Investing in solar energy in Spain involves several key financial considerations that potential investors must evaluate. 1. Initial investment required, including the cost of solar panels, inverter systems, and installation, ranges substantially, often from €5,000 to €10,000 for residential setups, depending on energy needs. 2. Government incentives play a significant role in offsetting expenses, with various subsidies and tax reductions available for solar energy projects. 3. Expected return on investment is crucial; many projects see payback periods of 5 to 10 years, influenced by energy prices and the efficiency of installed systems. 4. Ongoing maintenance and operational costs must be factored into the total expenditure, which can affect long-term financial calculations. Delving into these components provides greater insight into the overall financial commitment required for solar energy investment in Spain.

1. INITIAL INVESTMENT COSTS

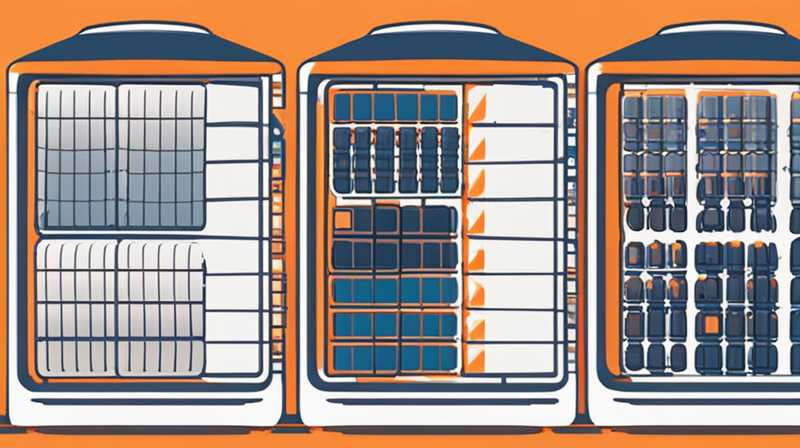

Embarking on a solar energy investment journey in Spain necessitates a thorough understanding of the initial financial outlay. Solar panels, which are the primary component of any solar energy system, can vary dramatically in price based on factors such as efficiency, brand, and technology type. As of recent data, the price for photovoltaic (PV) systems designed for residential use typically ranges from €5,000 to €10,000, a price that can fluctuate with equipment advancements and market dynamics. This initial cost is often inclusive of essential components like inverters, which convert the direct current produced by solar panels into alternating current.

Moreover, installation expenses, which include labor costs, must also be considered. Hiring a qualified professional is vital not only for compliance with regulatory standards but also for ensuring optimal system performance. Installation costs in Spain can range from €1,000 to €3,000 depending on the complexity of the setup and location specifics. Therefore, the financial commitment to solar energy involves careful budgeting, encompassing equipment purchases and labor costs. A well-budgeted initial investment lays the foundation for a successful solar energy journey.

2. GOVERNMENT INCENTIVES AND FINANCIAL SUPPORT

The Spanish government offers various incentives aimed at promoting renewable energy adoption, particularly solar power. The “Plan de Energías Renovables 2021-2030” is a national strategy focusing on increasing renewable energy consumption and reducing greenhouse gas emissions. Under this plan, there exist several grants and subsidies that can significantly mitigate the investment burden for potential solar investors.

For instance, local administrations often provide financial support or direct subsidies for both residential and commercial solar energy installations. Programs exist that can cover up to 30% of the total system costs, depending on the region and the specific project. Furthermore, a tax reduction program is available, allowing investors to deduct a portion of their investment from their income tax, often up to 20%. This proactive governmental approach not only enhances affordability but also positions solar energy as a viable alternative compared to conventional energy sources. As a result, potential investors must meticulously explore available incentives to maximize their benefits.

3. RETURN ON INVESTMENT AND CASH FLOW ANALYSIS

Understanding the return on investment (ROI) is pivotal when contemplating solar energy investments. ROI is fundamentally influenced by energy savings, which arise from reduced reliance on grid electricity, particularly in a country where energy costs can be relatively high. By leveraging solar energy, investors can experience savings averaging €600 to €800 annually, translating to significant financial relief over the lifespan of the system, which typically spans 25 to 30 years.

Calculating the payback period—the time required to recoup the initial investment—is crucial for prospective investors. Under ideal conditions, where energy prices remain steady and government incentives are effectively utilized, many solar investments can achieve payback periods ranging from 5 to 10 years. However, this varies based on system efficiency, location, and specific energy consumption patterns. Consequently, conducting a robust cash flow analysis can reveal whether the investment aligns with the investor’s long-term financial goals.

4. OPERATIONAL AND MAINTENANCE COSTS

Beyond the initial and ongoing investment, understanding the operational and maintenance costs of solar energy systems is essential for any responsible investor. While solar systems are generally low-maintenance, expenses may arise from routine inspections, cleaning, and occasional repairs, which should be factored into the long-term financial outlook. Specifically, potential costs can range from €100 to €300 annually for basic maintenance services.

Moreover, inverters, a critical component of solar energy systems, typically require replacement every 5 to 10 years, contributing to significant expenditures. Advanced models are being developed to extend the lifespan, yet budgeting for periodic replacements is prudent. As energy systems evolve, updating equipment to harness newer technologies can optimize efficiency and savings. Therefore, investor diligence in understanding ongoing operational expenses ultimately leads to well-informed financial planning.

5. SOLAR ENERGY FINANCING OPTIONS

For many investors, the high upfront costs might deter interest in solar energy investments. Fortunately, numerous financing options are available to facilitate access to this renewable energy source. Many banks and credit institutions offer green loans dedicated to financing solar energy installations. Interest rates for these loans can be more favorable than traditional loans, reflecting the increasing recognition of renewable energy in the financial sector.

Additionally, Power Purchase Agreements (PPAs) are another attractive financing model where a third-party developer installs and maintains the solar system on the investor’s property while providing them electricity at a predetermined rate. This arrangement can eliminate upfront costs, allowing property owners to benefit from solar energy without the burden of a significant financial commitment. Ultimately, adapting a financing strategy that aligns with individual financial circumstances will significantly influence the ability to harness solar energy.

FAQs

WHAT ARE THE PRIMARY COSTS ASSOCIATED WITH INSTALLING A SOLAR ENERGY SYSTEM IN SPAIN?

The primary expenses involved in installing a solar energy system in Spain encompass several key components: 1. Equipment costs such as solar panels, inverters, and battery storage, which typically ranges from €5,000 to €10,000 for residential systems. 2. Installation fees, charged by qualified professionals, can add between €1,000 and €3,000 to total expenditures. 3. Permit and inspection costs may also be incurred, required for compliance with local regulations. 4. Maintenance expenses, while generally low, are essential to budget for, as regular inspections and potential equipment repairs can vary from €100 to €300 annually. Overall, a comprehensive understanding of these costs is vital for anyone considering a solar investment in Spain.

HOW DO GOVERNMENT INCENTIVES IMPACT SOLAR ENERGY INVESTMENT COSTS?

Government incentives significantly mitigate the financial burden associated with solar energy investments in Spain. Various programs and grants can cover up to 30% of installation costs, making the transition to solar power more accessible for individuals and businesses. Additionally, tax deductions allow investors to reclaim up to 20% of their initial investment from income taxes, fostering a conducive environment for renewable energy adoption. Moreover, the national strategy, “Plan de Energías Renovables 2021-2030”, underscores the government’s commitment to promoting solar energy, suggesting that prospective investors should actively explore available financial support options. By leveraging these incentives, investors can accelerate the return on their investment while contributing to a more sustainable energy future.

WHAT IS THE AVERAGE PAYBACK PERIOD FOR SOLAR ENERGY INVESTMENTS IN SPAIN?

The average payback period for solar energy investments in Spain typically ranges from 5 to 10 years, contingent on various factors. Investors can expect to recover initial costs more swiftly if energy prices are relatively high and government incentives are optimally utilized. Factors influencing this metric include the efficiency of the installed solar system, local energy consumption patterns, and awareness of financing options. Ultimately, understanding these elements is critical for potential investors seeking to maximize their financial returns from solar energy, as it directly correlates with long-term economic viability.

In summary, investing in solar energy in Spain entails various financial dimensions that merit thorough examination. Initial outlays encompass equipment and installation costs, typically ranging from €5,000 to €10,000, supplemented by potential operational costs of €100 to €300 annually. By taking advantage of government incentives, investors can significantly alleviate upfront expenses, with potential reductions of up to 30%. Evaluating the expected return on investment reveals favorable payback periods of 5 to 10 years under optimal conditions. Furthermore, innovative financing options, such as green loans and power purchase agreements, provide pathways for breaking down the initial financial barrier. Therefore, diligence in planning and assessing available resources is essential for anyone considering a sustainable solar energy investment in Spain.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-does-it-cost-to-invest-in-solar-energy-in-spain/