Transforming Abandoned Salt Caverns into “Super Power Banks”: A Surge in Investment for Compressed Air Energy Storage

Compressed air energy storage (CAES) is essentially the process of “storing air during low electricity demand and generating power during peak demand.” In recent years, CAES has emerged as a promising large-scale physical energy storage technology, becoming a focal point for research and investment in the energy sector. Currently, the industry is entering a crucial phase of technological breakthroughs and large-scale applications.

According to a representative from China Power Construction Corporation, “In the past two years, the cost of compressed air energy storage has decreased rapidly, and its lifetime cost now has a competitive edge compared to electrochemical storage.” Recently, a reporter from Securities Times visited the CAES project in the salt caverns of Feicheng, Shandong Province, and learned that, supported by multiple policies and applications, the overall performance and economic viability of CAES continue to improve, marking a new stage in the industry’s development.

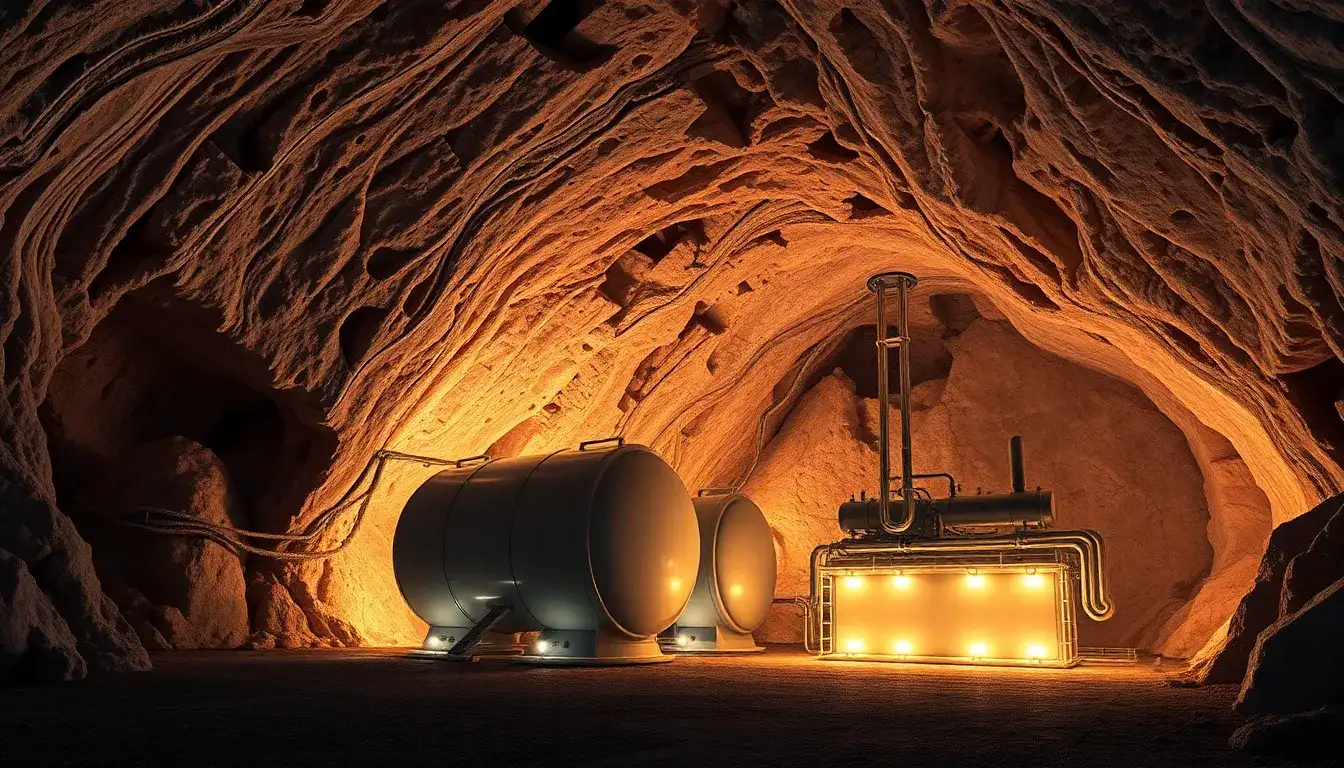

Reutilizing Abandoned Mines

In the Beiyuan Town of Feicheng, Shandong, the 2×300MW (Phase I) CAES project is under rapid construction. The project occupies 221 acres surrounded by farmland. Located 1,300 meters underground to the northwest of the site are two transformed high-pressure gas storage caverns with a total capacity of 900,000 cubic meters, connected to the surface facility via underground gas pipelines.

The project manager explained, “During off-peak hours, the power station draws electricity from the grid to drive the compression system, compressing air through the pipeline into the underground salt caverns, which can store up to 770,000 kilowatt-hours of electricity per hour. The heat generated during compression can also be stored. When electricity demand peaks, the high-pressure air is released from the caverns, heated using a heat exchanger, and drives the generator to produce electricity. This daily cycle helps to balance electricity demand and facilitates the absorption of renewable energy.”

Cheng Yongjing, Deputy General Manager and Board Secretary of Power Construction New Energy Group, stated that the total investment for this project is 3.64 billion yuan, making it the largest demonstration project in the industry with the highest operating pressure and largest bore diameter. The project is designed for an 8-hour charging duration and can generate power continuously at full capacity for 6 hours, which is the longest duration in the country. It is expected to generate an average annual on-grid electricity of 1.188 billion kilowatt-hours, enough to meet the annual electricity needs of 600,000 households, while saving approximately 310,000 tons of standard coal annually and reducing carbon dioxide emissions by about 600,000 tons.

Feicheng, located in central Shandong, is the largest rock salt production base in China, with proven rock salt reserves of 5.22 billion tons. Over the years of mining, 46 pairs of salt caverns have been formed, with a total underground cavity area exceeding 20 million cubic meters, and an additional 3 million cubic meters created each year. These previously viewed ecological restoration challenges, the abandoned salt caverns, are now leveraging their unique geological characteristics to become “ideal carriers” for compressed air energy storage, transforming into “super power banks.”

“The salt rock has excellent creep properties, automatically sealing small cracks under high pressure, ensuring the integrity and stability of the gas storage space. Its capacity to withstand 170 atmospheres and store over 500,000 cubic meters of air per cavern meets the demands of large-scale compressed air energy storage,” the project manager explained.

In August of this year, construction officially began on the first injection-production well for the salt cavern CAES project. Cheng Yongjing mentioned that the project is scheduled to be ready for unit power transmission by the end of 2025, entering the equipment installation and debugging phase, with the first unit expected to be grid-connected by June 2026.

Investment Surge in CAES

As a large-scale, long-duration physical energy storage technology, the core advantages of CAES lie in its substantial storage capacity, extended storage cycles, relatively low investment costs, and long service life. It is considered the most suitable storage technology for GW-level commercial applications, aside from pumped storage. With recent technological advancements, the CAES sector is experiencing a wave of investment.

In September 2021, the world’s first 10MW advanced CAES demonstration project in Feicheng successfully connected to the grid, marking China’s first commercial CAES power station and signifying a shift from laboratory testing to engineering application. Since then, the CAES industry in Feicheng has accelerated, attracting numerous domestic enterprises to invest and build projects.

On April 2, 2025, the largest CAES power station globally, the 350MW salt cavern storage project in Tai’an, Shandong, was officially put into operation, establishing Feicheng as a “hub” for CAES technology.

At the Feicheng salt cavern energy storage industrial park, multiple large power station projects are simultaneously progressing. In addition to China Power Construction Corporation, projects from China Energy Engineering Corporation and China National Chemical Corporation are also underway, showcasing a bustling construction scene.

Nationwide, the enthusiasm for CAES investment remains high. Currently, CAES is implemented not only in salt caverns but also in underground caves, mine storage, and above-ground tank storage. Industry data indicates that by 2024, new installed capacity for innovative storage in China will reach 42.37 million kilowatts, with cumulative installed capacity surpassing 73.76 million kilowatts, and the market share of CAES continuing to rise. This year, significant projects such as the 1050MW/630MWh project in Ulanqab, Inner Mongolia, and the hundred-megawatt project cluster in Jiuquan, Gansu, have been launched, pushing the industry into a “GW-level” development phase.

“In the context of the global energy transition accelerating, CAES is currently entering a golden development period,” Cheng Yongjing stated. “As of now, the localization rate of key equipment in China’s CAES sector has exceeded 90%, significantly lowering system construction costs and shortening delivery times.”

A securities industry analyst remarked, “It is foreseeable that with technological iterations and the accumulation of engineering experience, CAES will become a vital component of China’s long-duration energy storage in the coming years, supporting the establishment of a cleaner, more efficient, and stable new power system.”

Policy and Financial Support for CAES Development

The development of the CAES industry is gaining momentum, with its economic viability drawing particular attention. “With rapid technological advancements in recent years, China’s 300MW CAES generation technology has matured and is now at the forefront globally,” Cheng Yongjing noted. The localization of core equipment is key to cost reduction, with current CAES unit investment costs ranging from 6,000 to 7,000 yuan per kilowatt. As the localization rate of core equipment increases, costs are expected to decrease further.

The aforementioned analyst predicts that from 2025 to 2027, the unit investment costs for CAES are expected to continue to decline due to economies of scale and increased technological maturity. According to the “Special Action Plan for the Large-Scale Construction of New Energy Storage (2025–2027),” it is projected that by 2027, the national installed capacity of new energy storage will surpass 180 million kilowatts, with CAES being one of the key long-duration energy storage technologies benefiting from policy and financial support.

In terms of business models, capacity-based, energy-based, and ancillary services are the main revenue streams for current CAES power stations. For instance, the China Power Construction Feicheng project generates capacity-based revenue through shared energy storage leasing, capacity compensation, and peak-shaving capacity markets, while participating in the spot and medium-to-long-term markets to earn electricity price differentials for energy-based revenue. Additionally, it can generate income through ancillary services such as peak-shaving or frequency regulation.

“The investment in CAES projects is substantial, and the return period is long, which initially deterred corporate enthusiasm. Thus, policy support is crucial for breaking through these barriers,” a representative from Feicheng’s energy department stated. Shandong Province has taken the lead by issuing measures to support the pilot application of long-duration energy storage, clearly allowing energy storage projects to participate in the electricity spot market to earn price differentials through “low-cost charging and peak-time discharging.” Additionally, it states that for salt cavern storage systems generating electricity for four hours or more, the compensation standard will be twice that of lithium battery storage, effectively enhancing project profitability.

Currently, the National Development and Reform Commission, the National Energy Administration, and various provincial energy bureaus are releasing relevant policy documents to support the development of long-duration energy storage. More than 20 provinces have already issued specific implementation plans, with Shandong, Gansu, and Inner Mongolia introducing diverse policy supports such as electricity spot trading and grid ancillary services, injecting strong momentum into the industry’s growth.

“With the benefits of these policies, it is expected that by 2027, the unit investment intensity of CAES will decrease by over 15% compared to current levels, and the investment return period may shorten to 8 to 10 years, significantly enhancing its attractiveness,” the aforementioned analyst stated. As an important technology route for long-duration energy storage, CAES is poised to play a more significant role in new energy bases and grid peak regulation in the future.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/abandoned-salt-caverns-transform-into-super-batteries-as-investment-in-compressed-air-energy-storage-surges/