To determine which stocks energy storage funds should select, several factors come into play. 1. Market Trends and Innovations, 2. Company Fundamentals, 3. Revenue and Profit Expectations, 4. Regulatory Environment. A thorough analysis of these aspects is essential for making informed investment decisions. For instance, market trends significantly influence the performance of energy storage companies; as global demand for renewable energy surges, the necessity for storage solutions has escalated, creating immense potential in this sector. Investors should focus on companies that are pioneering innovative technologies and demonstrating strong growth prospects. Moreover, analyzing a company’s fundamentals, such as its balance sheet and cash flow, is vital. Finally, understanding how regulatory policies impact the energy storage market will shed light on which companies are poised for potential growth.

1. MARKET TRENDS AND INNOVATIONS

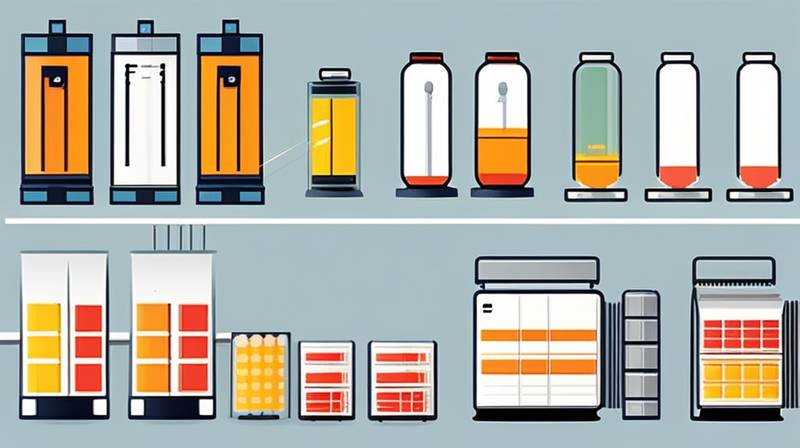

The energy storage landscape is rapidly evolving, influenced by both technological advancements and shifting market dynamics. A growing emphasis on renewable energy necessitates efficient storage solutions, making energy storage more crucial than ever. Recent advancements in battery technology, especially lithium-ion batteries, have significantly contributed to the decreasing costs of energy storage systems. Additionally, companies that harness cutting-edge technology stand to gain a competitive edge.

Investors must closely monitor innovations, such as solid-state batteries or flow batteries, that promise to enhance energy density and longevity. These technological strides not only improve performance but also reduce long-term costs for consumers. As countries worldwide commit to renewable energy targets, companies providing efficient energy storage systems will likely experience growth. Consequently, focusing on stocks associated with such innovations will position investment funds to capitalize on the anticipated market expansion.

2. COMPANY FUNDAMENTALS

Evaluating the solid financial health of potential investments is paramount for energy storage funds. Particular attention should be directed toward metrics such as debt-to-equity ratio, liquidity, and profit margins. Companies with robust fundamentals generally possess the resilience required to weather market fluctuations. A strong balance sheet often demonstrates prudent management practices and sustainable operational models, essential for navigating the volatile energy sector.

Moreover, analyzing the management team’s track record can provide insights into the company’s strategic direction. Innovative visions that align with market demands indicate strong readiness for future developments. Engagement in meaningful partnerships can also enhance a firm’s market standing. A company that collaborates with grid operators or renewable energy developers may access new markets and opportunities. Consequently, discerning a company’s potential through its fundamentals provides a clear pathway towards identifying promising investment prospects.

3. REVENUE AND PROFIT EXPECTATIONS

The trajectory of revenue generation is a critical aspect when selecting stocks for energy storage funds. Growth in the renewable energy sector correlates directly with a rise in revenue for energy storage companies. As demand for energy storage solutions grows—spurred by government incentives and increasing electrification—companies are likely to witness an acceleration in their profitability. Evaluating revenue forecasts allows investors to position themselves for potential high returns.

Profit margins must also be assessed meticulously. High-margin companies often indicate effective cost management strategies and superior products that typically command a price premium in the market. Investors should prioritize companies with promising profit projections that align with broader industry trends. When choosing stocks, scrutinizing analyst reports and market research can yield additional insights into expected revenue trajectories, helping funds make informed choices that could lead to outsize gains.

4. REGULATORY ENVIRONMENT

The regulatory landscape profoundly affects the energy storage industry’s growth potential. Government policies aimed at promoting renewable energy adoption directly impact the success of energy storage solutions. Key regulations, such as tax incentives and subsidies, heavily influence market dynamics and corporate profitability. It’s essential for investors to remain updated on evolving energy policies that could bear repercussions for companies in the sector.

Additionally, emerging legislation concerning carbon emissions and energy efficiency mandates can create lucrative opportunities. These regulations could lead to increased investments in energy storage technologies, as governments transition towards a more sustainable energy future. Understanding the intersection of regulation and market potential enables more precise stock selections.

Investment funds aiming to capitalize on energy storage opportunities must navigate this finely-tuned environment, ensuring that they align their portfolios with companies resilient to regulatory changes.

5. COMPETITION ANALYSIS

Evaluating competition within the energy storage sector provides critical insights into potential investment risks and opportunities. The market consists of a wide array of players, from established corporations to promising startups, each vying for market share. Understanding the competitive landscape can allow funds to identify companies with unique competitive advantages that set them apart from peers.

As this sector is characterized by rapid technological changes, companies that can innovate efficiently will be better positioned to outperform competitors. Funding research and development initiatives or acquiring patents gives firms an edge in differentiation. An investor’s ability to gauge which companies can adapt to competitive pressures plays a vital role in making prudent investment decisions.

6. SUPPLY CHAIN CONSIDERATIONS

The operational effectiveness of energy storage companies is intricately linked to their supply chain. Effective management of supply chain resources minimizes costs while ensuring timely product delivery. Disruptions due to geopolitical tensions or raw material shortages can have dire effects on a company’s profitability. For investors, understanding these risks is crucial.

Companies that establish resilient supply chains through diverse sourcing strategies and robust partner networks are generally more dependable. This resilience enables firms to navigate fluctuating market conditions more effectively. Therefore, comprehensive supply chain evaluations should be part of the investment assessment process, identifying potential vulnerabilities and strengths within target companies.

7. GEOPOLITICAL FACTORS

Geopolitical situations can have significant implications for the energy storage sector. Political relationships and trade policies shape the accessibility of key components like lithium for batteries. For example, regions rich in natural resources may develop different regulations that affect supply dynamics, creating fluctuations in costs and availability for energy storage companies.

Furthermore, international commitments to climate change initiatives can catalyze investments in energy storage solutions globally. Understanding the broader implications of political stability is essential for investors. A politically stable environment tends to bolster business confidence, encouraging innovative growth in the energy storage domain.

8. CAPITAL EXPENDITURES AND INVESTMENT STRATEGIES

Energy storage companies often require substantial capital expenditures to sustain growth and expand operational capabilities. Funds seeking to invest in this space must understand how different firms allocate their resources. Companies consistently investing in technology improvements and operational efficiencies demonstrate a commitment to long-term growth.

Investors must also discern the effectiveness of various investment strategies adopted by companies—whether focusing on organic growth through research and development or seeking mergers and acquisitions. These choices can significantly affect overall market positioning and share value. Monitoring how companies manage their capital structures and financial strategies can guide funds in selecting which stocks to invest in.

FREQUENTLY ASKED QUESTIONS

WHAT ARE THE MAJOR FACTORS TO CONSIDER WHEN INVESTING IN ENERGY STORAGE STOCKS?

To effectively invest in energy storage stocks, one must consider multiple factors. Market trends and innovations, company fundamentals, regulatory environment, and revenue projections are vital. Monitoring market trends helps identify emerging technologies and demand dynamics. Evaluating a company’s health—debt levels, liquidity, and profit margins—further solidifies investment decisions. Additionally, understanding government policies and how they affect the renewable sector is crucial. Analyzing future revenue and profit potential offers insight into financial performance. These considerations collectively enable informed investment choices, ultimately enhancing energy storage fund performance.

HOW DOES THE REGULATORY ENVIRONMENT IMPACT ENERGY STORAGE INVESTMENTS?

The regulatory environment plays a significant role in shaping the energy storage sector. Government regulations can either facilitate or hinder growth opportunities. Policies promoting renewable energy, such as tax credits and subsidies, greatly enhance the viability of energy storage solutions. Additionally, emission reduction mandates influence market demand for competitive energy storage technologies. Staying informed about upcoming legislation can provide investors with a competitive advantage. Companies that proactively align their strategies with regulatory changes are more likely to succeed. Therefore, understanding the regulatory framework is essential for effective energy storage stock selection.

WHAT STRATEGIES CAN INVESTORS USE TO EVALUATE ENERGY STORAGE COMPANIES?

To evaluate energy storage companies, investors should adopt a multifaceted approach. Analyzing financial health, market positioning, and technological innovations can provide valuable insights. Utilizing financial metrics, such as revenue growth and profit margins, allows for a clearer understanding of a company’s performance. Investors should also assess competitive advantages—such as unique technology or strong partnerships—which can indicate future growth potential. Furthermore, perusing industry reports and analyst insights enables a comprehensive assessment of market trends. By combining quantitative and qualitative analyses, investors can make informed decisions when selecting energy storage stocks.

TARGETING THE FUTURE ENERGY LANDSCAPE THROUGH STOCK SELECTION

Assessing which stocks to invest in for energy storage funds hinges on an intricate understanding of the overall market landscape. A successful strategy is contingent upon recognizing the interconnectedness between technological advancements, company fundamentals, and regulatory influences. By focusing on companies by aligning innovation with market demand, investors can uncover significant opportunities within the energy storage sector.

Through detailed exploration of revenue projections and competition analysis, energy storage funds can identify promising stocks poised for growth. Effective supply chain management and diligent attention to geopolitical factors further reinforce the resilience of potential investments. By employing strategic analysis frameworks, energy storage funds are empowered to construct a robust portfolio of investments that captures the dynamism of this forward-looking industry.

Ultimately, selecting stocks for energy storage funds requires a holistic approach, meticulously considering both macro and microeconomic variables. This comprehensive evaluation not only fosters judicious decision-making but also positions funds to harness the burgeoning potential of the energy storage market in the years ahead by strategically navigating complexities in a rapidly evolving sector. Through educated betting on the right stocks, investors can expect to play a vital role in advancing the transition towards more sustainable energy solutions.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/which-stocks-should-energy-storage-funds-choose/