1. The cost associated with 100 volts of solar power can vary significantly based on several crucial factors: 1) system size and components, 2) installation expenses, 3) location and incentives, 4) energy usage and financial considerations. For instance, the selection of high-efficiency panels generally leads to a higher upfront investment but can result in substantial long-term savings on electricity bills. When embarking on a solar energy project, comprehending the holistic cost structure is essential. This informs potential buyers about what to expect regarding initial outlays and ongoing savings.

1. UNDERSTANDING THE COST OF SOLAR POWER SYSTEMS

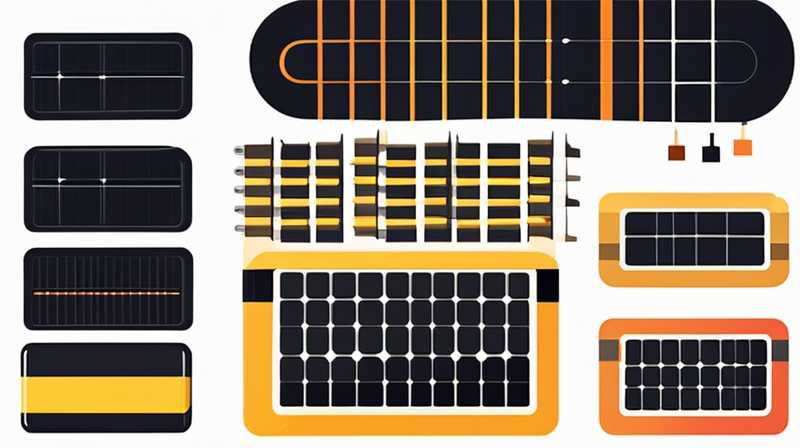

When delving into the costs surrounding solar power systems, a basic understanding of the components and their respective economic implications serves as the cornerstone for informed decision-making. Solar power systems primarily consist of solar panels, inverters, mounting hardware, and an optional battery storage solution. Each element contributes uniquely to the overall cost. For example, the specific type of solar panels—be it monocrystalline, polycrystalline, or thin-film—affects pricing dynamics due to variations in manufacturing processes and efficiency metrics.

Beyond the components, potential buyers must consider installation expenses, which can significantly contribute to the overall expenditure. Hiring qualified solar technicians who ensure optimal placement and functionality incurs additional costs but is vital for maximizing the efficiency of the setup. Furthermore, electrical permits and local regulations may also add to financial burdens. Understanding these underlying factors lays the groundwork for navigating the complexity of purchasing solar power technologies and realizing their full potential.

2. FACTORS INFLUENCING SOLAR POWER COSTS

Various aspects interplay when analyzing costs associated with solar power systems, and each warrants careful consideration. One notable element is the scale of the installation. Larger systems tend to be more cost-effective on a per-watt basis, as they benefit from economies of scale, reducing the overall expense incurred for installation and equipment. Conversely, smaller systems may present higher costs relative to their output, primarily due to fixed installation charges.

Additionally, the geographical location of the installation site has significant implications for the financial aspect of solar energy investments. Regions with abundant sunlight may yield more electricity production, resulting in reduced payback periods. Moreover, local energy prices, incentives, and tax credits influence the overall cost burden. States or municipalities offering solar tax credits, rebates, or net metering can dramatically alter the economics of solar power, improving the return on investment for homeowners and businesses alike.

3. LONG-TERM SAVINGS AND RETURNS ON INVESTMENT

Investing in solar power entails not only an upfront financial commitment but also promises considerable long-term savings and returns. As utility prices continue to escalate, harnessing solar energy for one’s energy needs provides a hedge against inflation. Customers opting for solar installations often enjoy reduced or eliminated monthly electric bills, depending on the scale of their system and the local energy market.

Moreover, the longevity of solar systems, often spanning 25 years or more, assures homeowners of ample time to recoup their initial investments through energy savings. In time, the cumulative savings can amount to tens of thousands of dollars, further underscoring the financial prudence of solar investments. Understanding these long-term financial benefits is pivotal for anyone contemplating a switch to solar energy, as it adds additional layers of motivation for investing in renewable resources.

4. TAX CREDITS AND REBATES: A FINANCIAL BOOST

Government incentives serve as a critical element in encouraging solar adoption, reducing the effective cost of installations. Many jurisdictions offer federal tax credits, state rebates, and local programs designed to make solar energy more financially accessible. The federal solar tax credit, for instance, allows homeowners to deduct a substantial percentage of the cost of installation from their federal taxes, which significantly lowers the overall expenditure.

State and local rebates can further enhance affordability by providing immediate financial relief upon the installation of solar systems. By capitalizing on these incentives, individuals can expedite their return on investment, making solar power an even more appealing option. Staying informed about available incentives based on location is vital for maximizing financial benefits tied to solar energy systems.

5. MAINTENANCE COSTS AND CONSIDERATIONS

While initial system costs and installation fees dominate financial discussions, ongoing maintenance costs also merit thorough examination. Solar systems generally require minimal upkeep, but aspects such as cleaning, monitoring, and occasional repairs are vital for sustained performance. Neglecting these components can result in decreased efficiency and potential loss of investment.

In most cases, maintenance expenses are relatively low, especially when compared to the ongoing costs associated with traditional energy sources. By establishing routine checks and taking proactive measures, homeowners can ensure their solar systems operate at peak efficiency over the years. These considerations help maximize returns and ensure that investments in solar energy remain profitable over time.

FAQ SECTION

HOW DOES THE SIZE OF A SOLAR INSTALLATION AFFECT ITS COST?

The dimension of a solar installation plays a pivotal role in determining its associated costs. Larger solar systems tend to have a lower cost per watt due to economies of scale; the more panels that are installed, the lesser the installation cost per unit becomes. For instance, in residential settings, typical systems range from 5 kW to 10 kW. The upfront costs may be substantial, yet the overall expenditure per watt decreases, creating significant savings in the long run. Additionally, homeowners with larger systems can often meet a more considerable percentage of their electricity needs, further enhancing the attractiveness of such investments. Conversely, smaller systems could encounter higher investment costs per watt while potentially benefiting for homes with limited energy requirements.

WHAT INFLUENCES INCENTIVES AND TAX CREDITS FOR SOLAR POWER?

Numerous factors influence available incentives and tax credits for solar power installations, primarily driven by governmental policies at both the federal and state levels. The federal solar investment tax credit (ITC) has been a significant motivating force behind solar adoption, allowing individuals to claim a percentage of their investment as a tax credit. Moreover, states can establish their own programs, including rebates and net metering arrangements that allow consumers to receive credits for surplus energy sent back to the grid. These incentive structures often evolve in response to the political climate and societal attitudes toward renewable energy, making it vital for potential buyers to stay informed regarding enhancements or reductions in such programs based on legislative changes.

HOW DOES SOLAR POWER IMPACT PROPERTY VALUE?

Investing in solar power can have a measurable impact on property value, often resulting in a higher resale value. Studies indicate that homes equipped with solar installations tend to sell for a premium compared to similar properties without such features. This outcome stems from the anticipated reduction in energy costs and the appeal of renewable energy systems to environmentally conscious buyers. However, several variables influence the degree to which property values rise, including the size and capacity of the solar system, location, and local market conditions. Homeowners need to consider these factors when assessing the potential financial benefits linked to the installation of solar energy systems.

The acquisition of solar power systems entails an intricate blend of factors that collectively influence total expenses. Whether for residential or commercial applications, the full spectrum of potential outlays comprises equipment costs, installation fees, incentives, community regulations, and even future maintenance responsibilities. Evaluating these elements arm potential solar adopters with the requisite knowledge to formulate sound decisions regarding their investments. Recognizing the impact of system size and location reinforces the notion that these agreements should not be entered into lightly; rather, they warrant thorough research and alignment with financial objectives.

The long-term advantages, prominently featuring reduced energy bills and independence from traditional electrical grids, present compelling arguments for this clean energy transition. Shifting perspectives to consider the environmental benefits adds further justification for pursuing solar alternatives. As society increasingly gravitates toward sustainable practices, the growing acceptance and promotion of solar technology emphasize the role of renewable energy in combating climate change.

In the end, evaluating costs while simultaneously acknowledging the myriad incentives makes solar energy an appealing prospect for a wide range of consumers. With these insights, promoting a greener future becomes not only a personal choice, but also a financially sound decision that supports the community and the planet.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-much-does-100-volts-of-solar-power-cost/