Enterprises can profit from self-managed energy storage through various mechanisms, including: 1. Cost savings on energy bills, 2. Selling stored energy during peak demand, 3. Participating in energy markets, and 4. Enhancing sustainability profiles. A detailed examination reveals that by investing in energy storage systems, companies can significantly reduce their energy expenditures and capitalize on fluctuations in energy prices. This strategic engagement not only fosters a more resilient energy infrastructure but also aligns with broader environmental goals, ultimately propelling enterprise profitability.

1. UNDERSTANDING ENERGY STORAGE

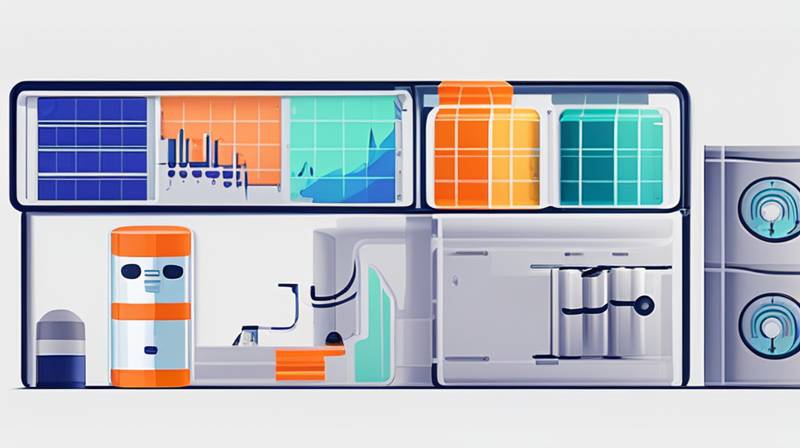

Energy storage has emerged as a pivotal element in the contemporary energy landscape. As enterprises navigate growing energy demands and fluctuating prices, the necessity to incorporate sophisticated storage solutions becomes increasingly evident. Energy storage systems (ESS) enable companies to capture surplus energy generated during off-peak periods, which can then be utilized during peak demand times or fed back into the grid for a profit. This system of energy management not only optimizes operational costs but also contributes to a more stable energy market.

The fundamental mechanics of energy storage involve the conversion of energy into a storable form. Most commonly, this is achieved through battery technologies. Various types of batteries possess distinctive properties, including lithium-ion, lead-acid, and flow batteries. Each range of batteries has unique advantages concerning lifespan, efficiency, and cost. The selection of the appropriate technology hinges on several factors including application, scale, and budgetary constraints. An in-depth understanding of these technologies allows enterprises to tailor their storage solutions in a way that maximizes financial returns.

2. COST SAVINGS ON ENERGY BILLS

One of the paramount advantages of self-operated energy storage systems lies in their capacity to generate substantial savings on energy bills. By deploying energy storage, companies can reduce their reliance on grid electricity, particularly during peak hours when prices are typically elevated. This operational strategy minimizes overall energy expenditure, translating to significant cost savings.

To illustrate, consider a manufacturing enterprise that incurs high energy costs due to its operations coinciding with peak demand times. By investing in an energy storage system capable of harnessing electricity during off-peak hours, the business can draw from its stored energy reserves during peak hours, substantially reducing its costs. In many regions, demand charges comprise a significant slice of energy bills, particularly for larger consumers. Implementing energy storage can effectively mitigate these charges, further bolstering profitability.

3. SELLING STORED ENERGY DURING PEAK DEMAND

Another lucrative opportunity for enterprises engaging in energy storage involves selling excess stored energy back to the grid during periods of peak demand. This strategy operates on basic economic principles, leveraging the disparities between demand and supply in energy markets. During peak demand periods, electricity prices typically spike, providing a financial incentive for energy storage owners.

When energy storage systems are strategically deployed, enterprises can become active participants in the energy market. By anticipating peak periods, companies can discharge their stored energy at premium prices, thus capitalizing on the high demand. This ability to sell energy not only enhances the financial viability of storage investments but also contributes to a more resilient energy grid. Furthermore, if multiple enterprises engage in this practice, they can collectively enhance grid stability and reliability.

4. PARTICIPATING IN ENERGY MARKETS

Engagement in broader energy markets represents another revenue-generating avenue for enterprises with energy storage capabilities. By participating in ancillary services and demand response programs, businesses can create additional revenue streams and improve their operational flexibility. Energy storage systems can provide critical services, such as frequency regulation and voltage support, thereby contributing to grid stability.

In many regions, independent system operators (ISOs) and regional transmission organizations (RTOs) incentivize companies to participate in such services. Companies with energy storage capabilities can enter contracts to provide these services, earning payments that increase their overall return on investment. Moreover, as the energy ecosystem evolves, new market opportunities continue to emerge, and enterprises that strategically position themselves within these markets can reap substantial rewards.

5. ENHANCING SUSTAINABILITY PROFILES

In today’s corporate environment, sustainability is no longer merely a buzzword but a vital component of competitive strategy. Energy storage directly contributes to enhancing the sustainability profiles of enterprises. By utilizing renewable energy sources alongside energy storage systems, businesses can significantly reduce their carbon footprints and overall energy consumption.

Importantly, sustainability enhances corporate reputation, thus influencing consumer purchasing decisions. Increasingly, consumers are favoring companies that demonstrate environmental responsibility. By investing in energy storage and leveraging renewable energy, businesses can align with these consumer preferences, ultimately driving brand loyalty and, consequently, revenues. Sustainability is also an increasingly important consideration for investors. Companies with strong sustainability profiles often enjoy access to better financing opportunities and investment incentives.

FAQs

HOW DOES ENERGY STORAGE WORK?

Energy storage systems operate by capturing and storing energy generated during off-peak hours for use during peak demand times. The most common technologies include batteries such as lithium-ion and lead-acid. These systems convert grid-supplied electricity into stored energy through various processes, allowing businesses to draw from this reserve during high-cost periods. By doing this, enterprises can optimize their energy use, reduce costs, and even sell energy back to the grid, especially during peak pricing periods.

WHAT ARE THE INITIAL COSTS OF INSTALLING ENERGY STORAGE?

The initial investment in energy storage systems can vary widely depending on the technology chosen, the scale of the installation, and additional components required for effective integration into existing systems. While upfront capital costs may be significant, financial incentives, rebates, and projections of long-term operational savings can mitigate these expenditures. Many businesses find these systems cost-effective over time due to the continuous savings on energy bills and potential income from selling energy back to the grid.

CAN SMALLER ENTERPRISES BENEFIT FROM ENERGY STORAGE AS WELL?

Yes, smaller enterprises can also greatly benefit from energy storage systems. Many companies, regardless of their size, face fluctuations in energy costs and seek to efficiently manage their energy consumption. For smaller firms, scaling down storage technology to fit their operational requirements can still yield significant savings and allow participation in energy markets. Additionally, advancements in technology have made energy storage more accessible even to smaller players, encouraging widespread adoption across various industry sectors.

In summation, enterprises cultivating self-reliance in energy storage can unlock multiple pathways to profitability. Through strategic initiatives encompassing cost savings, energy market participation, and increased sustainability, these organizations position themselves favorably amid the evolving energy landscape. The importance of energy independence continues to escalate as companies grapple with fluctuating energy costs and escalating demand. By harnessing energy storage effectively, businesses not only validate their operational strategies but also contribute to a resilient and sustainable energy framework. Investing in energy systems emerges not only as a fiscal tactic but also as a pivotal step toward ecological responsibility. Furthermore, the expanding landscape of regulatory incentives and market opportunities significantly enhances the attractiveness of energy storage for enterprises, presenting an unparalleled opportunity for financial growth. In trying times, the ability to manage energy consumption and harness savings stands as a competitive edge, pushing companies towards innovation and a more sustainable future.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-can-enterprises-make-money-by-doing-energy-storage-themselves/