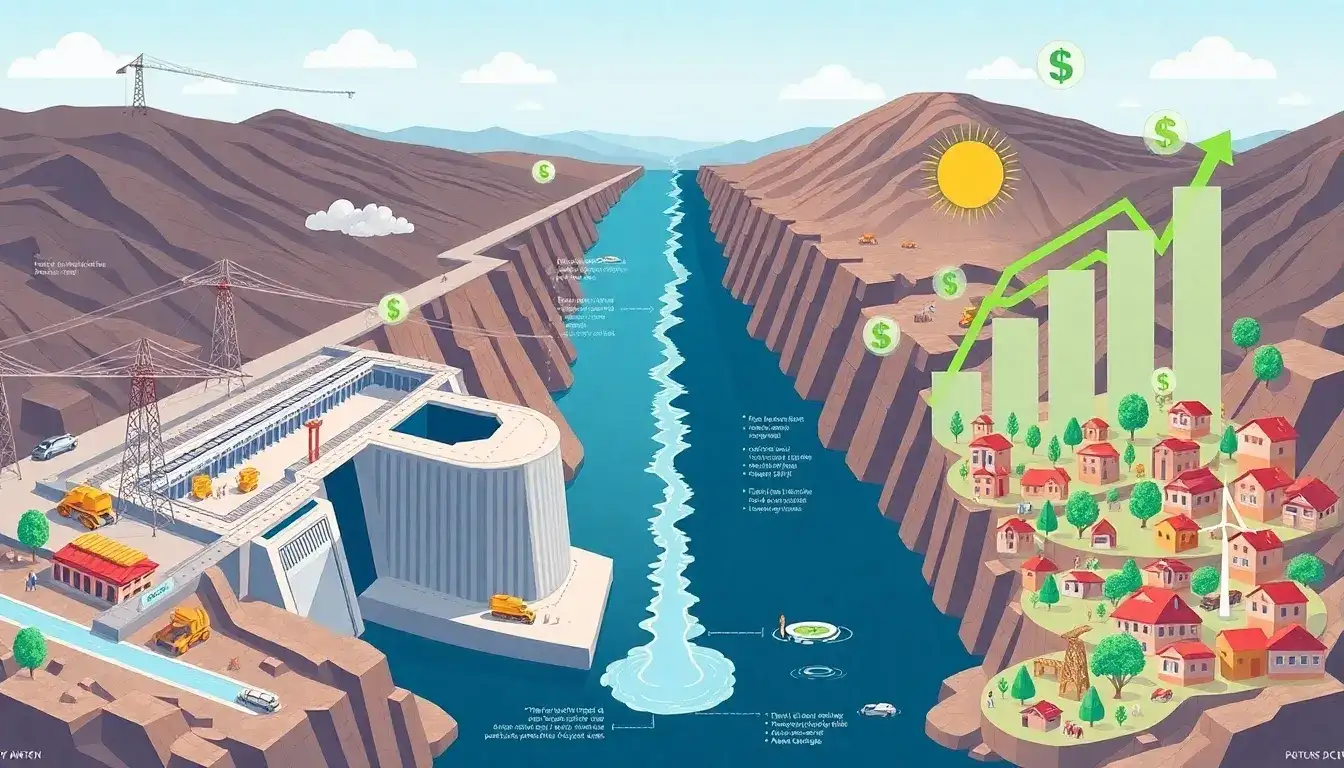

Impact of Capital Costs on Profitability of Pumped Hydro Storage Facilities

Pumped hydro storage (PHS) facilities are among the most capital-intensive energy storage technologies. Understanding how capital costs affect their profitability is crucial for investors and developers.

Key Factors Influencing Profitability

- Capital Costs: The initial investment required to establish a PHS facility is substantial and significantly impacts overall costs. Factors such as reservoir size, powerhouse capacity, and terrain complexity influence these costs. An increase in capital costs can make it harder for projects to secure financing, especially if the cost of capital rises.

- Cost of Capital: The weighted average cost of capital (WACC) plays a significant role in determining the viability of hydropower projects. An increase in WACC can lead to higher generation costs, affecting profitability.

- Break-Even Analysis: To break even, the selling price of electricity must cover both the energy cost of pumping water and operating expenses. For example, if the pumping cost is 0.1 EUR/kWh and assuming an efficiency of 85%, the minimum selling price needs to be approximately 0.118 EUR/kWh just to cover the variable costs. Adding operating costs increases this threshold.

- Market Conditions: The ability to sell energy at peak hours for higher prices is crucial. Fluctuations in electricity prices and demand cycles can impact revenue. PHS facilities benefit from stable or high peak prices to ensure profitability.

- Operational Efficiency: Modern PHS facilities achieve efficiency rates of about 85%. Improving efficiency can reduce energy losses during pumping and generation cycles, enhancing profitability.

Strategies for Enhancing Profitability

- Optimize Site Selection: Careful site selection can reduce costs associated with construction and maintenance.

- Leverage Technology Advances: Improving efficiency through technological innovations can lower operating expenses.

- Market Positioning: Aligning operations with peak demand cycles maximizes revenue potential.

- Investment Incentives: Securing favorable financing terms or government incentives can help mitigate high upfront costs.

In summary, while capital costs are a significant barrier to the profitability of PHS facilities, careful planning, efficiency improvements, and strategic market positioning can enhance their viability.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-do-capital-costs-impact-the-overall-profitability-of-pumped-hydro-storage-facilities/