The profit model for compressed air energy storage (CAES) primarily hinges on 1. operational efficiency, 2. energy market dynamics, and 3. capital and maintenance expenses. Its potential for profitability is enhanced by the ability to provide ancillary services and energy storage during periods of low electricity prices. Operational efficiency is critical; for instance, high round-trip efficiencies contribute significantly to revenue generation. By focusing on these elements, CAES systems can strategically position themselves in an evolving energy landscape.

PROFITABILITY OF COMPRESSED AIR ENERGY STORAGE

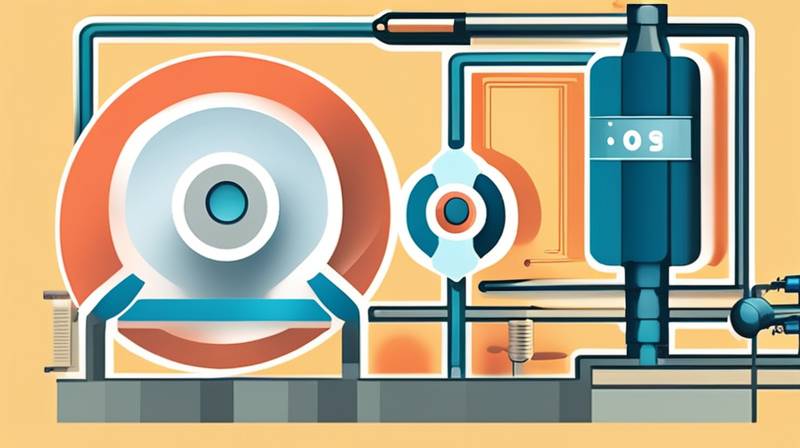

Compressed air energy storage (CAES) is an innovative technology that allows for the storage of energy in the form of compressed air. It serves as a pivotal solution for balancing supply and demand in energy systems, particularly with the increasing integration of renewable energy sources. The technology provides several advantages, including scalability and the ability to provide grid stability, yet understanding its profitability is essential for stakeholders and investors.

1. UNDERLYING PRINCIPLES OF CAES

At its core, CAES operates by using electricity to compress air into underground caverns or tanks. This compressed air is then stored until needed, at which point it is heated and expanded to drive turbines, generating electricity. The economic viability of this technology is influenced by various factors, including initial investment costs, local energy prices, and technological advancements.

Despite its promise, there are notable challenges that CAES operators must navigate. The initial capital investment required to construct facilities, including the necessary infrastructure for compression and storage, can be significant. However, advancements in technology and reductions in material costs over time may alleviate some financial burdens, making CAES more appealing to investors.

2. MARKET DYNAMICS AND PROFITABILITY

In the evolving energy market, several factors influence the profitability of CAES, particularly the dynamics of electricity pricing. CAES systems can serve to capitalize on pricing discrepancies in energy markets. For instance, during periods of low demand, electricity prices tend to plummet, enabling CAES operators to purchase energy at reduced rates, compress air, and store it. Once demand increases and energy prices rise, the stored compressed air can be released to generate electricity when prices are much higher, enhancing profit margins.

Another market consideration is the increasing number of renewable energy sources being integrated into the power grid. As wind and solar energy generation grows, there are often gaps in production that CAES systems can fill. By providing backup power generation during these gaps, CAES plants not only boost their revenue through energy sales but also contribute to a more stable and reliable power system.

3. OPERATIONAL EFFICIENCY AND TECHNOLOGICAL INNOVATION

Successful CAES systems depend highly on operational efficiency, including the ability to maximize round-trip energy efficiency. Round-trip efficiency refers to the ratio of energy output to energy input over the entire cycle. The typical efficiency for CAES can vary, but a focus on improving this metric yields higher profits.

Investments in technology can enhance operational capabilities. For example, the integration of advanced thermodynamic processes and innovative compressor designs can significantly increase energy capture and reduce losses during the storage and generation phases. An emphasis on research and development may present new avenues for reducing operational expenses, thereby fostering greater financial viability.

4. ANCILLARY SERVICES AND REGULATORY CONTEXT

Beyond energy arbitrage, CAES can provide various ancillary services to energy markets, such as frequency regulation and voltage support. These services are particularly valuable in modern energy systems where grid stability is paramount. Market operators are willing to pay for these auxiliary services, thereby enriching the revenue streams available to CAES plants and enhancing their overall profitability.

Furthermore, regulations and subsidy schemes that support renewable energy integration may incentivize the development of CAES facilities. These policies can create favorable conditions for investment and operation, further embedding CAES into the energy landscape.

FREQUENTLY ASKED QUESTIONS

WHAT ARE THE INITIAL COSTS ASSOCIATED WITH CAES?

The initial financial outlay for a compressed air energy storage system often includes expenses related to infrastructure, technology, and land acquisition. The costs can vary widely based on the project scale, the site selection, and the technological choices. Typical investments are substantial, often running into millions of dollars for both large- and small-scale facilities. Such expenses cover the construction of caverns or storage vessels, compressors, turbines, and ancillary systems necessary for operation. Over time, these costs may be offset by the sale of stored energy and ancillary services, thereby positioning CAES as a potentially lucrative investment, especially in regions with high energy values.

HOW DOES CAES COMPARE TO OTHER STORAGE TECHNOLOGIES?

When evaluating compressed air energy storage against other storage technologies, such as lithium-ion batteries or pumped hydro storage, it becomes evident that each has its strengths and weaknesses. CAES typically has lower cost per megawatt-hour when considering large-scale applications, making it particularly suitable for grid-scale operations. It can also provide longer duration storage compared to batteries, which can be limited in discharge duration. On the other hand, CAES facilities require specific geological formations, which can limit their deployment locations, whereas battery systems are more versatile regarding installation. Each technology’s suitability will largely depend on geographic, regulatory, and economic factors unique to the specific deployment conditions.

WHAT ARE THE ENVIRONMENTAL IMPACTS OF CAES?

Though compressed air energy storage systems can contribute significantly to managing renewable energy sources and reducing greenhouse gas emissions from fossil fuels, it is essential to consider potential environmental impacts. Intrusive exploration for storage caverns can disrupt local ecosystems and groundwater resources. However, when managed wisely, the overall environmental footprint can be minimized. Moreover, as CAES systems displace the need for traditionally fossil fuel-based generation, they contribute positively to climate goals by enhancing the utility of renewables. Future innovations aimed at reducing ecological impacts will play a crucial role in advancing public acceptance and regulatory support for CAES projects.

5. CONCLUSION AND FUTURE POTENTIAL

Examining the profitability of compressed air energy storage reveals a multifaceted portrait defined by operational efficiencies, market dynamics, technological advances, and ancillary service provisions. CAES has emerged as a viable solution for energy storage, particularly in the context of growing renewable energy integration. The initial capital requirements can pose challenges; however, the technology’s potential to capitalize on energy price disparities and provide valuable services to the grid offsets these expenses. Its ability to support grid stability while providing financial returns in increasingly unpredictable energy markets underscores its importance. As the industry evolves, focusing on improving round-trip efficiencies, enhancing technological capabilities, and navigating regulatory landscapes will be essential for ensuring long-term economic viability. The support of favorable policy and subsidy structures can catalyze investment, further embedding CAES as a solid player in the renewable energy landscape. Continued investment in research, technological advancements, and operational optimization will pave the way for CAES systems to evolve and prosper as integral contributors to a sustainable and resilient energy future.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-is-the-profit-of-compressed-air-energy-storage/