1. The profitability of an air energy storage power station hinges on several mechanisms: 1) The sale of stored energy during peak demand periods, 2) Participation in ancillary service markets, 3) Revenue from capacity payments, 4) Operational efficiencies that lower overall costs, and 5) Technological advancements leading to increased effectiveness. Profitability relies notably on the integration of these strategies into a cohesive business model, often necessitating sophisticated operational management and strategic partnerships within the energy sector.

1. FUNDAMENTALS OF AIR ENERGY STORAGE

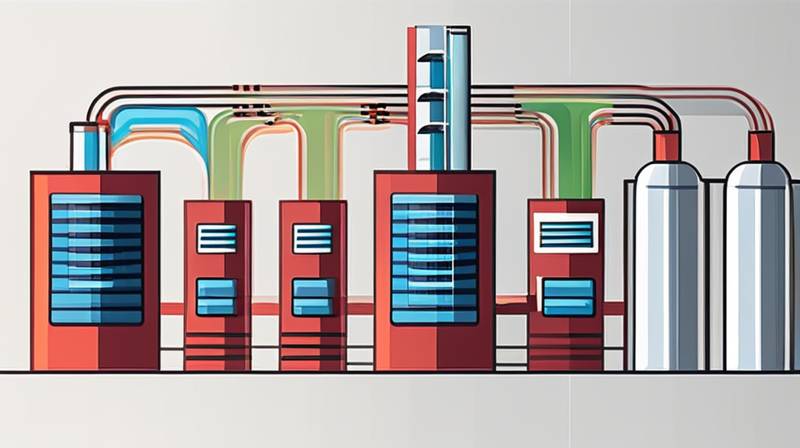

Air energy storage (AES) refers to a methodology that employs compressed air to store energy, converting it back to electricity when required. The underlying principle involves compressing air in underground caverns or aboveground containers using excess power generated during low-demand periods. When energy demand surges, this compressed air is released, driving turbines that produce electricity. AES provides a substantial advantage for balancing energy supply and demand, offering a reliable solution to integrate intermittent renewable energy sources into the grid.

Moreover, the operational capacity of an AES facility hinges on various factors, including site geography, technology employed, and the economic landscape. The economic attractiveness of such installations stems from fluctuating electricity prices; specifically, storing energy when it is cheaper and releasing it when prices peak can yield substantial financial returns. Innovative energy storage infrastructures continue to evolve rapidly, with improvements in efficiency translating into deeper profits.

2. DEMAND AND MARKET DYNAMICS

The demand for energy storage solutions is on the rise, predominantly driven by the need for grid stability as renewable energy sources proliferate. Air energy storage systems play a crucial role in this transition by addressing the intermittent nature of renewables like wind and solar energy. By acting as a buffer for excess energy generated during off-peak times, AES ensures that electricity can be dispatched when it is most needed, enhancing the overall reliability of power systems.

As electric grid operators strive to accommodate variable energy sources, AES facilities position themselves as indispensable assets. These facilities can offer services such as frequency regulation and load shifting, enriching their value proposition to stakeholders within the energy market. Furthermore, changes in regulatory frameworks that promote clean energy utilization have made air energy storage both a strategic and financial imperative for many energy companies.

3. CAPACITY PAYMENTS AND REVENUE FLOW

Participating in capacity markets constitutes a significant revenue stream for air energy storage systems. Capacity payments are financial incentives provided to power producers and storage systems that commit to delivering power during peak demand conditions or emergencies. By maintaining a defined operational capacity, AES entities can secure steady income, ensuring profitability independent of market price fluctuations.

The fundamentals of capacity markets involve auctions managed by grid operators, wherein energy storage providers bid to offer capacities that can be tapped into when the grid requires supplementation. These mechanisms incentivize availability, allowing AES facilities to cultivate stable and predictable income streams, bolstering their financial performance. Moreover, as grid operators increasingly recognize the essential role of energy storage in achieving reliability, capacity payments are set to grow, enhancing long-term profit viability for AES operations.

4. ANTECEDENTS TO EFFICIENCY

The efficiency of an air energy storage facility is paramount for its economic success. From technological advancements to optimized operational strategies, numerous factors underpin efficiency. One key consideration lies in the technology selection for air compression and expansion, where advancements in turbine design and materials can significantly affect energy losses during the storage process. Improved compression stages and heat recovery processes can substantially reduce the energy required for compression, further enhancing profitability.

Besides technological aspects, operational strategies influencing energy dispatch and the timing of market engagement also contribute to performance improvements. Active participation in energy markets involves strategically timing energy purchases and sales to capitalize on price differentials. Practicing real-time data analytics and market trend analyses enables operators to dynamically align operations with market conditions, maximizing returns through adept maneuvers that leverage inherent efficiencies.

5. ANCILLARY SERVICES AND INCOME STREAMS

Ancillary services play a complementary yet essential role in piecing together the financial puzzle for air energy storage systems. These services—including frequency response, voltage support, and spinning reserves—are vital for maintaining the operational integrity of electrical grids. AES providers have the unique ability to furnish these services due to their rapid response capabilities, markedly improving grid resilience at competitive rates.

By showcasing their ancillary service offerings, air energy storage facilities can thereby attract additional revenue streams. Contracts with grid operators that outline specific performance metrics—such as response time and reliability—ensures that AES systems are compensated based on their contributions to grid stability. As the importance of resilience and reliability in electricity supply intensifies amid climate-driven disruptions, the potential for profit through ancillary services grows alongside regulations that promote cleaner energy with reliability aspects in consideration.

FREQUENTLY ASKED QUESTIONS

WHAT ARE THE COMMON CHALLENGES FACED BY AIR ENERGY STORAGE SYSTEMS?

Air energy storage systems encounter various challenges that can impact profitability. A notable issue is the initial capital outlay necessary to establish these facilities, which can be substantial. Additionally, regulatory hurdles frequently pose obstacles in certain jurisdictions, requiring operators to navigate complex permits and policy frameworks. Practical limitations such as technological maturity and environmental considerations also present challenges that need addressing before implementation. Despite these obstacles, the shifting energy landscape encourages continued investment and innovation within the air energy storage sector.

HOW DOES TECHNOLOGY AFFECT THE PROFITABILITY OF AIR ENERGY STORAGE?

Technological advancements substantially influence the profitability of air energy storage. Innovations in turbine design, heat recovery methods, and advanced materials contribute to efficiency improvements, which lower operational costs. Furthermore, cutting-edge management software can optimize dispatch strategies while enabling real-time adjustments in response to market fluctuations. Consequently, these technological enhancements play a pivotal role in reducing energy losses, increasing output, and ultimately augmenting revenue potential for AES operators.

WHAT IS THE FUTURE OUTLOOK FOR AIR ENERGY STORAGE?

The future outlook for air energy storage appears promising, as the necessity for effective energy management intensifies amid the global transition to renewables. As energy policies evolve and further support is developed for clean technology implementations, air energy storage facilities will likely find favorable conditions for growth. Predictions indicate rapid advancements in energy storage technologies, improving capacity and efficiency, thus enhancing financial feasibility and profitability. Given the heightened focus on energy security and grid reliability, air energy storage will remain a choice asset for utility operators and investors alike.

Strong viability of air energy storage systems hinges on multifaceted revenue generation mechanisms. A combination of market engagement strategies, capacity payments, and operational efficiencies underscore the profit potential realized by these entities. As technological advancements propel these systems into the forefront of sustainable energy frameworks, profitability will continue to evolve. The extensive analysis demonstrates that effective operational management intertwined with strategic market engagement positions air energy storage power stations as pivotal players in balancing electricity supply and demand. Therefore, with ongoing innovations and regulatory support that incentivize cleaner energy generation, the potential for air energy storage systems to generate substantial profits remains robust and increasingly prominent within the energy landscape.

Original article by NenPower, If reposted, please credit the source: https://nenpower.com/blog/how-does-an-air-energy-storage-power-station-make-a-profit/