Trends in the Development of New Energy Vehicles

The future of new energy vehicles (NEVs) is characterized by multiple trends:

- Expanding Market Size: In 2022, China’s annual production of new energy vehicles surpassed 10 million units, accounting for 65% of the global total. This marks the 10th consecutive year that China has held the top position worldwide. In March 2025, retail sales of new energy passenger vehicles reached 988,000 units, reflecting a year-on-year growth of 39%, indicating a sustained high growth rate. Other countries in the Asia-Pacific region are also exhibiting strong electrification trends, contributing to a global growth in the NEV market.

-

Continuous Technological Innovation:

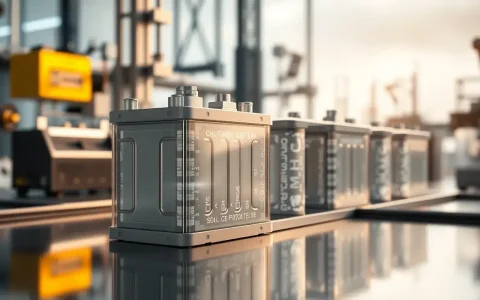

- Battery Technology: The sulfide solid electrolyte technology has become mainstream for all-solid-state batteries. Companies like CATL and BYD plan to achieve large-scale production of supercharging all-solid-state batteries by 2027, with energy densities exceeding 400Wh/kg. Advances in ultra-fast charging technology have also emerged, with companies like GigaWatt Research introducing new battery cells that can charge from 0 to 80% in just six minutes. Additionally, low-temperature performance is being optimized, as evidenced by CATL’s “Xiaoyao” hybrid battery, which can discharge normally at -40°C.

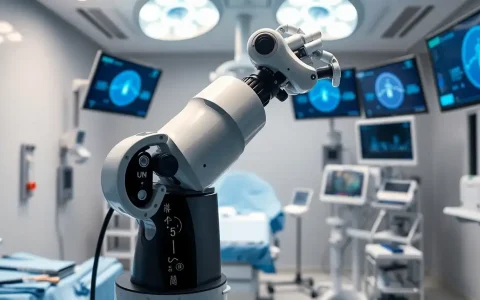

- Intelligent Driving Systems: Decision-making systems based on end-to-end large models are set to handle complex scenarios, with several automakers expected to launch L3 conditional autonomous driving models by 2025. The integrated “Beidou + 5G + V2X” technology supports lane-level navigation and global traffic optimization, already implemented in 2 million intelligent connected vehicles.

- AI and Smart Integration: The cockpit driving integrated chip facilitates the combination of cabin entertainment and autonomous driving computing power, achieving computational power exceeding 1000 TOPS. The application of large AI models is becoming more widespread; for instance, Geely’s integration with the DeepSeek model has improved interaction response times by 40%, while BYD’s AI suspension system offers millisecond-level adjustments to vehicle posture. The electronic architecture is evolving from a distributed to a centralized model, supporting vehicle OTA updates and functional iterations.

- Efficient Energy Systems: The 800V high-voltage platform is being promoted, with brands like BYD and Xpeng achieving 1000V-level voltage systems. The use of silicon carbide (SiC) power devices has enhanced electric control efficiency to 92%. In the commercial vehicle sector, hydrogen fuel cells are advancing, with the cost of green hydrogen production dropping below 30 yuan/kg and range exceeding 1000 kilometers. Super hybrid systems are also being optimized, with Geely’s Thor EM-i achieving a thermal efficiency of 46.5%, and Changan’s Kunlun extended-range system producing 3.63 kWh of electricity from 1 liter of fuel.

- Improved Charging Infrastructure: By the end of 2024, the total number of charging facilities in China is expected to reach 12.818 million units, a 49.1% increase year-on-year. The National Energy Administration will continue to promote the construction of charging facilities, focusing on fostering new technologies and business models in the charging sector. New technologies, such as megawatt-level fast charging terminals, are also being developed, with BYD’s fully liquid-cooled megawatt charging pile achieving a single-gun output power of 1360kW, compatible with future all-solid-state battery needs.

- Intensified Industry Competition and Cooperation: The NEV market is highly competitive, with both traditional automakers and new players accelerating their development. Partnerships among companies have become a new trend, such as collaborations between BYD and Toyota, and Evergrande and FEV. Furthermore, in light of the uneven global development of NEVs, China’s development model serves as a reference for other countries, fostering increasing international exchange and cooperation.

- Diversification of Products and Market Penetration: The NEV market has seen a surge in high-quality, long-range models, with the luxury and premium segments gradually dominating, while mainstream models also experience steady growth. In the future, small and medium-sized cities and rural areas are expected to become new growth points for the NEV market in China, indicating a clear trend of market penetration.

- Emergence of Energy Ecosystems: Vehicle-to-grid (V2G) technology is continuously evolving, allowing electric vehicles to participate in grid peak shaving as distributed energy storage units through bidirectional charging and discharging. By 2030, the scale of vehicle-grid interaction storage is anticipated to surpass that of fixed battery systems, leading to a closer integration of NEVs with the grid and a more complete energy ecosystem.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/trends-in-new-energy-vehicle-development-market-growth-technological-innovations-and-future-prospects/