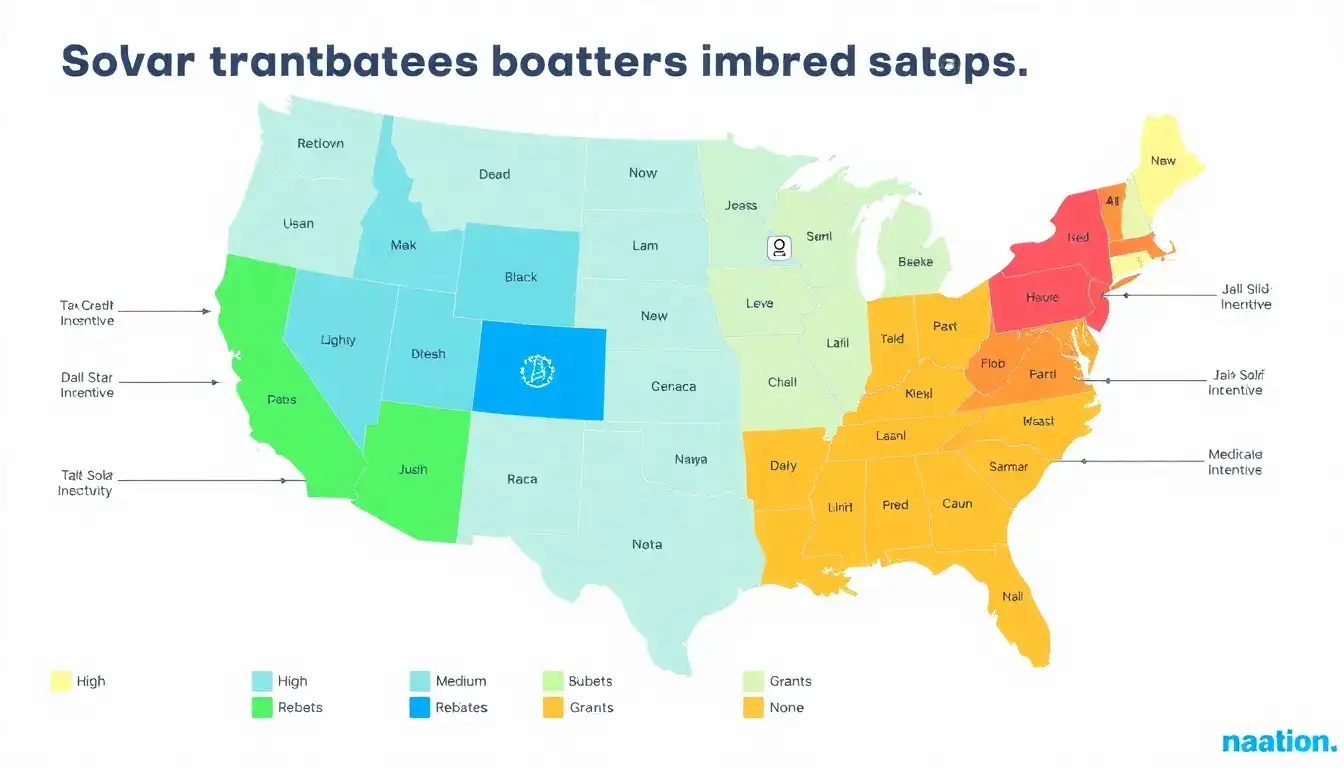

Solar battery incentives vary significantly between different states in the US, with each state offering distinct programs, rebates, and financial incentives designed to encourage the adoption of energy storage systems alongside solar installations. Here is an overview of how these incentives differ:

Federal Incentives (Baseline for All States)

- A federal solar tax credit (Investment Tax Credit, ITC) covers 30% of the total installation cost for solar photovoltaic (PV) systems installed between 2022 and 2032.

- A separate standalone federal tax credit is also available specifically for solar battery storage.

- This federal incentive provides a baseline benefit nationwide, averaging an $8,991 credit per solar system installed as of recent costs.

State-Level Incentives and Programs

California

- California’s Self-Generation Incentive Program (SGIP) is one of the most notable state-level battery storage incentives.

- It offers a rebate based on dollars per kilowatt ($/kW) of energy storage installed.

- Rebates decrease as more systems are installed but have increased support for customers in high fire threat zones and low-income households.

- This program combines a 50% upfront rebate with a 50% performance-based payment, rewarding efficient energy storage use.

- Additional utility rebates are available in areas like PG&E service territory, offering 15-20% off battery costs or even full rebates (up to 100%) for qualifying customers.

Connecticut

- Eversource and United Illuminating customers can utilize the Energy Storage Solutions program.

- Residential customers may receive up to $16,000 per installation plus incentives for exporting energy back to the grid.

- Businesses receive a 50% upfront incentive and further performance-based incentives twice per year for 10 years based on grid contributions during peak demand.

- This performance-based approach encourages using storage to reduce grid stress in summer months.

Massachusetts

- Massachusetts offers incentives through the Mass Saves ConnectedSolutions program, which provides financial incentives and zero-percent financing for battery installations.

- The state also has the SMART program that adds energy storage incentives to solar rebates, though updates for 2025 are pending.

- Massachusetts incentives primarily focus on performance payments rather than upfront rebates, distinguishing them from California’s approach.

Other States

- Several states like Rhode Island and Connecticut also offer performance-based incentives for energy storage, typically with payments spread over years to encourage ongoing grid support.

- Some states provide solar battery “adders” to existing solar incentive programs, increasing the overall rebate for projects that combine solar and storage.

- Certain pilot programs in various states have even offered free battery storage, though these are exceptions and not widespread.

Summary Table of Key Differences

| State | Incentive Type | Key Features | Target Customers |

|---|---|---|---|

| California | Upfront rebate + performance | $/kW rebate, higher incentives for fire zones and low-income; some full rebates for utilities | Residential & Commercial |

| Connecticut | Upfront + performance | Up to $16,000 residential, 50% upfront + long-term incentives for businesses | Residential & Commercial |

| Massachusetts | Performance + financing | Performance payments, zero % interest loans, solar rebate adders | Residential & Commercial |

| Others (RI, etc.) | Performance-based incentives | Payments over time to encourage grid support | Varies |

Conclusion

Solar battery incentives are complex and highly state-specific. States like California provide a blend of upfront rebates and performance rewards, with attention to vulnerable populations. Connecticut combines substantial upfront payments with long-term performance incentives, while Massachusetts emphasizes performance-based incentives and financing options. Many other states offer variations of these models or solar-adjacent incentives, creating a diverse and uneven landscape for solar battery adoption incentives across the US.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-do-solar-battery-incentives-vary-between-different-states/