1. Industrial energy storage battery costs vary widely and depend on several key factors, including battery technology, capacity, and installation requirements. 2. Average costs can range from $200 to $1,000 per kilowatt-hour (kWh). 3. Advanced technologies like lithium-ion tend to be more expensive but offer better long-term returns through efficiency. 4. Size and geographical location also impact pricing, with larger systems typically yielding lower costs per kWh and urban areas often seeing elevated installation expenses.

1. TYPES OF INDUSTRIAL ENERGY STORAGE BATTERIES

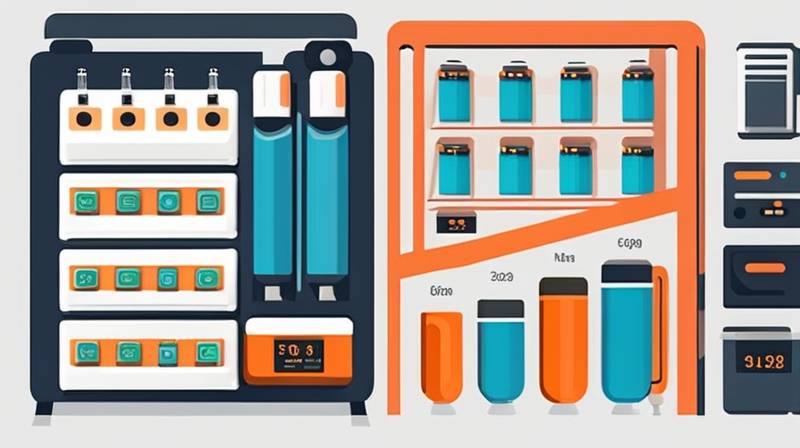

When exploring costs associated with industrial energy storage batteries, it is essential to consider the variety of battery technologies available on the market. Each type offers distinct advantages, limitations, and pricing structures that significantly influence the overall expenses. Notably, lithium-ion, lead-acid, and flow batteries represent the predominant technologies utilized in industrial applications.

Lithium-ion batteries have witnessed a substantial surge in popularity due to their high energy density, relatively low weight, and increasingly competitive pricing. A typical lithium-ion system may cost between $400 to $800 per kilowatt-hour (kWh), though prices are steadily decreasing due to advancements in manufacturing processes and economies of scale. Additionally, the technology’s superior depth of discharge and cycle life enables facilities to capitalize on their initial investment over an extended period.

Conversely, lead-acid batteries, while historically the most commonly employed energy storage solution, often present a lower upfront cost, typically ranging from $200 to $500 per kWh. However, their inefficiencies provide lower performance metrics, leading to more frequent replacements and diminished long-term viability. In contrast, flow batteries are emerging as a robust alternative, especially for large-scale energy storage requirements. Though their initial outlay can hover around $1,000 per kWh, their operational lifespan and scalability may justify the investment due to relatively low maintenance costs and enhanced safety features.

2. FACTORS INFLUENCING COST

The diverse array of elements that shape the expenses of industrial energy storage batteries can lead to significant variations in pricing between different systems and geographical markets. Primarily, capacity plays a crucial role in dictating the initial outlay for installation. Battery systems with greater kilowatt-hour ratings not only incur higher upfront costs but can also yield more advantageous pricing on a per-kWh basis. Consequently, larger installations tend to provide economies of scale, ultimately offering a lower cost proposition for businesses.

Another pivotal factor revolves around installation specifics, which can greatly affect the overall investment. Factors such as site accessibility, existing infrastructure, and local regulations influence the complexity and cost of the installation process. For example, urban locations with logistical challenges or stringent zoning laws might incur higher labor and regulatory expenses, driving the overall cost upward. Conversely, installations aligned with robust infrastructure may amortize expenses more efficiently, allowing for reduced capital outlay.

Geographical differences further contribute to the cost landscape, as regional markets exhibit diverse competitive dynamics and regulations. Some locations may benefit from state or federal incentives aimed at promoting renewable energy adoption, effectively subsidizing installation costs. Alternatively, areas with limited access to battery components or skilled technicians may observe inflated prices due to supply chain constraints.

3. LONG-TERM ECONOMICS OF ENERGY STORAGE

Analyzing the financial viability of industrial energy storage investments necessitates a focus on long-term consequences rather than merely initial costs. Operational efficiency, return on investment (ROI), and total cost of ownership (TCO) emerge as critical metrics for evaluating the overall expense associated with energy storage technologies.

In terms of operational efficiency, lithium-ion batteries frequently outperform traditional alternatives, offering higher depth of discharge and more efficient recharge cycles. This efficiency translates into valuable cost savings over time, as facilities can optimize energy consumption, utilizing stored energy during peak hours to avoid inflated utility rates. Similarly, advanced battery management systems can enhance performance, optimize charging cycles, and further reduce operational costs.

Assessing the ROI associated with various battery technologies also requires a nuanced understanding of energy needs and peak consumption times. Industrial facilities that operationalize their battery systems effectively can realize substantial savings by utilizing stored energy during peak pricing periods. Therefore, the ability to shift energy consumption patterns becomes integral to reaching a favorable ROI, which can dramatically alter the perceived upfront cost of the technology.

Evaluating the TCO encompasses ongoing maintenance, replacement intervals, and disposal considerations. Typically, lithium-ion batteries tend to have extended operational lifespans, averaging between 10-15 years, while lead-acid counterparts generally require replacement as frequently as every 3-5 years. Thus, when calculating cumulative expenses, the longevity of the investment should play a central role in decision-making processes.

4. POTENTIAL FUTURE TRENDS

Looking ahead, several emerging trends may significantly impact industrial energy storage battery costs and market dynamics. Technological advancements, regulatory landscapes, and sustainability efforts all point toward possible shifts in the pricing and adoption of energy storage solutions tailored for industrial applications.

One prominent trend includes ongoing research and development aimed at enhancing existing battery technologies and pioneering new solutions. Innovations such as solid-state batteries and other alternative chemistries may not only offer improved performance metrics but also reduce reliance on rare or expensive materials like cobalt and lithium. Such advancements could lead to declining costs and heightened accessibility for industries considering energy storage integration.

Another key factor in this evolving landscape is the regulatory environment increasingly focused on carbon reduction goals and renewable energy adoption. As governments worldwide implement incentives, tax breaks, or other stimulative policies designed to drive green energy initiatives, businesses that invest in energy storage solutions may witness additional discounts. As a result, fluctuating regulatory landscapes may alter the profitability equations for companies seeking energy independence or enhanced operational resilience.

Lastly, the global push for sustainability will likely play a pivotal role in determining the adoption and evolution of energy storage systems. As societal pressures to transition toward greener energy systems become louder, companies that invest in innovative technologies and efficient energy storage practices may gain a significant competitive edge. Thus, the interaction between sustainability efforts, regulatory measures, and technological advancements may ultimately reshape the industrial energy storage market and its costs in unforeseen ways.

INDUSTRIAL ENERGY STORAGE BATTERY FAQS

WHAT ARE THE MAIN APPLICATIONS OF INDUSTRIAL ENERGY STORAGE BATTERIES?

Industrial energy storage batteries serve a multitude of applications across various sectors. Primarily, they facilitate peak shaving, which allows businesses to reduce energy costs by discharging stored energy during peak demand hours when electricity prices soar. This strategy is particularly beneficial for facilities with fluctuating energy needs or those subject to time-of-use rates. Additionally, grid support applications enable businesses to contribute stored energy back to the grid during peak demand periods, benefitting both operators and consumers while generating potential revenue streams. Furthermore, energy storage solutions play a crucial role in renewable energy integration, helping to stabilize energy supply from intermittent sources like solar and wind through grid-level or behind-the-meter installations. These diverse applications demonstrate the multifaceted value of industrial energy storage batteries in contemporary energy management strategies.

HOW DO ENERGY STORAGE BATTERIES IMPACT INDUSTRIAL OPERATIONS?

The integration of energy storage batteries into industrial operations can profoundly influence a company’s energy management paradigm. For starters, implementing these systems allows facilities to shift energy usage to off-peak hours, resulting in significant cost savings. By engaging in demand-side management, businesses can avoid elevated utility rates during peak consumption periods while maximizing cost efficiency.

Moreover, energy storage systems contribute to enhanced operational resilience by ensuring reliable power supply during utility outages or disruptions. This reliability is particularly valuable for industries that rely on uninterruptible power supplies for critical processes. Additionally, energy storage solutions facilitate renewable energy integration, enabling businesses to leverage solar or wind energy effectively and reduce their overall carbon footprint. Consequently, energy storage batteries yield multifaceted benefits, driving cost savings and operational efficiency while reinforcing sustainability commitments.

HOW WILL THE COST OF INDUSTRIAL ENERGY STORAGE BATTERIES CHANGE IN THE FUTURE?

Predicting the future trajectory of industrial energy storage battery costs entails examining various influencing factors such as technological advancements, material availability, and market dynamics. Current trends indicate a gradual decline in prices for lithium-ion and alternative battery technologies, driven by economies of scale in production and competitive innovations. As manufacturing techniques evolve and more suppliers enter the market, price reductions are likely to accelerate, enhancing the accessibility of energy storage solutions for industrial applications.

Additionally, ongoing innovations focused on sustainability may reshape material sourcing and production processes, potentially reducing costs further. Markets concerned with environmental impact may also observe legislative support, incentivizing energy storage adoption and affecting demand dynamics. In conclusion, while costs may initially seem high, it is reasonable to predict that evolving technologies, combined with supportive regulatory measures, will enable greater affordability and efficiency in industrial energy storage battery investments.

EMBRACING THE TRANSITION TO ENERGY STORAGE

Integrating industrial energy storage battery systems represents a crucial step toward achieving enhanced energy management, cost efficiency, and sustainability. Understanding the diverse factors that impact pricing is integral to making informed decisions regarding energy storage investments. Positions taken by policymakers, innovations in battery technologies, and shifts in societal norms all play a role in shaping the potential of energy storage systems over time. Companies seeking to navigate the complex landscape of energy consumption and management must remain attuned to these evolving trends, weighing the benefits of various battery technologies and operational applications. As the landscape continues to evolve, prioritizing energy storage systems will become indispensable for companies aiming for economic viability alongside resilient energy futures. In doing so, they will not only position themselves as industry leaders but also contribute to broader goals of energy independence and climate sustainability.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-does-industrial-energy-storage-battery-cost/