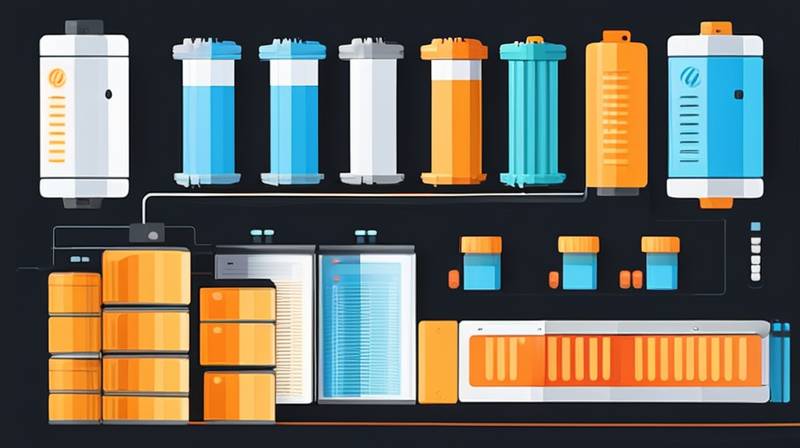

1. Energy storage stocks feature a variety of companies, including traditional energy sectors and innovative technology firms, 2. The surge in green energy initiatives propels investment opportunities in energy storage companies, 3. Top contenders in this market include manufacturers of batteries, advanced storage solutions, and alternative energy technology firms, 4. Investors should consider market trends, regulatory support, and technological advancements when selecting stocks in this sector. Among these, the growing demand for renewable energy sources drives the need for effective energy storage solutions, as it directly addresses the intermittency issues faced by solar and wind power. Companies innovating in battery technology, such as those involved in lithium-ion and solid-state batteries, are particularly noteworthy. Furthermore, governmental incentives aimed at reducing carbon footprints add an additional layer of appeal for potential investors, solidifying the future landscape of energy storage solutions.

ENERGY STORAGE STOCKS: A GROWING OPPORTUNITY

The landscape of energy investment has fundamentally shifted over the past decade, making energy storage stocks increasingly essential for investors looking to capitalize on a sector that underscores both environmental sustainability and economic growth. Amidst this backdrop, the continuing evolution of energy storage technology presents a unique blend of opportunity and challenge for potential investors. Companies are not only striving to improve energy efficiency but are also competing to bring innovative storage solutions to a market that is increasingly favoring renewable energy sources. With the global shift towards greener energy solutions, understanding the nuances of energy storage stocks is paramount for investors.

Key Drivers of Investment in Energy Storage

Market dynamics are shifting, driven by an increased demand for electricity and a renewed focus on renewable energy sources. This transition is largely being fueled by three notable trends: the urgent need for efficient energy distribution systems, advancements in energy storage technologies, and governmental policies favoring sustainable energy practices. First and foremost, the global push for reduced carbon emissions has triggered substantial investments in battery storage systems and other energy storage technologies. Governments around the world offer incentives and subsidies, which further drive the growth of these stocks. As more companies pivot towards renewable energy, stock market interest in reliable energy storage has surged.

The second driver of energy storage stock growth lies within technological advancements. From lithium-ion batteries to emerging solid-state solutions, innovations continue to reshape the energy storage landscape. These technologies not only improve energy efficiency but also lengthen storage capabilities, making energy systems more reliable. As a result, companies leading the charge in R&D are well-positioned to capture market share, making them attractive prospects for savvy investors. Both developments in charging stations and battery recycling processes will play key roles in determining which companies thrive and which may falter as market conditions change.

TOP CONTENDERS IN ENERGY STORAGE STOCKS

A plethora of firms contribute to the complex ecosystem of energy storage. Some of the most recognized companies include Tesla, Enphase Energy, and Fluence Energy, which are leading the charge in battery technology, smart energy solutions, and grid optimization. Tesla, with its Gigafactory, is not only producing electric vehicles but has also placed a massive focus on energy storage. Their Powerwall and Powerpack products have garnered attention by showcasing the feasibility of residential and commercial energy environments that rely on stored energy. The company’s ongoing innovations in battery technology aim to increase efficiency and energy output, making it a cornerstone company for anyone interested in investing in the energy storage market.

Enphase Energy represents another noteworthy player, primarily involved in solar energy storage solutions. Using its unique microinverter technology, the company has redefined the solar landscape by enabling homeowners to maximize solar generation while minimizing energy costs. Beyond mere solar energy solutions, Enphase is also innovating in battery storage systems, allowing households to store excess energy produced during peak sun hours for later use. This process adds a layer of resilience to home energy systems, making Enphase a compelling investment choice.

Fluence Energy, a joint venture between Siemens and AES Corporation, specializes in energy storage products and services. Their advanced energy storage systems offer scalable solutions to various sectors, demonstrating the versatility required in modern energy markets. Through their technology, Fluence enables the integration of renewable energy sources with existing grid infrastructure, enhancing grid reliability and energy security. The company is leveraging a global footprint to address regional energy issues, making it a strong contender for investors aiming to diversify within the energy storage space.

REGULATORY ENVIRONMENT AND MARKET TRENDS

Navigating the world of energy storage investments necessitates an understanding of the regulatory environment, which can greatly impact market performance. Governmental initiatives, environmental regulations, and energy policies play pivotal roles in shaping investment landscapes. For instance, in the U.S., federal and state governments provide various tax credits and incentives aimed at promoting energy efficiency and renewable technology adoption. These support mechanisms have considerable implications for the profitability and viability of energy storage investments.

Moreover, the rapid advancements in technology often coincide with shifts in regulatory frameworks, creating both opportunities and risks for investors. As policies adapt to reflect the growing consensus on climate responsibility, companies that align their strategies with governmental objectives will likely see a boost in market confidence. Spain’s ambitious climate goals and California’s innovative energy storage mandates serve as examples of how local policies can impact the broader investment landscape. Recognizing these trends can give investors insights into the potential performance of energy storage companies.

TECHNOLOGICAL ADVANCEMENTS IN ENERGY STORAGE

The heart of the energy storage sector beats with innovation. Battery technology, in particular, is evolving rapidly, opening doors to a plethora of investment opportunities. While lithium-ion technology continues to dominate the current landscape, research into alternative technologies such as solid-state batteries and flow batteries is gaining traction. These technologies are anticipated to increase energy density, performance duration, and safety, appealing to both commercial and consumer users alike.

Furthermore, the emergence of decentralized energy systems is heralding a new era for energy storage solutions. Companies focusing on smart grid technologies, energy management systems, and hybrid energy storage solutions are likely to thrive in this evolving marketplace. The ubiquity of IoT devices enables smarter energy consumption and better demand response to energy markets. Firms engaged in the development of such technologies will find themselves well-positioned to capitalize on the growth of distributed energy resources.

CONSIDERATIONS FOR POTENTIAL INVESTORS

When venturing into energy storage stock investments, several crucial considerations warrant attention. First, market volatility is an intrinsic characteristic of the energy sector. Investors should familiarize themselves with how fluctuations in oil prices, shifts in public policy, and technological breakthroughs can affect stock valuations. With this understanding, a diversified investment portfolio that incorporates various companies across sectors may help mitigate associated risks.

Second, ongoing developments in the energy storage arena necessitate diligence from potential investors. Staying informed about the latest research, emerging technologies, industry trends, and regulatory changes is essential for making informed investment choices. Investors must pay attention to announcements regarding partnerships, mergers, or acquisitions, as these activities can significantly impact a company’s market value and performance outlook.

FREQUENTLY ASKED QUESTIONS

WHAT ARE ENERGY STORAGE STOCKS?

Energy storage stocks represent companies that develop, manufacture, and sell technologies related to energy storage. This includes various forms of batteries, supercapacitors, and other innovative solutions that allow users to store energy generated from renewable sources. The necessity for such technologies has intensified alongside the growing adoption of wind and solar power, which inherently face intermittency challenges. These stocks have gained momentum as companies innovate to enhance efficiency, longevity, and capacity, making it easier to deploy renewable energy on a grand scale. With various players in the market, investment in energy storage can cater to diverse investor preferences and objectives.

HOW DO I IDENTIFY POTENTIAL ENERGY STORAGE INVESTMENTS?

Identifying promising energy storage investments involves thorough market analysis and an understanding of company fundamentals. Investors should focus on key indicators such as innovative technological capabilities, market positioning, and the ability to scale operations. Analyzing regulatory trends related to renewable energy, as well as individual company financial health and growth potential, can provide insights. Industry news and reports from trusted analysts can deliver valuable information about emerging trends and market shifts. Ultimately, proactive and informed decision-making increases the chance of identifying successful energy storage stocks.

WHAT IS THE FUTURE OF ENERGY STORAGE INVESTMENTS?

The outlook for energy storage investments remains exceptionally positive, primarily driven by the global transition towards renewable energy and sustainability. As governments worldwide implement stringent regulatory measures aimed at reducing greenhouse emissions, the demand for energy storage technologies will grow exponentially. Technological advancements will continue to enhance battery performance, efficiency, and safety, enabling a wider adoption of energy storage solutions across various sectors. Equity investors who align their portfolios with these emerging trends may see consistent growth as energy storage evolves into a cornerstone of the renewable energy infrastructure.

The energy storage sector is poised for vibrant growth, driven by multiple compelling forces that present both challenges and promising opportunities. As the urgency to combat climate change propels innovations in energy efficiency, the entrance of new technologies and players into the market stands to reshape existing dynamics. Investors willing to leverage empirical research, stay attuned to market developments, and recognize the implications of regulatory policies can position themselves strategically within this burgeoning sector. With an astute understanding of both the technological landscape and shifting policy frameworks, one can navigate the energy storage investment space effectively. In essence, the energy storage industry is not merely about financial gain; it embodies a crucial element of humanity’s pivot towards sustainable energy practices, ultimately benefiting both investors and the planet. By focusing on companies that demonstrate the capacity for innovation and resilience, investors can capitalize on significant growth potential while contributing to a cleaner, more sustainable future.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-are-some-energy-storage-stocks-to-invest-in/