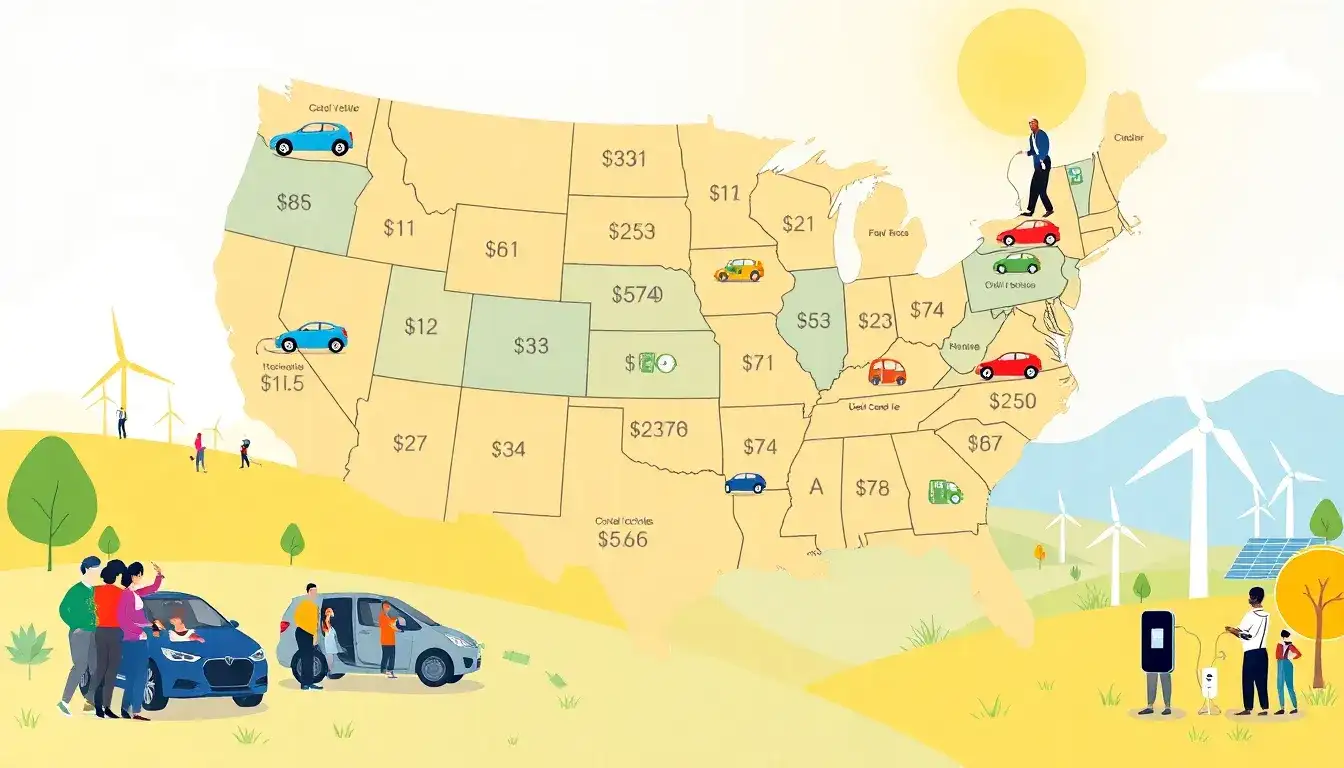

Yes, many states offer tax credits or rebates for electric vehicles (EVs) beyond the federal $7,500 credit. Here are key examples:

Notable state-specific incentives

- California, Connecticut, Maine: Up to $7,500 credit.

- Maryland: $3,000 excise tax credit for EVs under $50,000.

- Massachusetts: $3,500 rebate, plus $1,500 extra for income-qualified buyers.

- Alaska/Delaware: $1,000 credit.

- Washington, D.C.: 50% tax credit (up to $1,000) for charger installations.

EV charger incentives

- Maryland: $700 rebate for home chargers.

- Massachusetts: $250 discount for Level 2 chargers (Braintree Electric).

- SELCO customers (likely select utility areas): $350 rebate.

Registration fees

24 states charge extra EV registration fees ($50-$200 annually) to offset lost gas tax revenue. Five states (e.g., Colorado, Georgia) combine these fees with purchase incentives.

Income and price restrictions apply in many states, such as Maryland’s $50,000 vehicle price cap and Massachusetts’ income-based bonuses. Check local utility providers for additional off-peak charging discounts.

Updated as of January 2025.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/are-there-any-state-specific-tax-credits-for-electric-vehicles/