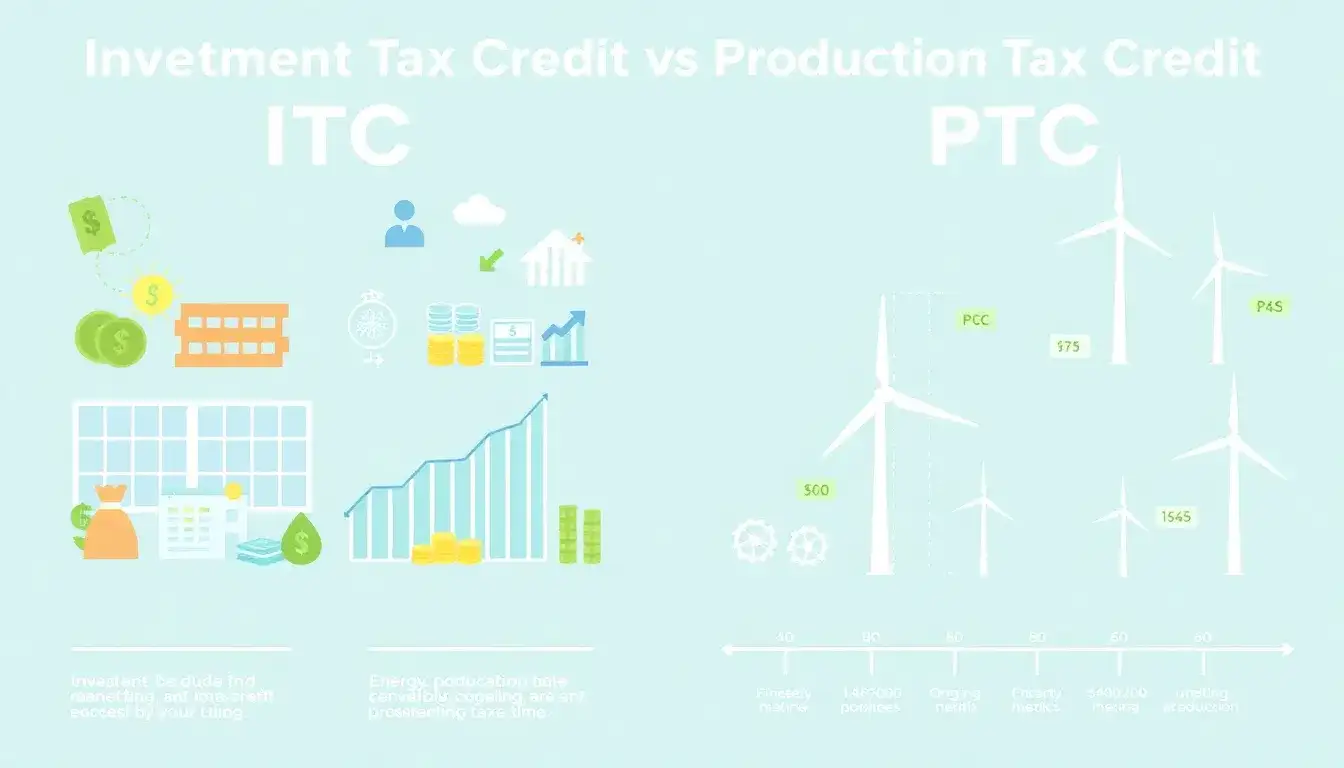

The Investment Tax Credit (ITC) and the Production Tax Credit (PTC)

The Investment Tax Credit (ITC) and the Production Tax Credit (PTC) are two distinct U.S. federal tax incentives designed to promote clean energy investment and generation, with key differences in how they calculate benefits and apply to renewable energy projects.

Key Differences Between ITC and PTC

1. Calculation Method

- ITC: The Investment Tax Credit offers a dollar-for-dollar reduction in income taxes based on a percentage of the total capital investment in a qualifying clean energy project. It provides an immediate tax credit calculated as a portion of the upfront project costs, often around 30% for many projects. This credit helps lower the initial cost of installing renewable energy systems by directly offsetting tax liability.

- PTC: The Production Tax Credit is a per-kilowatt-hour (kWh) tax credit based on the actual electricity generated and sold by the renewable energy facility. It provides ongoing benefits over a typical period of 10 years, incentivizing projects to produce as much clean energy as possible since credits increase with generation.

2. Timing and Benefit Structure

- ITC: Benefits are realized primarily when the project is placed in service, as the credit is based on the capital cost. This offers upfront financial support that reduces the installation expense.

- PTC: Benefits accrue gradually over time, tied directly to the volume of electricity produced, rewarding projects that perform efficiently over their operational life.

3. Eligible Technologies

- ITC: Applies to a wide range of clean energy projects including solar, wind, energy storage, microgrid controllers, fuel cells, geothermal (electric and heat pump), combined heat and power systems, and microturbines. It also covers interconnection costs.

- PTC: Primarily applies to technologies such as wind, biomass, landfill gas, hydroelectric, marine, and hydrokinetic power. The PTC supports technologies where ongoing production measurement is feasible.

- Some technologies like solar and wind may be eligible to choose either ITC or PTC but not both, depending on the project.

4. Use Cases and Strategic Considerations

- ITC is more beneficial for projects with high upfront costs but potentially uncertain or variable long-term energy production because it provides immediate tax relief.

- PTC is advantageous for projects expected to generate large amounts of electricity reliably over time, as it ties the credit directly to energy output, rewarding higher and sustained generation.

- Developers often analyze project-specific factors such as technology type, expected capacity, and financial strategy to determine which credit (ITC or PTC) offers the greatest benefit.

5. Legislative Updates

- The Inflation Reduction Act extended both credits through at least 2025, with the ITC maintaining a 30% credit rate and the PTC valued at about $0.0275 per kWh (2023 value), contingent on meeting labor standards.

- Starting in 2025, modified versions known as the Clean Electricity Investment Tax Credit and Clean Electricity Production Tax Credit will replace the traditional ITC and PTC, reflecting evolving policy goals.

Summary Table

| Feature | Investment Tax Credit (ITC) | Production Tax Credit (PTC) |

|---|---|---|

| Credit Type | Percentage of upfront capital investment | Per kWh of electricity generated |

| Benefit Timing | Immediate, upfront tax credit | Spread over ~10 years based on energy production |

| Typical Credit Rate | ~30% of project cost | ~$0.0275 per kWh (varies by year and policy) |

| Eligible Technologies | Solar, wind, energy storage, fuel cells, geothermal, CHP, microturbines, etc. | Wind, biomass, landfill gas, hydroelectric, marine, hydrokinetic |

| Incentive Focus | Lowering installation costs | Incentivizing ongoing clean energy production |

| Strategic Considerations | Best for projects with high upfront costs or uncertain generation | Best for projects with stable, high energy output |

In essence, the ITC reduces the initial financial barrier by crediting a portion of invested capital, while the PTC rewards sustained clean electricity generation over time, making each suited to different project profiles and developer priorities.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-are-the-differences-between-the-investment-tax-credit-itc-and-the-production-tax-credit-ptc/