1. Determining the appropriate investment in energy storage depends on several factors: 1. **Project Type and Scale—Understanding whether the investment is for residential, commercial, or utility-scale storage can significantly affect costs and returns. 2. **Technological Choices—Different technologies, such as lithium-ion batteries, flow batteries, or emerging technologies, present varied price points and efficiency levels impacting overall expenditure. 3. **Market Dynamics—Factors such as local regulations, incentives, and the fluctuating cost of energy can influence both initial and long-term financial commitments. 4. **Return on Investment (ROI)—Enhancing energy resilience and minimizing costs during peak demand periods are crucial for calculating potential returns. Each factor necessitates meticulous examination and a substantial understanding of the energy landscape. The complexity of the investment requires both market insight and advanced knowledge of energy systems to make an informed decision.

1. OVERVIEW OF ENERGY STORAGE

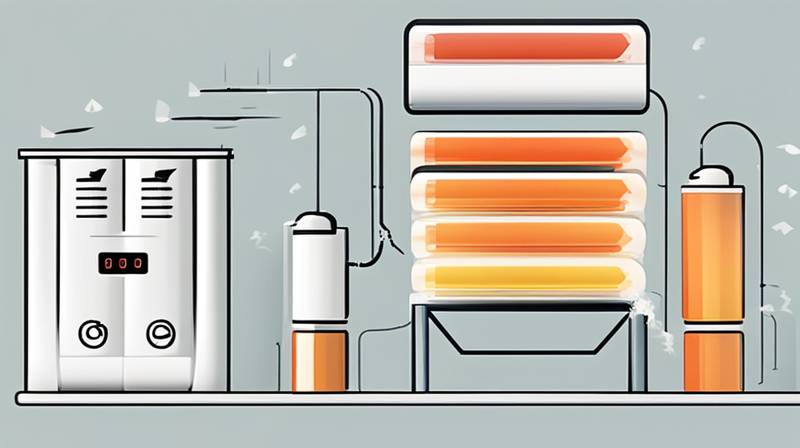

Energy storage has become an essential component in the transition towards sustainable and reliable energy systems. This sector encompasses a variety of technologies and strategies designed to store surplus energy generated from renewable sources, such as wind and solar, for later use. The relevance of this market is profoundly growing, responding not only to the need for better energy efficiency but also to the challenges posed by energy volatility. As economies increasingly adopt renewable sources, the necessity for robust energy storage solutions becomes paramount. The intricate relationship between generation, consumption, and storage creates a dynamic environment that requires careful consideration and strategic planning.

1.1. Importance of Energy Storage

The expansion of energy storage technologies is vital for easing the integration of renewable energy resources into existing grids. Energy storage systems enable the smoothing of supply and demand discrepancies, offering reliability to a grid that requires operational efficiency. Effective energy storage systems can alleviate peak demand, ensuring that sufficient energy is available when it is most needed while conserving energy generated during periods of excess production. This ability to store and dispatch energy enhances grid stability, making it capable of coping with unprecedented spikes in energy consumption—hence providing resilience to conventional and renewable sources alike.

Moreover, the implementation of energy storage systems can help stabilize energy prices. When storage systems are utilized effectively, they can prevent surges in energy prices by supplying stored energy during peak hours, thus reducing reliance on fossil fuel-based peaker plants. This integration of technology helps to create a more balanced energy market which benefits not only energy suppliers but also end-users who ultimately pay for energy consumption. Innovation in this sector is essential for not just sustainability, but economic viability as well.

2. FACTORS AFFECTING INVESTMENT AMOUNTS

Determining how much capital to allocate toward energy storage necessitates a comprehensive evaluation of various influential factors. These aspects significantly influence the financial landscape of energy storage ventures.

2.1. Project Type and Scale

The type of project—a residential facility, commercial establishment, or utility-scale installation—plays a pivotal role in dictating investment amounts. Each category entails distinct operational requirements and functionality levels. Residential energy storage typically involves smaller systems, often designed to work with home solar arrays, enabling homeowners to harness stored energy when sunlight levels diminish. Investment in residential setups is generally lower, fostering accessibility and catering to a growing number of energy-conscious homeowners.

Conversely, utility-scale storage involves larger projects requiring substantial capital expenditures. These systems are usually designed for grid stabilization, operating at a scale that ensures broad public service and energy supply stability. The costs associated with installations of this magnitude involve not only the technology itself but also land acquisition, infrastructure development, and regulatory compliance. Additionally, utility-scale systems often employ advanced technologies that may enhance their operational capabilities but come with corresponding financial implications.

2.2. Technological Choices

The choice of technology fundamentally impacts investment levels in energy storage projects. Technologies such as lithium-ion batteries, flow batteries, and other innovative storage solutions each present unique benefits and constraints, thus affecting their overall costs. Lithium-ion batteries, for instance, dominate the current market predominantly due to their high energy density and declining prices. However, while their initial costs may be lower compared to alternatives, they often come with limitations regarding life span and thermal stability, necessitating further investment in management systems.

In contrast, flow batteries provide a more scalable solution with potentially longer life spans. Although their upfront investment might be higher, they offer advantages in lifecycle management, making them more fiscally feasible over extended periods. Each energy storage technology presents advantages tailored to specific applications; thus, it is crucial to align your project with the appropriate technology to optimize investment outcomes. Understanding how these technologies interact with market requirements allows for strategic planning and informed expenditure decisions.

3. MARKET CONDITIONS AND REGULATORY ENVIRONMENT

Market conditions fundamentally alter the viability of energy storage investment. Dynamic elements such as local regulations, tariffs, and economic incentives guide decisions in an evolving energy landscape.

3.1. Regulatory Incentives

The influence of government regulations and incentives cannot be overstated. Various jurisdictions offer subsidies, tax credits, and grants which can alleviate initial investment burdens. This support can significantly alter the financial calculus around energy storage projects, making them more appealing to investors. The existence of favorable policies can lead to a surge in the installation of energy storage solutions, as both residential and commercial entities capitalize on the available incentives. A supportive regulatory framework also assists in defining frameworks for interconnection and market participation, ultimately facilitating the streamlined integration of energy storage systems into the existing grid architecture.

Furthermore, understanding the long-term regulatory outlook is crucial for assessing project viability. Anticipating potential changes in legislation can aid investors in crafting projects that are not only relevant today but also adaptable to future requirements. Strategic navigation through regulatory landscapes becomes essential for sustaining energy storage ventures. Remaining informed about both local and federal policy trends will enhance investment decisions,� thus maximizing future economic returns.

3.2. Market Dynamics and Pricing

Understanding interconnected market dynamics serves as another cornerstone toward comprehending investment levels. Costs associated with energy storage technology are subject to fluctuations influenced by commodity pricing, supply chain issues, and geographical factors. For instance, the pricing of lithium, a key component in many energy storage solutions, is affected by global supply limitations and demand surges. Moreover, local energy market fluctuations—affected by factors as diverse as weather patterns, regulatory changes, and technological advancements—may significantly dictate pricing.

Investing in energy storage also presents opportunities to capitalize on price arbitrage—where energy is purchased during off-peak times and sold or used during peak demand. However, realizing these financial benefits necessitates a thorough understanding of pricing trends and the ability to forecast future market conditions. Investors must equip themselves with comprehensive market analysis capabilities to make astute decisions that align with fluctuating energy pricing.

4. RETURN ON INVESTMENT (ROI) CONSIDERATIONS

A meticulous examination of ROI factors is paramount when contemplating energy storage investments. The primary motivations behind investing in energy storage systems usually revolve around potential financial gains, energy savings, and operational flexibility.

4.1. Efficiency and Cost Savings

Energy storage systems not only enhance the reliability of energy supply but also contribute significantly to efficiency gains and cost savings. For homeowners with solar installations, energy storage facilitates the diversion of excess energy production for later use, minimizing reliance on the grid during peak hours. Consequently, homeowners can significantly reduce their energy bills, creating a direct financial incentive for investing in storage solutions.

Business and industrial sectors also reap similar benefits through enhanced operational efficiency. By deploying energy storage systems, companies can strategize energy utilization, avoiding peak-hour pricing while aligning their energy consumption with economic stimuli during lower periods. Optimizing operational expenses and minimizing energy costs fosters a profound economic advantage in highly competitive markets, thus incentivizing broader adoption across industries.

4.2. Enhancing Energy Resilience

One of the most compelling factors driving investments in energy storage is the enhancement of energy resilience. As climate change-related extreme weather events become more prevalent, businesses and homeowners face increased risks associated with energy supply disruptions. Energy storage offers not just reliability but a safeguard against unforeseen energy shortages.

In an era where energy dependence is increasingly scrutinized, the operational resilience afforded by energy storage creates immeasurable value. Investments geared towards establishing robust energy storage capabilities yield long-term dividends by mitigating operational disruptions and safeguarding productivity. Investors who recognize this imperative and align their energy storage strategies accordingly are poised to benefit significantly from enhanced resilience initiatives.

FAQS

HOW DOES ENERGY STORAGE FUNCTION?

Energy storage systems are designed to absorb and store energy when supply exceeds demand, subsequently releasing that stored energy when demand surpasses supply. Various technologies, including batteries, pumped hydroelectric storage, and compressed air storage, serve this purpose. Each technology operates on distinct principles, ensuring flexibility in application. For instance, lithium-ion batteries connect to renewable energy sources, charging during periods of excess generation and discharging during high demand. This operational versatility underlines the critical role of energy storage in modern energy ecosystems, providing not only a bridge between generation and consumption but also enhancing grid reliability. Furthermore, energy storage functions not just dynamically adjusting to demand fluctuations, but also serves as a crucial financial instrument for effective energy procurement through price arbitrage in competitive markets.

WHAT FACTORS SHOULD I CONSIDER BEFORE INVESTING IN ENERGY STORAGE?

Prior to embarking on energy storage investments, numerous factors warrant comprehensive assessment. Considerations include project scale and type, technology selection, regulatory environments, and long-term ROI expectations. Each of these elements fundamentally influences feasibility and profitability. Delve into market dynamics that impact pricing and availability of technology, for instance. Regulatory incentives may considerably affect both initial investment and operational costs, thus tailoring strategies as per local legislation evolves. Moreover, a detailed understanding of market trends equips investors with actionable insights for optimizing energy storage deployments. Strategic consideration of these factors, aligned with well-informed technological choices and a clear view of financial expectations, will enhance the probability of long-term success and sustainability of energy storage investments.

HOW CAN ENERGY STORAGE SUPPORT RENEWABLE ENERGY?

Energy storage fundamentally supports renewable energy by addressing its inherent intermittency challenges. Renewable energy sources like solar and wind are often unpredictable, producing energy only in specific conditions. Energy storage systems create a buffer by capturing excess energy during peak generation times and releasing it during periods of low production. This balance is critical for maintaining grid reliability while encouraging higher usage of renewable resources without compromising stability. Hence, as economies strive to transition toward integrated renewable energy systems, the symbiotic relationship between energy storage and renewables becomes increasingly vital. By enabling greater penetration of renewable technologies into existing infrastructure, energy storage plays a pivotal role in fostering a sustainable energy future.

Significant consideration of capital allocation for energy storage investments is critical for achieving sustainable outcomes. Moreover, strategic planning around project type, technology choice, market environments, and potential ROI forms a comprehensive understanding of what may be involved. As energy storage continues to evolve, the interplay between resident, commercial, and utility-scale strategies offers diverse pathways, supporting customization to fit specific needs within growing energy markets. Furthermore, regulatory environments and the multitude of incentives available can enhance investment viability, driving broader deployment of energy storage solutions. Innovations in technology play an indispensable role by facilitating the transition towards cleaner energy systems, so evaluating options diligently is essential. Moving forward, investors equipped with knowledge about consumer behavior, market dynamics, and forward-looking policies will undoubtedly position themselves advantageously in emerging avenues, paving the way for both economic efficiency and environmental sustainability in the energy sector. With prudent investment and insightful planning, energy storage may not just become a strategic asset but also an integral component for sectors transitioning toward resilient energy ecosystems.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-to-invest-in-energy-storage/