1. The net profit of industrial energy storage is influenced by several key factors, including 1. the operational efficiency of energy storage systems, 2. market demand for energy flexibility, 3. regulatory frameworks that incentivize storage deployment, and 4. the decreasing cost of technology enabling storage solutions. This analysis delves deeper into operational efficiency, explaining its vital role in maximizing profits. Efficient energy storage solutions can reduce operational costs, enhance productivity, and ultimately lead to a significant increase in the net profit for industrial operators. This presents a compelling case for investments in advanced technologies and strategic operational practices to elevate profitability in the industrial energy storage sector.

1. OPERATIONAL EFFICIENCY

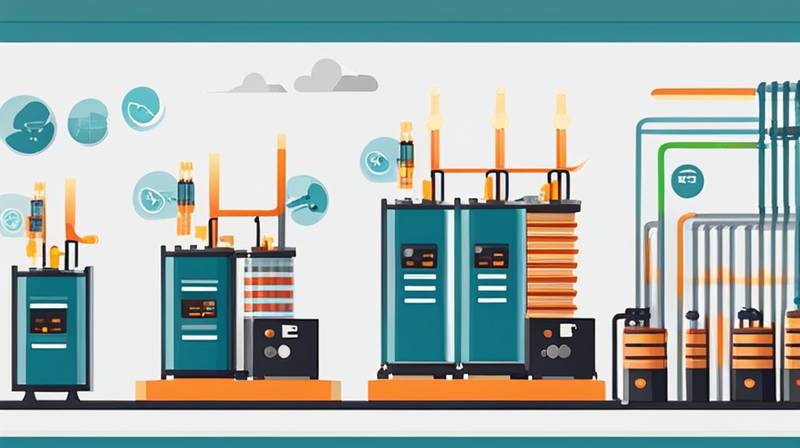

Operational efficiency stands as a cornerstone of profitability within the industrial energy storage landscape. Streamlining energy processes can lead to significant cost reductions and increased overall performance. Efficient systems minimize waste, lower maintenance costs, and improve energy output, which are critical elements that can contribute to higher net profit margins. Energy storage solutions, such as batteries and pumped hydro storage, can be optimized to enhance their storage capacity and release energy when demand peaks, resulting in better utilization of resources.

Moreover, the integration of intelligent software solutions can augment operational efficiency. These tools allow for predictive maintenance, helping to avert potential downtimes that could lead to revenue losses. By employing machine learning algorithms and data analytics, companies can anticipate system failures or performance issues before they arise. This proactive approach not only diminishes maintenance costs but also elevates system reliability, leading to greater customer satisfaction and retention. The implication here is clear: investing in technology that boosts operational efficiency can have a direct and positive impact on the bottom line.

2. MARKET DEMAND FOR ENERGY FLEXIBILITY

The landscape of energy consumption is undergoing a transformative shift, with an increasing demand for flexibility. As industries face fluctuating energy prices and regulatory pressures to reduce carbon footprints, energy storage has emerged as a vital solution. Companies can leverage storage technologies to manage energy loads more effectively, positioning themselves to capitalize on market trends. Given the rise of renewable sources, which are often intermittent in nature, the need for robust energy storage systems becomes even more pronounced. These systems enable businesses to store excess energy generated during off-peak times and release it during peak demand, thus optimizing their energy usage.

Furthermore, energy flexibility allows industries to participate in demand response programs. These programs incentivize businesses to reduce or shift their power consumption during periods of peak load. By effectively managing their energy storage and usage, companies can unlock additional revenue streams. Consequently, the strategic integration of energy storage with demand response initiatives not only enhances operational efficacy but also reinforces financial performance. The interplay between market demand and energy flexibility underlines the necessity for industries to adapt smartly to the rapid evolution of the energy market.

3. REGULATORY FRAMEWORKS

Regulatory frameworks play a crucial role in shaping the economic viability of industrial energy storage solutions. Governments around the world have started recognizing the potential benefits of energy storage, which has led to the implementation of supportive policies. Incentives such as tax breaks, subsidies, and grants can significantly reduce the capital burden of implementing energy storage systems. These financial advantages are pivotal in making energy storage a more appealing investment choice for industrial sectors.

Additionally, regulatory measures like net metering policies allow businesses to receive credit for energy stored and used at a later time. This not only validates the investment in storage technologies but also creates a more balanced energy ecosystem where renewables can thrive alongside traditional energy sources. The evolving landscape of regulations continues to impact the profitability of energy storage systems, driving innovation while ensuring compliance. In effect, as regulatory environments become more conducive to energy storage deployment, industries can realize substantial financial benefits that bolster their overall profitability.

4. DECREASING TECHNOLOGY COSTS

The technological advancements in energy storage have led to a remarkable decrease in costs over the years. Batteries, for instance, have seen significant price drops due to improvements in manufacturing processes and the scalability of production. This trend not only democratizes access to energy storage solutions but also opens new avenues for industrial players to enhance their profit margins. Lower capital expenditures mean that companies can implement energy storage systems without incurring prohibitive costs, thus leading to quicker payback periods.

Moreover, as technology continues to advance, there is a potential for even more efficient energy storage solutions to emerge. Innovations such as solid-state batteries and flow batteries promise to increase energy density and longevity, contributing to enhanced economic returns. These developments signify that not only is the current landscape favorable for industrial energy storage investments, but the trajectory suggests a promising future for further profitability. Thus, understanding and capitalizing on the decreasing costs of energy storage technology becomes fundamental for industries seeking to optimize their operations and financial performance.

5. FINANCING OPTIONS

Financing plays an essential role in the expansion of industrial energy storage solutions. Many businesses face the challenge of securing adequate funding to invest in energy storage technologies, as initial capital outlay can be considerable. Financial instruments such as power purchase agreements (PPAs), leasing options, and hybrid financing models offer companies flexible solutions to overcome these barriers. By utilizing capital efficiently, industries can implement energy storage systems without alienating their financial resources.

Additionally, the entry of investment funds dedicated to clean energy technologies has created further opportunities for collaboration and funding. With many investors keenly focused on sustainable investments, private equity and venture capital can prove beneficial for companies looking to harness energy storage innovations. Ultimately, the right financing strategy can significantly enhance the accessibility of energy storage solutions, thus leading to improved profitability and longevity in the market. By focusing on innovative financing solutions, industries can position themselves favorably to benefit from the advantages of energy storage technology.

6. IMPACT OF RENEWABLE ENERGY INTEGRATION

The rising integration of renewable energy sources poses opportunities and challenges for industrial energy storage solutions. With fluctuating output levels, particularly from solar and wind, energy storage becomes essential for maintaining reliability in energy supply. By acting as a buffer, energy storage systems can store excess energy generated during high production periods and provide it during low production times. This capability smoothens the transition towards a cleaner energy landscape by mitigating the intermittent nature of renewables.

Moreover, as renewable energy integration increases, industries can enhance their sustainability credentials, thereby attracting eco-conscious customers and investors. The financial implications are clear: as companies demonstrate their commitment to sustainable practices through energy storage investments, they not only appeal to a growing market segment but also potentially unlock new funding avenues. The relationship between renewable energy and industrial energy storage is symbiotic, ultimately leading to improved profitability as companies capitalize on the benefits associated with sustainable energy practices.

7. STRATEGIC PLANNING AND EXECUTION

Navigating the intricate landscape of industrial energy storage necessitates diligent planning and execution. Companies must undertake comprehensive analyses to understand their energy requirements and identify suitable storage solutions that align with their operational strategies. A strategic approach ensures that investments in energy storage technologies yield the best possible returns over time. Implementing pilot projects can also facilitate gainful insights into operational efficiencies and potential scale-up opportunities.

Additionally, continuous monitoring and evaluation post-implementation are crucial for sustaining profitability. Organizations must employ data-driven frameworks to assess the performance of their energy storage systems regularly and adjust strategies accordingly. These actions allow businesses to remain agile in responding to evolving market conditions and technological advancements, thus bolstering their financial standing. In the long run, a commitment to strategic planning and robust execution processes paves the way for a profitable future in the industrial energy storage sector.

8. ENVIRONMENTAL AND SOCIAL IMPACT

The environmental and social implications of industrial energy storage are ever-increasingly under scrutiny. As the demand for sustainable industrial practices escalates, companies face growing pressure to invest in cleaner energy solutions, including energy storage systems. Environmental advantages include reduced greenhouse gas emissions and enhanced air quality, fostering a positive public perception of organizations committed to sustainability. By aligning their operations with social responsibility goals, businesses can enjoy long-term benefits that resonate with both consumers and investors.

Moreover, societal impacts extend beyond environmental considerations. Energy storage systems can potentially facilitate job creation within the renewable energy sector. The transition to sustainable energy practices through storage deployment necessitates skilled labor in installation, monitoring, and maintenance. This expands employment opportunities and creates a skilled workforce attuned to the needs of a greener future. Thus, the ramifications of industrial energy storage stretch far beyond immediate financial returns, embedding the sector within a broader framework of social and environmental stewardship.

9. FUTURE PROSPECTS

The future landscape of industrial energy storage holds significant promise as technology and market dynamics evolve. With increasing global focus on climate change and renewable energy adoption, the scalability of energy storage solutions becomes a critical component in energy management strategies. Anticipated advancements in energy storage technologies, such as improvements in battery efficiency and new materials, could further enhance the sector’s adaptability and profitability.

In addition, collaborative efforts among governments, industries, and research institutions are likely to accelerate innovation within the energy storage realm. As stakeholders align their interests towards shared objectives, the potential for breakthroughs in energy storage capabilities could unlock new market opportunities and generate substantial profits. The intersection of evolving technology, market trends, and regulatory support forms a robust foundation upon which industrial energy storage development can thrive, ultimately leading to a prosperous future.

FREQUENTLY ASKED QUESTIONS

WHAT IS INDUSTRIAL ENERGY STORAGE?

Industrial energy storage refers to systems designed to capture and store energy for later use within industrial operations. These systems include batteries, thermal storage, and pumped hydro storage, among others. Industrial facilities use these solutions to optimize energy consumption, manage peak loads, and enhance overall operational efficiency. The effective use of energy storage can lead to reduced costs, improved reliability, and the ability to integrate more renewable energy into operations.

HOW DOES ENERGY STORAGE INFLUENCE PROFITABILITY IN INDUSTRIAL SETTINGS?

Energy storage significantly influences profitability through various mechanisms. It provides industrial operations with greater flexibility to respond to fluctuations in energy demand and pricing. By storing energy during lower-cost periods and utilizing it during peak demand, companies can reduce their electricity bills. Additionally, energy storage can help avoid over-reliance on the grid during peak times, further lowering operating costs. Thus, the strategic use of energy storage can enhance the financial performance of industrial facilities.

WHAT ARE THE CHALLENGES ASSOCIATED WITH IMPLEMENTING ENERGY STORAGE SOLUTIONS IN INDUSTRIES?

While energy storage presents numerous benefits, challenges also exist. These can include the initial capital investment, which may appear substantial. Additionally, industries may face regulatory hurdles or a lack of appropriate incentives in their region. There may be concerns regarding the technology’s compatibility with existing systems. Furthermore, training personnel to interpret data from advanced storage systems and address operational complexities needs careful consideration. Hence, potential implementers must navigate these challenges effectively to realize the benefits of energy storage.

Ultimately, the net profit of industrial energy storage is a multifaceted topic influenced by various interconnected elements. Understanding the core components—operational efficiency, market demand for flexibility, supportive regulatory frameworks, and decreasing technology costs—positions businesses to enhance profitability. Production-oriented organizations can further refine their strategies by diving deeper into operational improvements, financial considerations, and sustainability impacts. The interplay between these factors, coupled with impending market trends, shapes the future scenario for industrial energy storage. By adapting proactively, industries can create favorable conditions for sustainable profitability in an evolving energy landscape. Furthermore, aligning energy storage strategies with broader environmental goals not only boosts profitability but also fosters a commitment to social responsibility. In the broader context of energy management, successful navigation of the industrial energy storage terrain requires a comprehensive approach that incorporates innovative solutions, strategic planning, and a keen understanding of market dynamics. Companies that embrace these principles stand to benefit significantly as they contribute to a cleaner, more efficient energy future. The ongoing advancements in technology and policy frameworks are poised to further galvanize the growth of this sector, providing substantial opportunities for those ready to invest in their energy storage capabilities.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-is-the-net-profit-of-industrial-energy-storage/