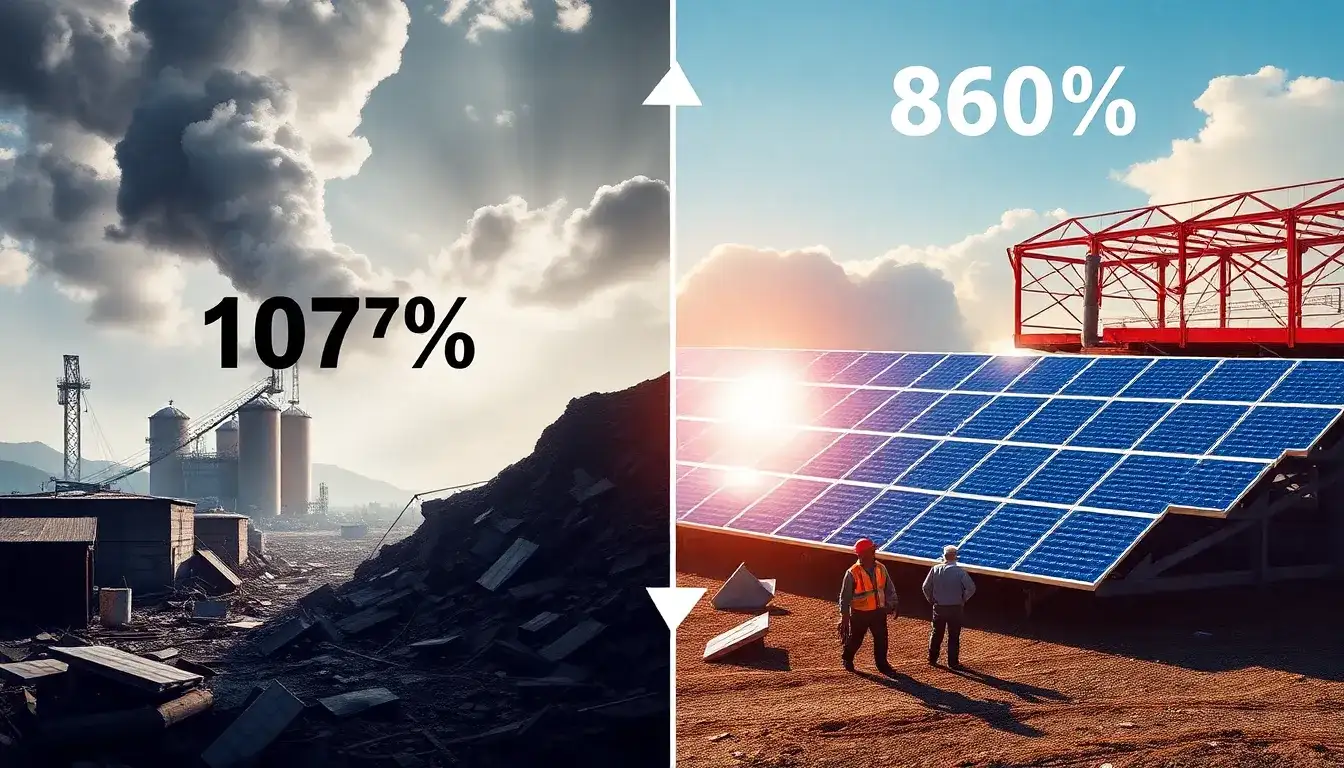

Industry Trends: 107% Increase, 860% Profit: Significant Shifts in the Dual-digit Inverter Market

Date: May 6, 2025

Views: 580

As the market for inverters evolves, forecasts suggest a reduction in 2024 production, with a slight increase expected in Q1 2025 and stability in overseas distribution channels. The financial reports for 2024 and 2025 have already been released, indicating that inverter companies are still operating under traditional constraints. However, it is noteworthy that many inverter manufacturers are capable of maintaining profitability.

According to data from the Energy Source Network (Code: hxny3060), in 2024, inverter companies are expected to face a decline in profitability, with eight major inverter manufacturers reporting five experiencing significant reductions. Furthermore, only one company, Giant Tech, has shown a capacity to maintain profitability in the face of these challenges.

By the end of 2025, among inverter companies, five firms are projected to have profitability ratios exceeding 60%. Companies that show substantial growth will be those that adapt to market changes swiftly. The most remarkable profit margins are expected from the top-performing companies, although one company is still expected to report a decline of 55%.

As the market continues to evolve, what will be the leading trends in the inverter sector? This year, inverter market stability raises questions about whether companies can sustain profitability in 2024. In 2024, the profitability of several inverter companies, including Upper Energy (SZ:300827), Dewei Technology (SH:605117), and Sunlight Energy (SZ:300274), will likely be under significant pressure, while others are expected to remain stable.

Sunlight Energy reports a profitability of 110 billion yuan, with a growth rate of 17%, making it the highest-grossing company among its peers. Dewei Technology is expected to achieve 29.52 billion yuan, with a growth rate of 65%. Upper Energy, on the other hand, will report 4.19 billion yuan, with a growth rate of 46%.

Among those reporting declines, Jinwei Energy (SZ:300763) and Jiawei Electric (SH:603063) indicate reductions in profitability ranging from 11% to 12%. Other companies, such as Jiangsu Energy (SH:688032) and Yineng Technology (SH:688348), report declines of 32% and 35%, respectively. The largest drop is expected from Giant Tech (SH:688390) with a decline of 107.25%.

Overall, the projected decline in profitability is a significant concern for inverter companies in 2024. There are many reasons for this decline, including supply chain disruptions, high production costs, and increased competition from overseas markets.

Giant Tech indicates that the primary stressor is the impact of overseas market demand, which has been exacerbated by overseas supply challenges, causing significant pressure on profitability. The market requires a careful balance between maintaining production efficiency and meeting the growing demand.

In 2024, Giant Tech’s total revenue is expected to reach 26.79 billion yuan, primarily driven by inverter and battery sector growth. These companies have reported revenue declines of 22.5% for the current year and 9.65% for the inverter sector, indicating a challenging environment.

In 2024, Jinwei Energy’s revenue is expected to be 6.91 billion yuan, Jiawei Electric 4.41 billion yuan, Upper Energy 4.19 billion yuan, Jiangsu Energy 3.47 billion yuan, and Yineng Technology 1.42 billion yuan, while only Giant Tech is projected to maintain profitability of 618.1 million yuan.

By 2025, the market dynamics are expected to shift significantly, with inverter companies projected to ramp up production significantly. In the first quarter of 2025, Sunlight Energy, Jinwei Energy, Jiawei Electric, and Upper Energy are expected to report substantial revenue growth.

According to the latest data from Wind, in the first quarter of 2025, China’s inverter exports are estimated to reach 16.9948 billion US dollars, marking a growth of 5.3394% compared to the previous year.

The overseas market for inverters is also notable, with companies such as Sunlight Energy, Dewei Technology, and Upper Energy seeing substantial revenue generation from international sales.

As for the opportunities in overseas markets, it is expected that demand will continue to grow, particularly in regions such as North America and Europe, where solar technology adoption remains robust.

In summary, the inverter market is experiencing significant shifts, with companies needing to adapt quickly to changing market conditions to maintain profitability and competitiveness.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/dramatic-market-shifts-solar-inverter-companies-see-107-loss-and-860-growth-in-2024/