Investment in energy storage necessitates clarity on several pivotal factors: 1. Technological maturity – understanding the innovation levels and readiness of energy storage technologies; 2. Regulatory landscape – navigating policies that affect operational capabilities; 3. Economic viability – conducting thorough cost-benefit analyses; 4. Market demand – identifying energy needs and integration potential within existing infrastructures. The emphasis on technological maturity deserves further examination because it influences long-term sustainability and returns on investment. Investors should evaluate not just current technologies but also future trends that may impact energy storage effectiveness and reliability.

1. TECHNOLOGICAL MATURITY

Understanding the technological maturity of energy storage solutions is paramount for any investment consideration. The advancement and evolution of different storage technologies, such as lithium-ion batteries, flow batteries, and mechanical systems, determine their viability and the degree of risk involved in investment decisions. Given the rapid advancements in battery technology, particularly lithium-ion, investors must stay informed about ongoing research, development trends, and the emergence of new materials that might enhance energy density, lifespan, and cost-effectiveness.

Investing in technologies at various maturity stages involves different risk profiles.** More mature technologies often pose lower risks due to established operational track records and extensive market penetration. Conversely, novel technologies may provide enhanced functionalities or reduced costs but can introduce higher uncertainties regarding reliability and market acceptance. Thus, proper risk assessment and a comprehensive understanding of each technology’s life cycle stage are crucial.

2. REGULATORY LANDSCAPE

Navigating the regulatory landscape is a complexity that cannot be overlooked when considering energy storage investments. Various governmental policies and regulations shape the operational environment for energy storage systems, influencing everything from grid interconnection standards to financial incentives. Understanding local, regional, and national regulatory frameworks enables investors to position themselves advantageously within the market.

Regulatory bodies may promote energy storage through incentives such as grants, tax credits, or subsidies. These initiatives can significantly bolster the economic viability of a project, making it essential for investors to remain apprised of shifts in legislation. Moreover, regulatory uncertainties can pose challenges, emphasizing the need for thorough due diligence. Analyzing existing legislation alongside potential shifts in policy helps investors anticipate risks and opportunities within the evolving energy landscape.

3. ECONOMIC VIABILITY

Conducting a meticulous cost-benefit analysis is vital to assessing the economic viability of energy storage investments. This evaluation must encompass a wide array of factors, including initial capital outlay, operational and maintenance costs, expected lifespan, and return on investment timelines. Moreover, predicting future market trends, electricity prices, and energy demand is crucial for crafting a comprehensive financial model.

Central to this discussion are the levelized costs of storage (LCOS), which serve as a critical metric for determining the affordability of various storage solutions. Investors should closely analyze how changes in technology costs, financial incentives, or market demand can influence LCOS positively or negatively. Additionally, scenario analysis allows stakeholders to weigh potential outcomes based on varying assumptions, thus enhancing decision-making robustness.

4. MARKET DEMAND

The market demand for energy storage must be thoroughly understood before committing capital. Factors such as the increasing integration of renewable energy sources, enhancing grid reliability, and shifting energy consumption patterns drive the need for effective storage solutions. Stakeholders should consider the specific energy landscape in their target markets, including renewable penetration levels and grid infrastructure conditions.

Evaluating market demand also requires investigating competing technologies and their potential substitutes. Understanding the competitive edge that energy storage offers over alternatives, such as peaking power plants or demand response mechanisms, enables investors to determine the strategic positioning of their investments. A comprehensive market analysis combines understanding current demand drivers with projected trends, providing crucial insights into the future landscape.

5. STRATEGIC PARTNERSHIPS

Forming strategic partnerships represents a critical component of successful energy storage investment strategies. Collaborating with technology providers, government entities, and utility companies can unlock opportunities for shared resources, reduced costs, and enhanced market insights. Partnering with experienced local firms can help navigate regulatory complexities and harness regional expertise, thus improving the investment’s success rate.

Moreover, joining forces with research institutions enhances access to innovative advancements and emerging trends within the energy storage sector. This collaborative approach facilitates knowledge sharing, enabling all stakeholders to stay at the forefront of developments that may impact their investments. Strong partnerships yield not just operational efficiencies but also competitive advantages in rapidly evolving markets.

6. ENVIRONMENTAL IMPACT

Investors must also analyze the environmental impacts of energy storage technologies. As the global focus shifts toward sustainability, understanding the ecological footprint of energy storage solutions is essential. Evaluating the lifecycle impacts of systems, including manufacturing, operation, and recycling, informs stakeholders of their compliance with environmental regulations and market expectations.

Technologies like lithium-ion batteries pose specific environmental concerns, particularly regarding resource extraction and end-of-life disposal. Investors should advocate for sustainable practices, such as responsible sourcing of materials and the implementation of recycling programs. A strong commitment to environmental stewardship enhances a project’s attractiveness and supports broader sustainability goals within the energy sector.

7. TECHNOLOGY INTEGRATION

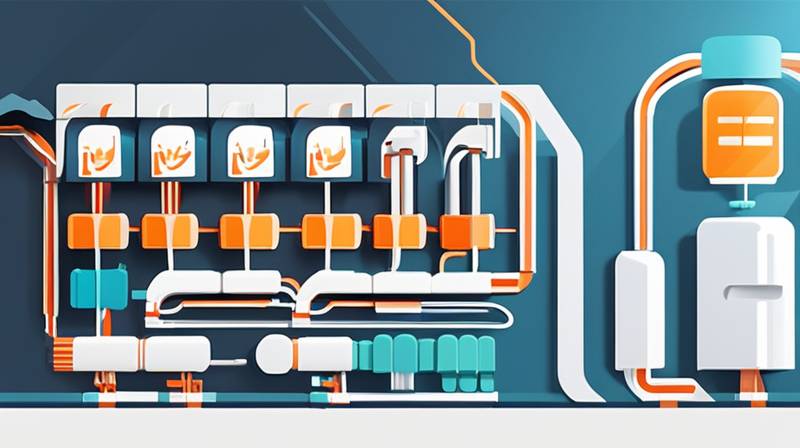

The successful integration of energy storage systems into existing power grids poses another significant challenge. Stakeholders must consider the compatibility of storage technologies with current infrastructure, regulatory standards, and operational practices. This involves understanding grid architecture, system interdependencies, and the impact of deployment on grid stability and reliability.

Moreover, advances in smart grid technologies can facilitate enhanced integration of storage solutions. Intelligent systems allow for real-time monitoring and optimization of energy storage deployments, maximizing their effectiveness. Investors should be aware of how emerging technologies can bolster system performance and provide valuable insights into operational efficiencies, enhancing the long-term viability of their investments.

8. RISK MANAGEMENT

Effective risk management strategies are indispensable for navigating the inherent uncertainties in energy storage investments. Risks may arise from technological dysregulation, market fluctuations, operational failures, or even shifts in policy environments. Proactively identifying, assessing, and mitigating these risks is crucial for safeguarding investments and ensuring sustainable growth.

Establishing a robust risk management framework involves continuous monitoring of market trends, regulatory changes, and technological advancements. Employing scenario planning and sensitivity analysis can further enhance risk assessment processes, allowing stakeholders to devise contingency strategies. Moreover, integrating insurance solutions can offer added protection against unforeseen operational challenges, ensuring a resilient investment framework.

9. FINANCING STRUCTURES

Innovative financing structures are crucial for supporting energy storage investments and achieving financial sustainability. The capital-intensive nature of energy storage projects often necessitates diverse funding sources, including equity, debt, grants, and public-private partnerships. A strategically crafted financial model enables investors to assess the optimal combinations of funding to minimize costs and maximize returns.

Green financing initiatives, such as green bonds or sustainability-linked loans, can provide attractive opportunities for investors committed to environmentally friendly projects. These financial tools not only enhance capital accessibility but also emphasize alignment with sustainability goals, making them particularly appealing in today’s investment landscape. Assessing different financing strategies empowers stakeholders to choose models that best align with their investment objectives.

10. LONG-TERM STRATEGY

Lastly, establishing a clear long-term strategy is essential for guiding energy storage investments toward sustainable growth. This strategy should encompass precise objectives regarding market positioning, technological adoption, risk mitigation, and regulatory compliance. By articulating a comprehensive vision, investors can align their efforts toward achieving meaningful outcomes in the evolving energy landscape.

Additionally, regularly revisiting and reassessing long-term strategies ensures alignment with shifting market dynamics and technological advancements. An adaptive approach allows stakeholders to pivot as necessary, optimizing investment performance amidst changing conditions. Ultimately, a commitment to long-term strategy fosters resilience and enhances competitive positioning in a rapidly evolving sector.

FREQUENTLY ASKED QUESTIONS

WHAT ARE THE PRIMARY BENEFITS OF ENERGY STORAGE INVESTMENT?

Investing in energy storage offers numerous advantages that extend beyond immediate financial returns. First and foremost, enhanced reliability and resilience in the power grid become evident as energy storage systems play a pivotal role in smoothing out fluctuations in supply and demand. By integrating these systems, investors contribute to a more stable energy ecosystem that can efficiently manage surplus generated from renewable resources.

Furthermore, energy storage solutions provide significant cost savings over time. By storing excess energy during periods of low demand and discharging it during peak demand, investors can optimize operational efficiencies and reduce reliance on expensive peaker plants. The adaptability of energy storage also facilitates the transition toward greener energy sources, supporting sustainability goals while addressing the imperative for modernizing aging infrastructure. Overall, the multifaceted benefits of energy storage extend well beyond immediate financial gains and create lasting value across various environmental and economic fronts.

HOW DOES REGULATORY FRAMEWORK IMPACT ENERGY STORAGE INVESTMENTS?

The regulatory framework surrounding energy storage investments plays an indispensable role in shaping operational parameters and determining the viability of projects. Supportive regulations can stimulate investment by providing ample incentives, such as subsidies and tax credits, helping to offset initial development costs and enhance financial attractiveness. Positive regulatory environments can encourage stakeholders to integrate energy storage solutions into their infrastructures, further advancing their implementation.

Conversely, rigid or unclear regulations can stifle investment, creating uncertainty that discourages stakeholders from proceeding with projects. Investors must remain closely attuned to shifts in policies and the emerging legislative landscape to effectively navigate risks. Engaging in active dialogue with policymakers and participating in industry associations can also yield opportunities for stakeholders to contribute to shaping favorable regulations that promote energy storage investments while ensuring compliance and operational feasibility.

HOW CAN INVESTORS EVALUATE THE LONG-TERM VIABILITY OF ENERGY STORAGE TECHNOLOGIES?

Evaluating the long-term viability of energy storage technologies requires a comprehensive approach that includes analyzing various criteria. Initially, investors should assess the technological maturity of specific storage solutions, taking into account historical performance data, reliability, and compatibility with existing infrastructures. Understanding how these systems operate within different contexts is essential for gauging their sustained operational effectiveness.

Furthermore, evaluating market trends and projected adoption rates can shed light on expansion opportunities. Potential innovations that could enhance energy storage capabilities or reduce costs are also crucial factors to consider. Analyzing the financial sustainability, including total cost of ownership and expected return on investment, adds an additional layer of depth to the evaluation process. Ultimately, a holistic assessment empowers investors to make informed decisions based on a well-rounded understanding of the long-term viability and potential of energy storage technologies.

Investments in energy storage are increasingly vital as global energy demands evolve, aligning with sustainability objectives. Key elements encompass technological maturity, regulatory considerations, economic viability, and market demand. Thorough analyses of these components will arm investors with the knowledge necessary to navigate this dynamic market effectively. Understanding the complexities surrounding energy storage equips stakeholders to capitalize on opportunities for long-term growth while responding agilely to ongoing changes in the energy landscape. This multifaceted approach not only enhances the prospects for financial returns but also contributes to a more sustainable, resilient energy future. Collaboration and strategic partnerships further strengthen efforts in this arena, ensuring successful integration within broader energy infrastructures. Overall, staying informed and adaptable allows investors to seize the potential that energy storage presents, ultimately driving substantial advancements in meeting current and future energy needs.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/what-are-the-requirements-for-energy-storage-investment/