How much is the commission for industrial energy storage business?

1. The commission for industrial energy storage business varies widely, influenced by several factors such as market conditions, project size, and geographical location. 2. Generally, commissions range from 5% to 15% of the total project cost, depending on the complexity involved in facilitating the transaction. 3. Larger projects may negotiate lower commission rates, while smaller and more specialized projects could incur higher rates. 4. Understanding the structure and rationale behind these commissions is essential for stakeholders.

1. UNDERSTANDING INDUSTRIAL ENERGY STORAGE

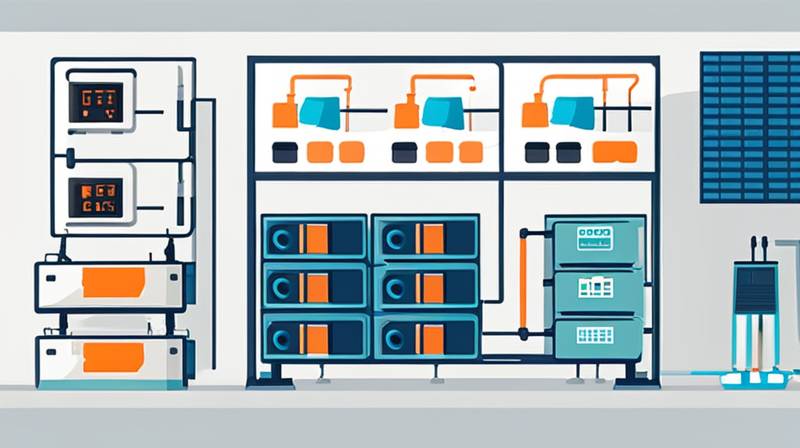

The industrial energy storage sector is increasingly recognized for its potential to transform energy consumption patterns in various sectors. Energy storage solutions, such as batteries, play a crucial role in balancing supply and demand, improving energy resilience, and enabling the integration of renewable energy sources. As the focus on sustainability grows, businesses are investing significantly in energy storage technologies to capitalize on their benefits. The financial arrangements associated with these investments, particularly commissions, can greatly impact the overall cost and viability of energy storage projects.

In this context, the commission structure becomes a pivotal aspect of any energy storage undertaking. Often, these commissions are charged by brokers, consultants, or project developers who facilitate the relationships between technology providers, financing entities, and end-users. Understanding these commissions is key to effectively managing budgets and forecasting potential returns on investment.

2. VARIABLES IN COMMISSION STRUCTURE

A multitude of factors influences the commission rates within the industrial energy storage realm. Geographic location is one notable element; markets with varying energy policies, regulatory frameworks, and competitive dynamics often experience different commission trends. For instance, regions that strongly promote renewable energy may see a more organized and structured commission landscape, while other areas might feature more disarray and fluctuating rates.

Moreover, the size and scope of individual projects also determine commission percentages. Generally, larger-scale projects can command lower rates due to their higher volume and lower risk profiles for brokers and project developers. Conversely, boutique projects or innovative technologies may require more specialized knowledge and risk tolerance, leading to comparatively higher commission charges. Navigating these variables is essential for stakeholders seeking to optimize their projects financially.

3. THE ROLE OF BROKERS AND CONSULTANTS

Brokers and consultants play a vital role in the industrial energy storage landscape, serving as intermediaries facilitating transactions. Their expertise in market trends, project financing, and technology pairing allows them to add significant value throughout the project lifecycle. This added value justifies the commission fees they charge, which may vary based on their level of involvement and the complexity of the project.

Additionally, understanding the contributions these professionals make can foster more effective partnerships. For instance, a broker’s role in negotiating financing options or identifying suitable locations for installation can save a company considerable future costs. Engaging with experienced intermediaries can lead to more favorable terms and conditions, demonstrating a clear return on the upfront commission investment.

4. COMMISSION RATES BY PROJECT SIZE

The relationship between commission rates and project size warrants careful consideration. Larger installations often benefit from economies of scale, leading to reduced commission percentages. This reduction occurs because the overall project cost becomes more substantial, diluting the commission fee as a percentage of the total. Thus, organizations planning large-scale energy storage implementations can leverage this dynamic to negotiate lower rates.

On the other hand, smaller projects may encounter elevated commission rates. These projects frequently experience more significant financial risk and may necessitate comprehensive support to navigate market challenges. As such, brokers and consultants may charge higher commissions to account for the additional workload associated with these undertakings. Understanding this dynamic will empower project stakeholders to negotiate more effectively.

5. IMPACT OF MARKET CONDITIONS

Market conditions can dramatically affect commission rates in the industrial energy storage sector. In periods of robust demand for energy storage solutions, competition among brokers and consultants may drive commission rates downward. Conversely, when the market is saturated or experiencing lackluster demand, companies may face higher commissions as brokers and consultants seek to maintain their revenues despite a smaller pool of projects.

Moreover, technological advancements and regulatory changes can also influence commissions. New energy storage technologies often attract significant interest, warranting deeper engagement from brokers. As a result, commission rates may shift to reflect the market’s enthusiasm for cutting-edge solutions, especially if regulatory frameworks favor these technologies. Staying informed of market dynamics is essential for businesses to make shrewd financial decisions.

6. NEGOTIATING COMMISSIONS

Negotiating commission rates can be a strategic process. Companies engaging with brokers and consultants should prepare thoroughly by researching prevailing market rates, understanding the value offered, and clarifying the project’s specific needs. A well-prepared organization is more likely to achieve favorable terms.

Additionally, fostering a long-term partnership with energy storage professionals might yield more advantageous commission structures. Establishing trust and ongoing collaboration can create an environment where both parties feel comfortable negotiating rates that reflect the project’s unique complexities and potential. Such an approach can result in mutually beneficial arrangements, aligning financial incentives for continued success.

7. CASE STUDIES AND BENCHMARKS

Analyzing case studies from successful energy storage implementations can provide invaluable insights into commission structures. By examining specific projects, stakeholders can identify benchmarks that illustrate common commission rates associated with different project sizes and complexities. This information proves beneficial in assessing one’s own energy storage initiatives against industry standards.

For example, a large-scale energy storage project in California may reveal different commission trends compared to similar projects in Europe or Asia. Factors such as regional regulatory environments, funding options, and the prevailing demand for energy storage can create distinct differences. By benchmarking against such examples, companies can be better equipped to make informed decisions regarding commission negotiations.

8. FUTURE TRENDS AND PREDICTIONS

As the energy storage landscape continues to evolve, numerous future trends may impact commission structures. The growing prominence of renewable energy sources will likely catalyze increased investment in energy storage technologies, affecting both demand and supply dynamics. Such changes could lead to further fluctuations in commission rates as brokers and consultants adapt to the shifting market environment.

Additionally, advancements in technology and project financing models might introduce new pricing strategies and commission arrangements that better align with the unique needs of both clients and service providers. Staying astute regarding these trends and being prepared to adjust strategies will be crucial for all stakeholders in this sector.

9. STRATEGIC IMPERATIVES FOR BUSINESSES

To navigate the complexities of commissions in industrial energy storage, companies must adopt a strategic mindset. Understanding the interactions between project size, market conditions, and the role of brokers can help form more informed decisions. Furthermore, investing in building relationships with energy storage experts will create opportunities for collaboration and potentially more favorable financial terms.

By approaching the energy storage sector with thorough research, well-defined goals, and an understanding of the market dynamics at play, organizations can create a powerful foundation for successful projects. This will enable them to optimize their investments and position themselves advantageously in an increasingly competitive landscape.

FREQUENTLY ASKED QUESTIONS

WHAT DETERMINES COMMISSION RATES FOR ENERGY STORAGE PROJECTS?

Commission rates for energy storage projects are influenced by several key factors, including project scale, complexity, geographical location, and the specific services provided by brokers or consultants. Generally speaking, larger projects tend to command lower commission percentages due to economies of scale. Regional market conditions also play a pivotal role, with locations supporting renewable energy typically exhibiting more organized commission structures.

The services rendered can significantly impact fees as well. Specialized knowledge or experience in cutting-edge energy storage technologies may warrant higher commissions. As such, organizations must evaluate their specific project requirements and assess how these dynamics might impact their overall commission expenditures.

HOW CAN COMPANIES NEGOTIATE BETTER COMMISSION RATES?

Negotiating for improved commission rates necessitates thorough preparation and a strategic approach. Companies should begin by conducting comprehensive research on prevailing commission structures within their sector. This enables them to understand the norms and leverage that knowledge in discussions with brokers or consultants.

In addition to knowing the market, fostering strong relationships can lead to better negotiation outcomes. Establishing trust and showing a commitment to long-term partnerships can create a conducive atmosphere for negotiating more favorable rates. Companies that articulate their needs and demonstrate the potential for ongoing collaboration may find that service providers are more amenable to adjusting commission structures to reflect mutual benefit.

WHY IS UNDERSTANDING COMMISSION STRUCTURES IMPORTANT?

Grasping commission structures within the energy storage field is critical for organizations aiming to optimize their project investments. Inadequate insight into commission rates can lead to inflated costs, impacting budgets and overall project feasibility. By being aware of how commissions function, companies can make informed decisions about which brokers or consultants to engage.

Moreover, understanding commission structures allows companies to effectively negotiate better terms, enhancing the profitability of energy storage implementations. Ultimately, knowledge in this area translates into strategic advantages, enabling organizations to thrive in an evolving market.

Companies venturing into the industrial energy storage space must consider the intricacies of commission structures comprehensively. Awareness of the underlying influences on commission rates, such as project size, market conditions, and the roles of intermediaries, is paramount for maximizing the value derived from energy storage investments. As the industry progresses, stakeholders should remain agile, capable of adapting to changing trends and leveraging strategic partnerships to secure the best possible outcomes.

Active engagement with brokers and continuous assessment of project requirements, market dynamics, and emerging technologies will cultivate stronger financial insights. Such efforts will ultimately contribute to sustainable growth in the industrial energy storage sector, allowing businesses to harness opportunities effectively while managing risks associated with their investments.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-is-the-commission-for-industrial-energy-storage-business/