What types of energy storage ETFs are there?

1. Energy storage exchange-traded funds (ETFs) primarily focus on companies involved in various aspects of energy storage technologies, including manufacturing, development, and deployment. 2. Types of energy storage ETFs include those centered on battery technologies, hydrogen storage, and other innovative solutions. 3. The investment potential varies with market trends and technological advancements influencing performance and growth. 4. Understanding the underlying assets, regulatory environment, and market dynamics is crucial for potential investors. In recent years, the urgency to transition from fossil fuels to renewable energy has catalyzed innovations in energy storage, making ETFs a viable option for investors looking to capitalize on this burgeoning sector.

1. OVERVIEW OF ENERGY STORAGE ETFs

To comprehend the array of energy storage ETFs currently available in the financial landscape, it is essential to frame energy storage in the context of a rapidly changing energy paradigm. The demand for clean, reliable, and efficient energy storage continues to rise as renewable energy sources, such as solar and wind, become more prevalent. The resultant variation in energy generation necessitates efficient storage capabilities to ensure a balanced supply and demand.

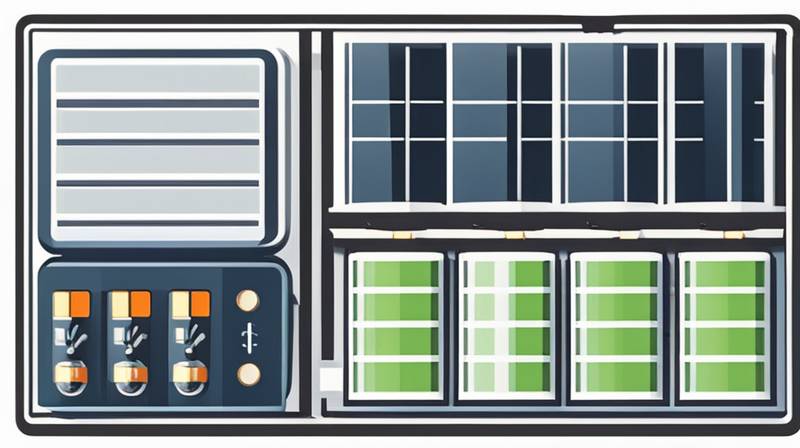

Energy storage ETFs represent portfolios that are primarily composed of companies involved in various energy storage technologies. These portfolios may span a range of sectors, such as battery manufacturing, technology-related companies that develop storage solutions, or focus more broadly on companies that utilize energy storage in their operations. Notably, the most common energy storage solution remains battery technology, which has seen significant advancements in performance and reduction in cost over recent years.

2. CATEGORIES OF ENERGY STORAGE TECHNOLOGIES

The landscape of energy storage technologies encompasses a variety of approaches and systems designed to store energy for later use.

2.1 BATTERY STORAGE

Battery storage is arguably the most recognized technology associated with energy storage. Various types of batteries serve different purposes, from small-scale applications in homes to large utility-scale energy storage systems. Lithium-ion batteries dominate this market due to their high energy density, efficiency, and decreasing costs driven by advances in technology and increased production capacity. These batteries are commonly employed in electric vehicles (EVs) and renewable energy integration projects.

The growth of the electric vehicle sector inherently drives the demand for lithium-ion batteries, representing a symbiotic relationship between transport and energy storage markets. In addition, emerging technologies, such as solid-state batteries and flow batteries, promise improved performance and safety, enhancing the diversification of this group of ETFs.

2.2 HYDROGEN STORAGE

Hydrogen storage represents another innovative energy storage solution that has gained traction in recent years. As nations commit to reducing carbon emissions, hydrogen is emerging as a clean fuel alternative, derived from renewable energy sources through processes such as electrolysis.

Hydrogen storage technologies can be grouped into three main methods: compressed hydrogen, liquid hydrogen, and chemical hydrogen storage. Each method embraces distinct advantages and challenges related to energy density, efficiency, and usability. Hydrogen is particularly appealing due to its ability to store large quantities of energy for extended durations, making it an attractive option for balancing intermittent renewable energy generation.

2.3 OTHER EMERGING TECHNOLOGIES

Apart from battery and hydrogen storage, several other emerging energy storage technologies are worth mentioning. These include thermal energy storage, gravitational energy storage, and supercapacitors.

Thermal energy storage systems work by retaining energy generated during peak generation times (e.g., from solar or wind sources) and releasing it later when demand rises. This method is particularly advantageous for applications related to district heating and cooling. Gravitational energy storage leverages gravitational potential energy, using heavy materials that are elevated to store energy that can be released when the stored potential converts back into kinetic energy.

Supercapacitors represent a specialized storage technology, providing very high power density and quick charging and discharging capabilities. They are particularly well-suited for applications requiring frequent charge-discharge cycles, such as in certain industrial applications or for providing bursts of power in transportation systems.

3. FACTORS INFLUENCING ENERGY STORAGE ETF PERFORMANCE

Investors contemplating energy storage ETFs must recognize the multi-faceted factors influencing their performance. These elements include technological advancements, regulatory developments, market demand, and competitive dynamics within the relevant sectors.

3.1 TECHNOLOGICAL INNOVATIONS

Innovation serves as a crucial driver in shaping the energy storage market. Breakthroughs in battery efficiency and chemistries, alternate storage solutions, and impactful scale-up manufacturing techniques can significantly enhance the viability of companies operating in this domain.

The pace of these technological advancements can directly affect investor sentiment and performance of energy storage ETFs. Investment in research and development plays a significant role in determining which companies will thrive in a fast-evolving landscape where new solutions may emerge to challenge incumbents.

3.2 REGULATORY AND POLICY SUPPORT

The regulatory environment is fundamental in establishing a conducive landscape for energy storage technologies. More and more governments globally are setting ambitious renewable energy targets and incentivizing energy storage deployment through tax incentives and subsidies.

Policy frameworks that integrate energy storage objectives into broader renewable energy commitments can create a robust environment for growth, enhancing the prospects for companies within energy storage ETFs. Sustained regulatory support would not only facilitate investments but also contribute significantly to the public’s acceptance and integration of such technologies.

4. PORTFOLIO DIVERSIFICATION AND INVESTMENT STRATEGIES

The deployment of energy storage ETFs as components of an investment portfolio warrants careful consideration concerning diversification and strategy. Balancing inherent risks with potential rewards requires an understanding of both the market dynamics and investor objectives.

4.1 DIVERSIFICATION THROUGH ETFs

One of the fundamental advantages of investing in energy storage ETFs lies in the inherent diversification that such financial instruments provide. By possessing a range of underlying assets in a single fund, investors can mitigate risks associated with individual stocks while benefiting from collective growth prospects provided by the energy storage sector.

The structure of these ETFs can vary widely, with some emphasizing a specific subset of energy storage technologies—like battery or hydrogen storage—while others might adopt a more blended approach. Understanding the composition of each ETF can help investors align them with broader investment goals and risk tolerance.

4.2 STRATEGIES FOR INVESTING

Various strategies can be employed when investing in energy storage ETFs. Investors might opt for a growth strategy focused on capturing high growth potential from emerging technologies while accepting elevated risks, or they might prefer a value strategy aimed at identifying undervalued companies within the sector.

Additionally, dollar-cost averaging, a method where investors systematically invest a fixed amount over time, can help mitigate market volatility risks. This investment strategy is particularly beneficial in industries characterized by rapid technological advancements and shifting market sentiments.

5. FUTURE OF ENERGY STORAGE ETFs

Looking ahead, the future of energy storage ETFs appears promising as the global energy transition continues to accelerate. Increased reliance on renewable energy, policy reforms, and technology enhancements will likely propel growth in this unfolding sector.

5.1 MARKET TRENDS

As demand for clean energy rises, so does the necessity for diversified and scalable energy storage solutions, leaving significant room for expansion in energy storage ETFs. Market trends indicate a rising interest among retail and institutional investors alike, signaling the potential for asset inflows and enhanced valuations within this sector.

Emerging markets and technological advancements present a fertile ground for innovation and investment opportunities, further enriching the ecosystem surrounding energy storage. As more awareness spreads regarding energy security and sustainability, energy storage ETFs may stand at the forefront, bridging the gap between renewable energy production and consumption demands.

5.2 ROLE OF INVESTORS

Investors play a crucial role in driving the evolution of energy storage through their investments and behavior. As they focus on sustainable and responsible investment strategies, energy storage ETFs are likely to feature prominently in the sustainable investing narrative.

The success of energy storage ETFs also reflects broader societal values as public sentiment shifts toward a heightened focus on environmental sustainability and energy efficiency. Investors can drive positive change by consciously allocating capital to sectors that emphasize sustainability, thereby fostering further development in energy storage technologies and infrastructure.

ENERGY STORAGE ETFs FREQUENTLY ASKED QUESTIONS

WHAT ARE ENERGY STORAGE ETFs?

Energy storage ETFs are financial instruments that provide investors with exposure to a portfolio of companies engaged in the development, manufacturing, and deployment of technologies designed to store energy. These technologies may include various battery systems, hydrogen storage, thermal storage, and other innovative energy solutions. By investing in these ETFs, individuals gain indirect ownership in companies revolutionizing energy storage, taking a step toward capitalizing on a sector that is expected to grow substantially as global energy systems transition toward renewable sources.

Investors should consider the diverse technologies encompassed within energy storage ETFs. Different companies may focus on lithium-ion batteries, solid-state technology, or even hydrogen storage methods. Awareness of the ETF’s specific holdings and focus is crucial for making informed decisions while mitigating risks associated with any single company or technology.

HOW DO I CHOOSE AN ENERGY STORAGE ETF TO INVEST IN?

Selecting the right energy storage ETF involves an evaluation of several key factors, including the fund’s investment strategy, expense ratio, liquidity, and the underlying companies it encompasses. An initial step is to assess the ETF’s overarching focus—some might concentrate narrowly on battery technologies, whereas others adopt a broader approach.

Analyzing the ETF’s historical performance and responding to market trends is essential for gauging potential growth. Additionally, investors should consider the expense ratio, which impacts overall returns on investment. Some ETFs may offer competitive fees, which can enhance net gains over time. Finally, liquidity is vital; ensure that the ETFs have sufficient trading volume, enabling a favorable entry and exit during changing market conditions.

WHAT ARE THE RISKS ASSOCIATED WITH INVESTING IN ENERGY STORAGE ETFs?

Investing in energy storage ETFs involves various risks, including market and sector-specific risks that may influence performance. Market volatility can result in fluctuations in share prices, impacting investment returns regardless of the intrinsic value of the included companies.

Sector-specific risks include technological advancements or failures that may threaten the effectiveness of companies within the ETF. For instance, the rapid evolution of battery technologies could affect the competitiveness of investments in older technologies. Additionally, regulatory challenges or changes in policies supporting alternative energy sources could represent significant hurdles. Investors should maintain a diversified portfolio to help mitigate such risks while remaining informed about market dynamics and technological advancements in energy storage.

The realm of energy storage ETFs is vast and complex, featuring a multitude of investment possibilities that are becoming increasingly relevant in today’s energy landscape. With a focus on advanced storage solutions, these funds provide critical pathways for investors looking to engage with transformative technologies shaping the future of clean energy. Factors such as regulatory frameworks, technological adaptations, and market demand will undoubtedly play defining roles in the evolving narrative of energy storage. Understanding these dynamics will enhance the ability to make informed investment decisions while contributing to the ongoing transition toward a sustainable energy future. The synchronization of investor interests with environmental and sustainability goals will not only yield financial benefits but also influence positive societal and ecological change in the years to come.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-types-of-energy-storage-etfs-are-there/