The partnership-flip structure is primarily used in renewable energy projects, such as solar and wind, but can be adapted for energy storage projects when those projects become eligible for tax credits. Here’s how it generally works:

Basic Principles of Partnership Flip

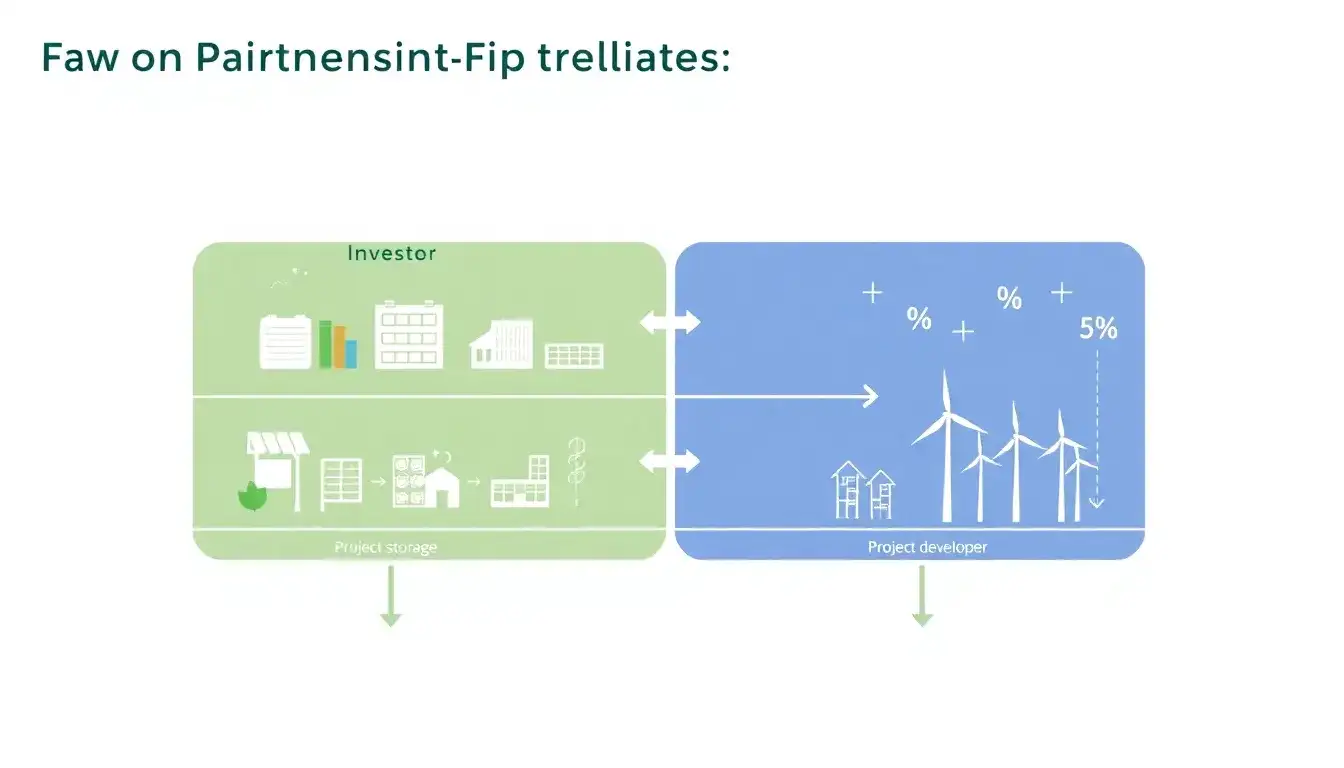

- Partnership Formation: A developer (sponsor) and a tax equity investor form a partnership to own a renewable energy project, which could include energy storage when applicable. This structure allows for the allocation of income, losses, and tax credits between partners.

- Tax Credit Allocation: Initially, the tax equity investor receives a significant percentage (typically 99%) of the project’s tax benefits, such as investment tax credits (ITCs) or production tax credits (PTCs), and a smaller share of the cash distributions. This arrangement maximizes the tax benefits to the investor, enabling them to offset their tax liabilities.

- Flip Mechanism: Once the tax equity investor achieves a predetermined target return, often an after-tax internal rate of return (IRR), the allocation of tax benefits “flips” to favor the developer. After the flip, the investor’s share typically drops to about 5%, while the developer’s share increases significantly. The developer often retains an option to purchase the investor’s remaining interest at fair market value.

- Cash Distribution: Cash is generally distributed in a different ratio before the flip, with the tax equity investor receiving a lower percentage compared to their tax benefit allocation.

Adaptation for Energy Storage

While the partnership-flip structure is well-established in solar and wind projects, its application to energy storage projects is less common but becoming more relevant as energy storage technologies become more integral to renewable energy systems and potentially eligible for tax credits.

- Eligibility for Tax Credits: Energy storage projects might become eligible for tax credits under certain conditions, such as when directly integrated with solar or wind projects. The Inflation Reduction Act (IRA) and other legislative developments have expanded the scope of tax credits, making energy storage more attractive for similar financing structures.

- Structural Adaptation: For energy storage, the partnership-flip structure could be adapted to optimize tax benefits and returns, ensuring that investors can benefit from the tax credits while sponsors gain long-term control and financial returns.

Challenges and Considerations

- Tax Equity Absorption: Ensuring that the tax equity investor can absorb the allocated tax benefits without triggering IRS concerns about being merely a lender or tax credit purchaser is crucial. This may involve deficit restoration obligations (DROs) to address any shortfalls in the investor’s capital account.

- Regulatory Environment: The IRS guidelines and legislative changes must be closely monitored to ensure compliance and maximize the benefits of the partnership structure.

- Market Demand and Competition: As energy storage technology advances and integrates with renewable energy projects, the demand for efficient financing structures like the partnership flip will likely increase, driving innovation and competition in the market.

Hybrid Structures and Emerging Trends

- Hybrid Models: Hybrid models that combine traditional partnership flips with credit transfer options (t-flips) are becoming more prevalent, allowing greater flexibility in managing tax credits and providing additional value to both developers and investors.

- Emerging Technologies: As energy storage becomes more integral to the energy landscape, there may be a shift towards more specialized financing structures tailored to its unique characteristics and benefits.

In summary, while the partnership-flip structure is more established in solar and wind projects, it can be adapted for energy storage when applicable. As the energy storage market evolves and becomes more closely tied to renewable energy projects, such financing structures will likely play a crucial role in its development.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-does-the-partnership-flip-structure-work-in-tax-equity-investments-for-energy-storage/