In the realm of energy markets, 1. Costs fluctuate based on regulatory frameworks and market dynamics, 2. Regional price differences significantly influence overall expenses, 3. Technological efficiency plays a crucial role, and 4. Capital expenditure and operational costs combine to shape profitability over time. Selling electricity from energy storage power stations involves understanding complex pricing structures that vary by location, technology, and market incentives. For instance, an energy storage facility might initially incur high capital costs for battery systems but can mitigate these over time while capitalizing on peak pricing opportunities in wholesale energy markets. The profitability of selling stored energy depends on numerous factors, including the energy storage system’s ability to operate efficiently and the prevailing energy market conditions. Understanding these intricacies is essential for operators seeking to maximize their returns when selling electricity generated from storage facilities.

1. UNDERSTANDING ENERGY STORAGE TECHNOLOGIES

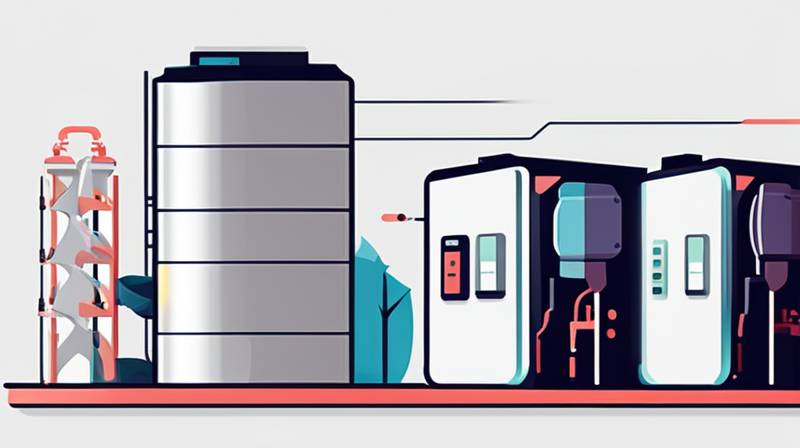

In the exploration of energy storage power stations, it is vital to emphasize the various technologies available. Energy storage systems predominantly employ batteries, flywheels, pumped hydro storage, and compressed air. Each technology presents unique advantages and disadvantages that influence the economic viability of selling electricity.

Batteries, particularly lithium-ion, have gained significant popularity due to their efficiency and declining cost. These systems facilitate rapid charging and discharging, making them ideally suited for responding to demand fluctuations. Conversely, pumped hydro storage exploits gravitational potential energy and is recognized for its longevity and ability to store large quantities of electricity. However, geographical constraints can limit its deployment.

Integrating diverse storage technologies can optimize performance and reduce costs. By understanding the underlying principles behind each technology, stakeholders can assess which solutions are best suited to their needs.

2. REGULATORY FRAMEWORKS AND MARKET DYNAMICS

Electricity markets operate within intricate regulatory frameworks that dictate pricing and operational parameters. Various countries and regions have implemented distinct policies concerning energy storage deployment and participation in electricity markets. These regulations significantly influence the financial feasibility of selling electricity from energy storage power stations.

Incentives and subsidies offered by the government are pivotal in enhancing the attractiveness of energy storage investments. For example, certain regions may provide tax credits, rebates, or guaranteed feed-in tariffs that serve to reduce initial capital outlay and improve return on investment. Additionally, understanding net metering policies—often available to distributed energy resources—can significantly impact the overall financial picture.

Ultimately, operators must navigate these regulations to ensure compliance while maximizing profitability. A comprehensive understanding of market dynamics, influenced by both policy and competition, can lead to strategic positioning in energy trading.

3. REGIONALLY VARIABLE PRICING STRUCTURES

Geographical considerations exert considerable influence on the economics surrounding energy storage facilities. Price variations for electricity stem from factors such as local demand, supply constraints, and the availability of renewable energy sources. Depending on regional electricity market conditions, the opportunity to sell electricity may present lucrative prospects or diminish revenues.

In metropolitan areas, high demand for electricity during peak hours can result in elevated prices. Energy storage facilities can capitalize on this by charging during off-peak hours when prices are lower and discharging stored electricity during peak demands, ultimately profitably arbitraging price differentials.

Conversely, rural regions may experience lower demand overall, resulting in reduced selling prices for electricity generated from storage systems. This highlights the importance of understanding local markets and strategically positioning energy storage investments for optimal economic outcomes.

4. OPERATIONAL COSTS AND PROFITABILITY

Beyond initial capital expenditures, ongoing operational costs profoundly impact the profitability of selling electricity from energy storage power stations. These can include maintenance expenses, operational inefficiencies, and labor costs. An in-depth analysis of these factors is necessary to understand their influence on overall profitability.

Maintenance costs can vary considerably based on the technology employed. For instance, a well-maintained lithium-ion battery system might exhibit different operational costs compared to a pumped hydro installation. Additionally, operators must consider the cost of energy inputs when charging storage facilities. Ideally, these inputs should be acquired at low prices during off-peak periods to maximize profit margins during discharging events.

By meticulously managing operational and maintenance expenses, stakeholders can enhance the profitability of their energy storage ventures. Continuous monitoring and optimization hold the key to leveraging technology effectively while minimizing costs.

5. THE FUTURE OF ENERGY STORAGE MARKETS

The global shift towards renewables has sparked tremendous growth potential for energy storage markets. Anticipating future trends is critical for stakeholders aiming to remain competitive. Innovations in energy storage technologies, coupled with aggressive renewable energy targets, suggest a promising landscape for energy storage operators.

Emerging technologies like solid-state batteries and advanced grid-scale storage solutions are poised to revolutionize the industry by offering higher efficiency, longer lifespan, and lower environmental impact. As societal reliance on renewable sources such as wind and solar continues to escalate, energy storage will play a pivotal role in stabilizing supply and demand.

Additionally, as regulatory frameworks evolve to support decentralized energy solutions, energy storage facilities are likely to gain increased recognition as key players in electricity markets. Stakeholders must remain vigilant to adapt to these trends and capitalize on the opportunities they present.

FAQs

WHAT FACTORS INFLUENCE THE COST TO SELL ELECTRICITY FROM ENERGY STORAGE POWER STATIONS?

Numerous factors shape the overall cost of selling electricity from energy storage power stations. Initially, capital costs associated with technology installation, including batteries or other storage systems, can vary significantly based on the chosen approach. For example, lithium-ion batteries entail substantial investments, yet their efficiency and declining cost can provide a favorable return on investment.

Furthermore, maintaining operations incurs ongoing expenses, requiring operators to manage costs associated with upkeep, energy acquisition during charging, and regulatory compliance. Market dynamics, such as electricity demand fluctuations and pricing variability, also play an essential role, impacting the revenue potential for energy storage operators. A comprehensive analysis of these factors is crucial for understanding the total cost of selling electricity from energy storage systems.

HOW DO ENERGY STORAGE MARKETS OPERATE?

Energy storage markets function by providing a mechanism for balancing supply and demand for electricity. These markets allow participants to store energy during periods of low demand and sell it during peak consumption hours when prices surge. Thus, electricity generated from renewable sources, which is inherently variable, can be stored and released when needed.

Operators usually engage in wholesale markets, trading energy as conditions change. Advanced algorithms and software are employed to optimize storage and discharge strategies based on real-time market data and projections. Understanding these market dynamics and leveraging technological advancements equip operators to maximize profitability, making energy storage a vital component of modern energy systems.

ARE THERE GOVERNMENT INCENTIVES FOR ENERGY STORAGE INVESTMENTS?

Yes, various government incentives support investments in energy storage solutions. Many countries and regions provide financial incentives to encourage the adoption of renewable energy technologies, including storage systems. These incentives can manifest as tax credits, rebates, grants, and favorable regulatory frameworks designed to stimulate the energy storage sector.

In addition to direct financial support, policymakers may establish programs aimed at enhancing market access for energy storage operators by easing participation rules in electricity markets or guaranteeing fixed prices. These mechanisms serve to lower barriers for participation, enabling more stakeholders to invest in energy storage and contribute to a more resilient and sustainable energy future.

Selling electricity from energy storage power stations represents a complex interplay of technological, economic, and regulatory factors. Navigating these intricacies requires a comprehensive understanding of market dynamics and an adept approach to leveraging resources effectively. Operators must continuously adapt to shifts in technology and policy to optimize profitability and capitalize on emerging opportunities in the energy landscape. Strategic positioning within the evolving energy markets, coupled with efficient operations, can unlock the potential of energy storage systems as pivotal assets in driving a sustainable and reliable electricity grid. By demonstrating an agility in responding to market signals, maintaining infrastructure, and exploiting pricing discrepancies, stakeholders can thrive amidst constant change while playing a crucial role in the transition to a greener energy future. Understanding these multifaceted aspects ensures that energy storage is not merely a backup solution but an invaluable cornerstone in achieving energy security and sustainability.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-does-it-cost-to-sell-electricity-from-energy-storage-power-stations/