Comparison of Green Bonds and Traditional Bonds

Green bonds and traditional bonds differ primarily in their environmental impact. Here’s a comparison of the two:

Environmental Impact

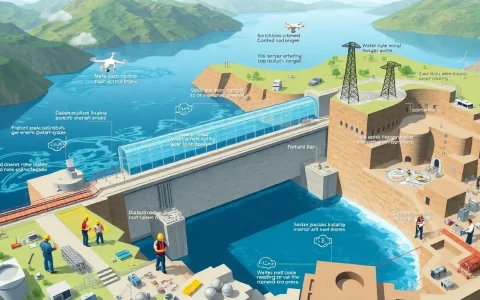

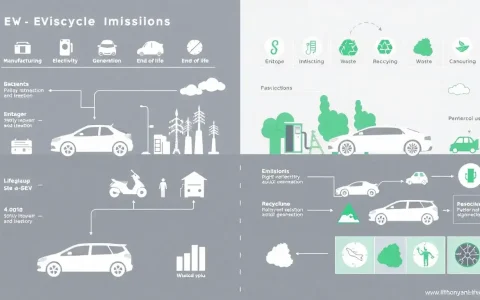

- Green Bonds: These bonds are specifically designed to finance projects with a positive environmental impact, such as renewable energy, green buildings, and sustainable infrastructure. The funds raised are exclusively used for initiatives that reduce carbon emissions or promote environmental conservation.

- Traditional Bonds: In contrast, traditional bonds do not have specific environmental considerations. They can be used to finance a wide range of projects, including those with negative environmental impacts.

Financial Characteristics and Benefits

- Green Bonds:

- Market Growth: The green bond market is growing rapidly due to increasing demand for sustainable investments.

- Reputation and Access: Issuing green bonds enhances a company’s reputation and provides access to a broader investor base interested in ESG (Environmental, Social, and Governance) criteria.

- Benefits: They may offer tax incentives and more favorable borrowing terms due to their appeal to socially responsible investors.

- Traditional Bonds:

- General Use: They can be used for any purpose and are not restricted to environmental projects.

- Investor Base: Attract a more general investor pool without specific environmental considerations.

Reporting and Transparency

- Green Bonds: Require ongoing reporting and tracking of the use of proceeds to ensure that funds are allocated as intended for environmental projects. External verification and transparency are crucial.

- Traditional Bonds: Generally do not require specific environmental reporting or tracking.

Risk and Liquidity

- Green Bonds: Studies indicate that green bond liquidity is generally comparable to that of traditional bonds, with no significant additional risk identified during market turmoil.

- Traditional Bonds: The liquidity and risk profile can vary based on the issuer’s creditworthiness and market conditions.

Incentivizing Performance

- Green Bonds with Performance-Based Contracting: When combined with pay-for-performance strategies, green bonds can incentivize project outcomes and enhance environmental impacts.

- Traditional Bonds: Typically do not involve performance-based incentives tied to specific environmental outcomes.

In summary, green bonds offer a unique opportunity for environmentally conscious investing, focusing on projects that support sustainability and reduce carbon emissions. While they share many financial characteristics with traditional bonds, their environmental impact and reporting transparency set them apart.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-do-green-bonds-compare-to-traditional-bonds-in-terms-of-environmental-impact/