1. Implementing solar photovoltaic power generation can offer lucrative opportunities for income through several avenues. 2. The key methods include direct energy sales, providing energy to the grid, and leveraging government incentives. 3. Individual investors can also engage in solar system installations on their properties, which results in reduced electricity bills and potential profits. 4. Additionally, various financial models such as leasing and Power Purchase Agreements (PPAs) can facilitate earnings without large upfront investments.

In-depth exploration of how to monetize solar photovoltaic (PV) systems reveals a multifaceted approach, which includes understanding the technology and its market context. The shift towards renewable energy means there’s potential for both residential and commercial entities to become active participants in this transition.

1. UNDERSTANDING SOLAR PHOTOVOLTAIC TECHNOLOGY

Solar photovoltaic technology operates on the principle of converting sunlight directly into electricity using solar cells. These cells are composed of semiconductor materials, typically silicon, which absorb photons from sunlight and release electrons. This process generates an electric current. The growth of the solar industry has been spurred by advancing technology that enhances efficiency and reduces costs, making solar installations more economically viable for both individuals and businesses.

The efficiency of a solar panel is critical in determining its performance and the overall output of an installed system. Efficiencies have progressively improved with advances in material science, allowing for higher energy generation in smaller physical areas. Higher efficiency panels, while initially more expensive, can yield better financial returns in the long run. Understanding these parameters ensures that potential investors select the most appropriate system for their needs.

2. DIRECT ENERGY SALES AND GRID INTEGRATION

One of the primary avenues for generating income from solar PV systems is through energy sales. Households and businesses that install solar panels can utilize the energy generated for their own consumption. However, any excess energy produced can potentially be sold back to the grid. This is often facilitated through net metering or feed-in tariffs, which allow producers to receive compensation for the surplus electricity they generate.

Net metering enables users to receive credits on their utility bills equal to the amount of solar energy that is exported to the grid. This arrangement makes solar energy even more appealing as it directly reduces energy costs while also providing a potential revenue stream. Feed-in tariffs, on the other hand, guarantee a fixed payment for each unit of electricity fed into the grid. Understanding these models allows individuals and businesses to evaluate the most beneficial financial arrangements for their solar activities.

3. GOVERNMENT INCENTIVES AND POLICY SUPPORT

Government incentives are a significant factor in making solar power financially attractive. Many regions offer tax credits, rebates, and grants, which can help defray the costs of installing solar systems. These incentives can vary significantly from one jurisdiction to another, necessitating thorough research to take advantage of available programs.

For instance, the Investment Tax Credit (ITC) in the United States allows solar system owners to deduct a percentage of the installation costs from their federal taxes. Other financial models such as state-level rebates can also supplement federal incentives, providing further financial relief. Utilizing these programs not only improves the financial viability of solar installations but also accelerates the adoption of renewable technologies across communities, aligning personal financial goals with broader environmental objectives.

4. LEASING AND POWER PURCHASE AGREEMENTS (PPAs)

Leasing and Power Purchase Agreements (PPAs) provide alternative pathways to engage with solar energy without significant upfront investments. With leasing, a solar provider installs the system on a homeowner’s property, and the homeowner pays a fixed monthly fee for the use of the system. This allows for immediate savings on energy bills without the financial burden of purchasing the system outright.

Similarly, PPAs involve a solar provider installing a system and the consumer agreeing to purchase the generated power at a predetermined rate. This model is particularly attractive in areas where property owners may be unable to pay for an installation upfront, yet still want to capitalize on solar energy. Both leasing and PPA arrangements typically result in lower energy costs and can be structured to meet the financial objectives of the consumer effectively.

5. MAINTAINING SOLAR SYSTEMS FOR OPTIMAL PERFORMANCE

To maximize earnings from solar power generation, regular maintenance of solar systems is essential. Conducting periodic checks on solar panels, inverters, and batteries will ensure they are functioning efficiently. Dust, debris, and snow accumulation can significantly reduce the effectiveness of solar panels, leading to lost potential income. Additionally, monitoring system performance through software solutions can help identify any discrepancies in energy production, allowing for timely interventions.

Investors and homeowners should also be educated on the lifespan of key components within their solar systems. Regular maintenance not only helps prolong the lifespan of the technology but also ensures that the maximum amount of energy is being produced — reinforcing overall profitability over time. It is prudent to either engage with professional service providers or implement a DIY approach with monitoring tools that can assist in maintaining optimal functionality.

6. CULTIVATING ENVIRONMENTAL AWARENESS AND BRAND REPUTATION

In the current era of increasing awareness regarding environmental sustainability, businesses and homeowners alike can benefit from the public perception associated with solar energy investment. Engaging with renewable energy not only aligns with global sustainability goals but can also enhance a company’s brand reputation as a forward-thinking, environmentally conscious enterprise.

Promoting solar energy initiatives or showcasing installations can create marketing opportunities by attracting customers who prioritize sustainability. Furthermore, businesses can leverage their commitment to renewable energy as a distinctive selling point, which can potentially translate into increased market share and customer loyalty.

7. ANALYZING FINANCIAL RETURNS AND MARKET TRENDS

Investors should conduct thorough analyses of potential returns on investment from solar photovoltaic systems. This involves assessing energy savings, incentive programs, and the long-term benefits associated with rising energy prices. Furthermore, as market trends shift toward renewable energy, understanding local and regional energy policies can significantly impact potential earnings.

Engaging with financial advisors or industry experts can provide valuable insights into current market dynamics. This knowledge enables investors to make informed decisions regarding solar investments, ensuring that they capitalize on financial opportunities throughout the lifecycle of their energy systems.

8. FUTURE PROJECTIONS FOR SOLAR ENERGY EARNINGS

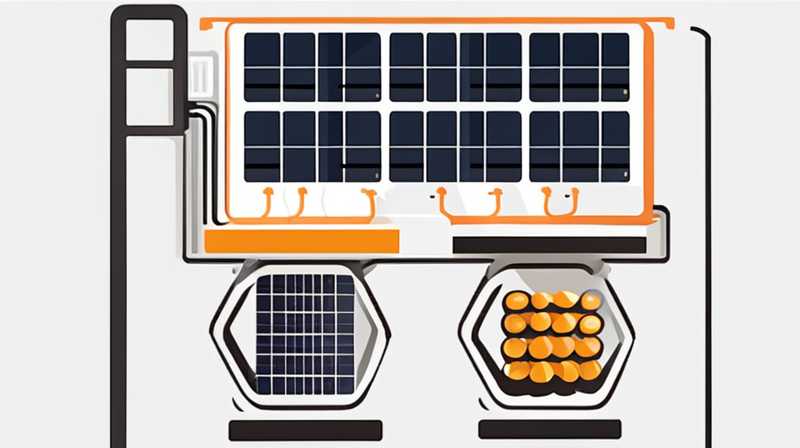

As technology progresses and the demand for renewable energy grows, the potential for profit from solar PV systems is likely to expand. Advancements in energy storage solutions, such as batteries, will also facilitate more efficient energy use. The ability to store energy for later use enhances not just profitability but also grid stability, as consumers can depend on their solar energy even during periods of low sunlight.

In the coming years, as more jurisdictions adopt encouraging policies and financial incentives, the profitability of investing in solar energy will become increasingly attractive. The changing landscape of the energy sector signifies a pivotal moment where stakeholders can align their investments in solar with both economic gains and broader environmental benefits.

Frequently Asked Questions

HOW CAN I FINANCE THE INSTALLATION OF A SOLAR POWER SYSTEM?

Financing options for solar power system installation are vast and can cater to different financial situations. Individuals may opt for solar loans, which allow them to borrow money specifically for the purchase of a solar system. These loans typically have favorable terms, including lower interest rates and deferred payment options. Another option is the lease model, allowing homeowners to install solar panels with little to no upfront cost, just monthly payments. Additionally, investors can explore Power Purchase Agreements (PPAs), where they pay only for the energy produced rather than the system itself. New and evolving financial incentives also play a significant role, with many governments offering subsidies and tax credits that can significantly reduce the total capital needed for installation.

Furthermore, community solar projects provide another financing avenue. These collaborations allow individuals to invest in larger solar installations shared among multiple participants, which can lead to cost savings and energy credits. A thoughtful evaluation of different financing options, alongside potential energy savings and income earned through selling excess energy or government incentives, will help interested parties determine the best approach for financing their solar initiatives effectively.

WHAT ARE THE MAIN BENEFITS OF INSTALLING SOLAR PANELS?

The primary advantages of installing solar panels center around cost savings, environmental impact, and energy independence. Initially, solar panels provide substantial reductions in electricity bills, especially for households and businesses that consume a significant amount of energy. With net metering, individuals may also receive payments for any excess energy generated, further enhancing savings.

Environmentally, solar energy is a clean and renewable source, significantly reducing greenhouse gas emissions compared to fossil fuels. This shift not only contributes to combating climate change but also supports efforts to build sustainable communities. Moreover, governments increasingly recognize the importance of renewable energy, often implementing supportive policies that encourage solar installations, including tax incentives and rebates.

Finally, solar energy promotes energy independence, particularly for regions reliant on imported fuels. By investing in solar technology, both households and businesses can gain greater control over their energy sources, reducing vulnerability to energy price fluctuations and enhancing the resilience of local energy supply chains. Overall, these benefits create a compelling case for the adoption of solar energy solutions.

WHAT ARE THE LONG-TERM FINANCIAL PROJECTIONS FOR SOLAR ENERGY INVESTMENTS?

Long-term financial projections for solar energy investments are quite favorable, driven by both technological advancements and evolving market dynamics. As technology becomes increasingly cost-effective, the price of solar panels continues to decrease, making installations more accessible and attractive for a broader range of consumers. In many areas, solar energy has already reached grid parity, where it is as cost-effective as conventional energy sources, thereby incentivizing wider adoption.

Additionally, with rising energy prices, solar energy systems can provide stability to their owners by locking in lower utility costs over the long term. Many analyses suggest that the average return on investment for solar systems can exceed 10%, alongside the added value to the property as homes with solar panels often command higher selling prices.

It’s also worth considering the significant long-term savings on energy bills and income from selling surplus energy back to the grid, which can contribute to the overall financial feasibility of solar investments. Therefore, stakeholders can expect favorable financial conditions as solar technology continues to evolve and the world collectively moves toward a sustainable energy future.

Investing in solar photovoltaic systems represents a multifaceted opportunity that combines financial returns with environmental benefits. By understanding the various pathways toward monetization—be it through energy sales, government incentives, leasing, or PPAs—investors can make informed choices that maximize returns while contributing to the global renewable energy movement. As technology progresses and societal demand for clean energy intensifies, the potential for profitability from solar energy will only grow. Implementing a proactive approach to maintenance, monitoring market trends, and capitalizing on financial incentives will foster sustainable investment in this green technology. Ultimately, embracing solar energy not only aligns with individual financial goals but also plays a role in creating a sustainable and resilient energy future for all.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-to-make-money-from-solar-photovoltaic-power-generation/