1. Inquiring about the expense associated with the Shenzhen Energy Storage Firewall primarily reveals that costs can fluctuate based on various factors including capacity requirements, installation parameters, and ongoing maintenance fees, with general estimates ranging from approximately 50,000 to 200,000 USD, 2. Key determinants of pricing often include the scale of energy storage capacity, selected technology type, and supplier market dynamics. 3. A comprehensive analysis of the system’s technical specifications and user needs is essential for obtaining an accurate quotation. 4. Businesses and individuals aiming to invest in this technology should conduct thorough market research to identify competitive offerings.

1. UNDERSTANDING METHODICAL ASPECTS OF SHENZHEN ENERGY STORAGE FIREWALL

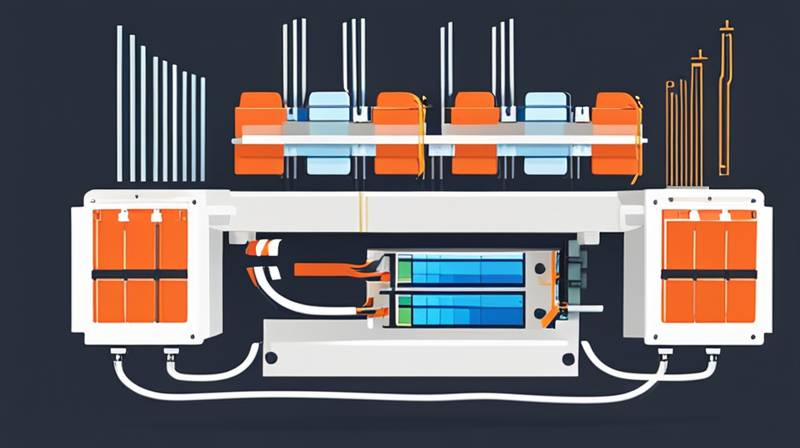

The Shenzhen Energy Storage Firewall represents a cutting-edge solution aimed at addressing the growing demand for efficient energy management and safeguarding against potential disruptions. With the increased reliance on renewable energy sources and the complexities of modern energy grids, the need for robust energy storage systems has never been more critical.

When evaluating the financial implications of acquiring a Shenzhen Energy Storage Firewall, it is essential to recognize the overarching framework in which these systems operate. The investment in such technology isn’t merely about the upfront costs but encapsulates a wider spectrum of financial sustainability, efficiency, and long-term operational benefits. Understanding the pricing factors linked to these solutions will provide stakeholders with crucial insights necessary for making informed decisions.

2. PRICING VARIABLES OF ENERGY STORAGE SOLUTIONS

As with any technological investment, multiple factors directly influence the overall pricing structure associated with the Shenzhen Energy Storage Firewall. Examining these aspects will uncover the complexities that contribute to the final cost.

2.1 CAPACITY REQUIREMENTS

One of the primary considerations while acquiring an energy storage firewall is the required storage capacity. The more substantial the energy storage needs, the greater the required investment. For instance, household applications may require less capacity, which consequently results in lower upfront expenditures. However, industrial applications could necessitate considerably larger systems to ensure seamless operational flow, thus elevating costs significantly.

Alongside capacity, it’s prudent to understand that increased storage translates to higher installation demands as well. Uniformity in energy supply, as achieved through larger storage systems, often necessitates more complex installation processes. Moreover, the need for additional components such as inverters, disconnects, and control systems can further inflate the total cost.

2.2 TECHNOLOGY TYPE

Different types of energy storage technologies come with varying price tags based on their efficacy, longevity, and application compatibility. Within energy storage, technologies such as lithium-ion batteries, flow batteries, and supercapacitors stand at the forefront.

Lithium-ion is the most prevalent in commercial applications, offering high energy density and efficiency. However, these features come at a premium price. Conversely, flow batteries are gaining traction due to their lower environmental impact and longer lifespan but may require a steeper initial investment compared to lithium-ion counterparts. Each technology presents unique advantages and drawbacks that necessitate careful evaluation during the purchasing process.

3. MAINTENANCE AND OPERATIONAL EXPENDITURES

Beyond initial acquisition costs, continuous expenditure factors play a crucial role in assessing the overall financial commitment associated with the Shenzhen Energy Storage Firewall. While the initial cost may offer one perspective, operational and maintenance costs can significantly impact the total long-term investment.

3.1 COST OF MAINTENANCE

Maintenance expenditure is an often-overlooked aspect that can affect the lifetime cost of energy storage solutions. According to manufacturers, regular upkeep of energy storage systems is vital to ensure performance efficiency and prolong operational life. This may include routine inspections, software updates, and periodic replacement of worn-out components, all of which contribute to ongoing operational costs.

Additionally, the inability to budget adequately for these ongoing expenses can lead to unexpected financial liabilities down the road. Stakeholders should prioritize realistic budgeting to factor in maintenance requirements over time, ensuring that operating the energy storage firewall remains sustainable without unplanned financial burdens.

3.2 OPERATIONAL EFFICIENCY

The efficiency of the energy storage system also impacts operational costs. High study efficiency equates to less energy loss during charging and discharging cycles, directly influencing electricity bills. Systems with proven high operational efficiency may justify higher upfront costs due to their long-term savings potential.

Furthermore, implementing energy management strategies can optimize the use of stored energy and minimize operational costs. Businesses and homeowners should consider integrating such strategies to exploit their systems effectively, ensuring a high return on investment.

4. MARKET DYNAMICS AFFECTING COSTS

The energy storage market is constantly evolving, driven by shifts in technology, policy changes, and societal demand for greener energy solutions. Understanding these market dynamics is essential for anticipating how these variables may impact the cost of Shenzhen Energy Storage Firewalls.

4.1 SUPPLIER COMPETITION

Supplier market dynamics significantly influence product pricing. Increased competition—characterized by the emergence of various suppliers providing similar technology—often leads to price reductions. As numerous companies strive for market share, prospective buyers may benefit from favorable pricing and enhanced negotiated terms.

Potential purchasers ought to continually assess the evolving supplier landscape while remaining cognizant of differing product offerings and features. Engaging with multiple suppliers enables potential customers to compare costs effectively, thereby securing the most advantageous financial agreement for their energy storage needs.

4.2 POLICY INFLUENCES

Various government policies and grants aimed at promoting sustainable energy solutions can incentivize the adoption of energy storage technologies. These initiatives could result in significant cost reductions or financial benefits that encourage investments in systems like the Shenzhen Energy Storage Firewall.

Staying informed about available incentives is paramount as these can directly alter investment calculations by mitigating initial costs or encouraging favorable financing terms. Maintaining vigilance over evolving policies can ultimately be instrumental in guiding prospective buyers to make better financial decisions.

5. INVESTMENT CONSIDERATIONS FOR STAKEHOLDERS

When embarking on acquiring a Shenzhen Energy Storage Firewall, stakeholders must approach the investment process with due diligence and comprehensive analysis. Properly evaluating technology choices, project scope, and financial implications is vital to the success of such undertakings.

5.1 STRATEGIC PLANNING

Establishing a strategic plan before proceeding with an energy storage system can lead to more informed decision-making. This includes assessing the intended application for the energy storage solution, desired capacity, and operational objectives.

Moreover, creating a detailed financial outline can help identify initial costs, ongoing operational expenses, and any potential return on investment. By formulating a cohesive strategy, stakeholders can align their financial capabilities with their energy storage objectives, leading to optimized investments.

5.2 SELECTION OF SERVICE PROVIDERS

Carefully choosing service providers plays an integral role in the energy storage investment process. Securing contractors or consultants with proven expertise in energy storage systems can streamline installation and minimize potential risks associated with the operational phase.

Conducting thorough due diligence on service provider credentials—such as customer reviews, project portfolio, and industry certifications—will ensure stakeholders engage a reputable entity that aligns with their long-term energy goals.

FREQUENTLY ASKED QUESTIONS

HOW LONG DOES THE SHENZHEN ENERGY STORAGE FIREWALL LAST?

The lifespan of an energy storage solution is critical in determining its long-term value. Typically, manufacturers design systems like the Shenzhen Energy Storage Firewall to operate over a range of 10 to 25 years. Lifespan longevity often hinges on factors such as the type of battery used, operational conditions, and maintenance practices. Lithium-ion batteries usually exhibit a lifespan of approximately 10 to 15 years, while flow batteries can remain operational for up to 25 years or even longer under optimal conditions. Furthermore, regular maintenance largely influences performance longevity. An effective maintenance strategy could mitigate degradation and ensure the unit functions at optimal efficiency throughout its operational life. All stakeholders should prioritize a detailed understanding of expected lifespan variations, ensuring purchases reflect both short-term needs and long-term objectives.

IS THERE A RETURN ON INVESTMENT FOR ENERGY STORAGE SYSTEMS?

Investing in energy storage systems can yield substantial returns over time, contingent on usage patterns and energy market dynamics. Stakeholders often realize significant returns through cost savings associated with reduced electricity bills, especially in regions with high peak demand charges. By drawing on stored energy during peak hours, users can avoid incurring elevated utility costs. Additionally, governments may offer incentives and rebates for sustainable energy practices, further enhancing potential returns. It is prudent for prospective investors to conduct a detailed analysis of projected savings and income from any ancillary services their energy storage solution could support, such as energy management systems or participation in local demand response programs. Ultimately, the long-term financial viability of energy storage investments rests on understanding ongoing market conditions, utility pricing structures, and leveraging any available incentives.

WHAT SHOULD BE CONSIDERED WHEN PURCHASING ENERGY STORAGE SYSTEMS?

Several vital considerations require evaluation before purchasing energy storage systems. First and foremost, potential buyers should establish their energy requirements, factoring in total storage capacity and expected usage patterns. Furthermore, understanding the intricacies of various energy storage technologies—including costs, advantages, and drawbacks of each system—is crucial for making informed decisions. The compatibility of the energy storage system with existing renewable energy sources, such as solar or wind, must also be pondered, ensuring seamless integration into existing infrastructure. Moreover, examining warranty provisions and long-term maintenance requirements can protect investments from unforeseen operational issues. In summary, thorough research and alignment of energy storage solutions with individual goals are indispensable in the effective purchase process.

The acquisition of a Shenzhen Energy Storage Firewall is a multifaceted endeavor, influenced by an array of variables that can greatly impact overall expenses. Beyond the mere upfront costs, attention must be paid to capacity requirements, technology selections, ongoing maintenance needs, and prevailing market dynamics. Each of these elements will play a critical role in not only determining the initial investment but also influencing the long-term viability of the purchased system. The interplay between these factors necessitates careful consideration and profound understanding from stakeholders, allowing for informed choices that align with operational goals and financial capabilities. Moreover, engaging with reputable vendors and assembling a strategic plan can facilitate a smoother acquisition process and optimize investment outcomes. As the push for sustainable energy solutions continues to build momentum, exploring solutions like the Shenzhen Energy Storage Firewall can provide long-lasting benefits while navigating the increasingly complex landscape of energy management. By taking all of these aspects into account, stakeholders will be well-positioned to make astute investment decisions that support their long-term energy objectives.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-does-shenzhen-energy-storage-firewall-cost/